Fresh Ripple Addresses Jump to 8-Month-High as $6 XRP Target Emerges

Ripple’s native token has moved back up to $2.33, recovering from recent lows after strong activity on the XRP Ledger. The recovery comes after a week where the asset dropped by double digits, influenced by broader market stress.

According to market data from Santiment, 21,595 new XRP wallets were created over a two-day span, the largest increase in eight months. This comes after a 12% price jump in 24 hours, offering gains to those who bought during the recent dip.

On-Chain Transactions and Wallet Trends

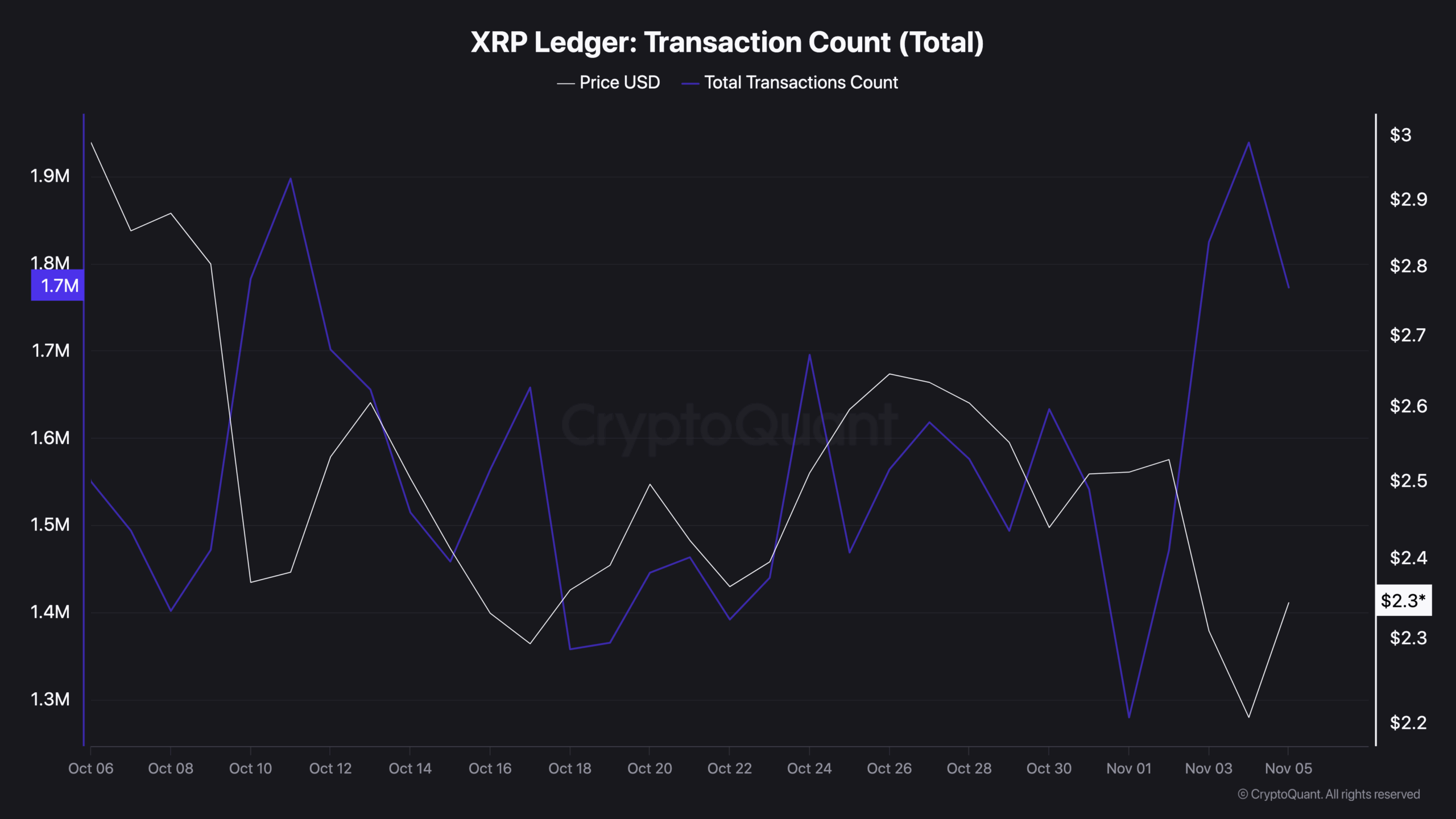

Between October 6 and November 6, XRP Ledger transaction counts moved between 1.3 million and 1.9 million. The peak occurred around November 3, when activity reached around 1.9 million transactions before pulling back to 1.7 million by November 5. During this time, XRP’s price dropped from $2.50 to $2.20, later recovering to $2.3.

Source: CryptoQuant

Source: CryptoQuant

While prices were falling, transaction counts stayed elevated, showing a rise in on-chain usage. The surge in new wallets supports this increase in network activity, with wallet growth pointing to more users joining or becoming active.

In addition, on November 4, XRP Ledger’s built-in decentralized exchange (DEX) processed 954,000 transactions in a single day, reaching a new record. This marked one of the busiest periods for XRP on-chain trading in recent months, even as the price stayed under pressure.

Whale behavior has added to the recent drop. Around 900,000 tokens were sold by large holders over a five-day stretch, as recently reported by CryptoPotato. Transfers from whales to exchanges have since slowed, but earlier selling may still be affecting sentiment in the market.

Analyst Price Levels and Market Structure

Analyst Javon Marks pointed to $5.76 to $9.73 as possible next levels for XRP based on previous breakout patterns. A similar setup was seen in past cycles, where the asset surged after long consolidation phases. Fibonacci-based targets on the current structure align with those estimates.

Meanwhile, another analyst, EGRAG CRYPTO, noted that if XRP stays above $1.94, the current range could act as an accumulation zone. They outlined two scenarios: one targeting $10 and another projecting $50 in an extended breakout.

In the short term, CryptoWZRD noted strong daily closes for both XRP and XRPBTC. The analyst marked $2.75 as key resistance and $2.27 as short-term support.

Price action near $2.55 could serve as a decision point, especially with Bitcoin still guiding broader market movement.

The post Fresh Ripple Addresses Jump to 8-Month-High as $6 XRP Target Emerges appeared first on CryptoPotato.

You May Also Like

TD Cowen cuts Strategy price target to $440, cites lower bitcoin yield outlook

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings