Ethereum Price Rally a Trap? Trader Predicts One More Drop Coming

The post Ethereum Price Rally a Trap? Trader Predicts One More Drop Coming appeared first on Coinpedia Fintech News

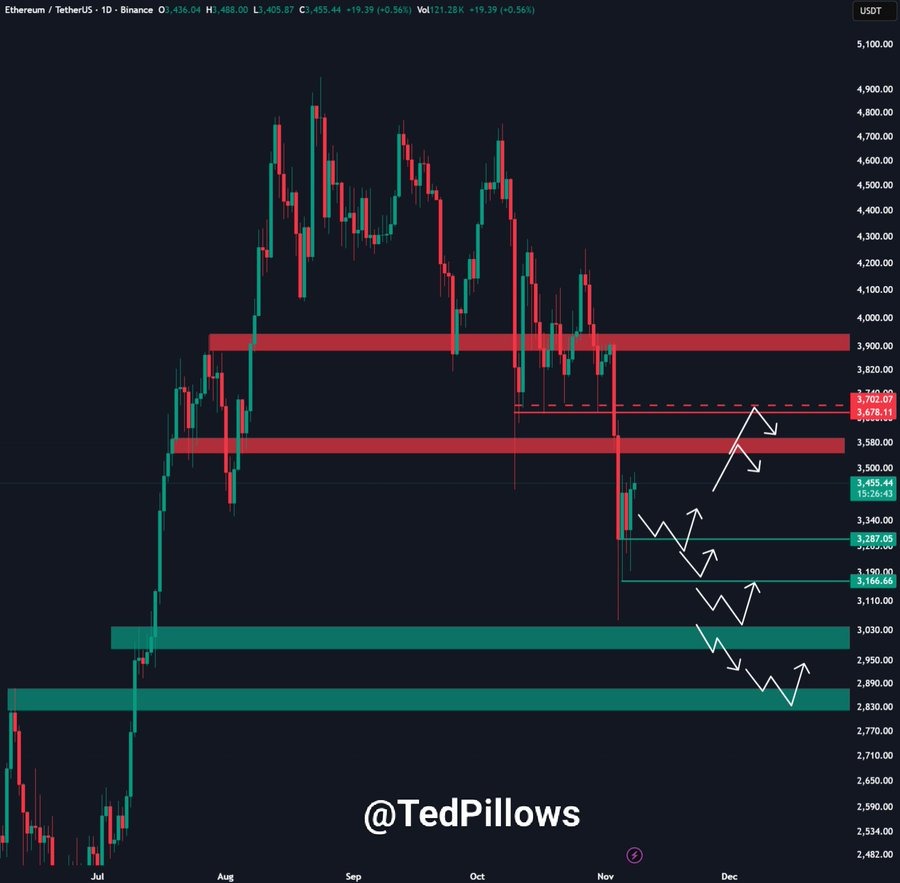

After weeks of steady decline, Ethereum is finally showing some strength, bouncing back near the $3,460 level. But not everyone is convinced the worst is over. Prominent crypto analyst Ted warns that this sudden recovery might be a “false signal,” suggesting that Ethereum could face one more big drop before a real rebound begins.

Here’s how low the ETH price can go.

Short Squeeze or Real Reversal?

While Ethereum’s recent 5% daily jump has given traders a brief sense of relief, crypto analyst Ted suggests that this move is likely driven by short liquidations rather than real buying interest.

He noted that many traders who bet against Ethereum have been forced to close their positions, creating a quick price push that looks like a rally but lacks strong market support.

And the numbers back it up, over $133.83 million worth of ETH positions were liquidated, wiping out both over-leveraged longs and shorts, temporarily boosting prices. But Ted warns that this is a common trap, a short-term bounce before another drop.

Ethereum Price To Drop To $2800 Level

Despite the temporary bounce, the trader insists that Ethereum’s market structure still looks heavy. In his view, the earlier drop wasn’t the final one, just a pause before the “real move” down.

His chart highlights strong resistance zones between $3,700 and $3,800, where Ethereum has repeatedly failed to break higher. Until these levels flip into support, the market remains under bearish pressure.

But for now, Ted expects another potential drop toward the $2,900–$3,200 zone, which has acted as a key support area before.

If that level breaks, Ethereum could slide even further, possibly to around $2,800, before finding solid ground.

Key Level to Watch: $3200

For now, Ted is watching the $3,200 mark closely. Holding above it could give Ethereum’s bulls a chance to rebuild momentum. But if it slips below, another wave of selling could follow.

As of now, ETH is trading around $3446, reflecting a 5.2% jump seen in the last 24 hours

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

The whale "pension-usdt.eth" has reduced its ETH long positions by 10,000 coins, and its futures account has made a profit of $4.18 million in the past day.