Building a Crypto Portfolio for 2026: Where IPO Genie Fits In

Why Allocation Matters More Than Individual Token Picks

In serious portfolio construction, one principle is non-negotiable: allocation is more important than selection.

In crypto, where volatility is extreme and narratives evolve quickly, this truth is even more pronounced. Two investors can hold similar assets yet experience radically different outcomes simply because one structured their exposure intelligently, while the other chased momentum.

As the market evolves toward 2026—with AI-enhanced research, tokenized private markets, audited presales, and institutional-grade infrastructure—investors seeking the best crypto allocation must think in terms of risk layers, not isolated bets.

Core Requirements of the Best Crypto Allocation in 2026

A robust allocation today must:

- Distribute risk across blue-chip, growth, and emerging assets

- Incorporate AI-driven discovery tools

- Include exposure to tokenized private and pre-IPO markets

- Allow limited, controlled participation in frontier innovation

- Be structured enough to survive drawdowns, but flexible enough to capture upside

At the same time, sophisticated investors increasingly use tracking methods like UTM-tagged links to understand how interest, research, and engagement flow over time. For example, visiting the official IPO Genie portal allows performance and engagement to be measured in a structured way.

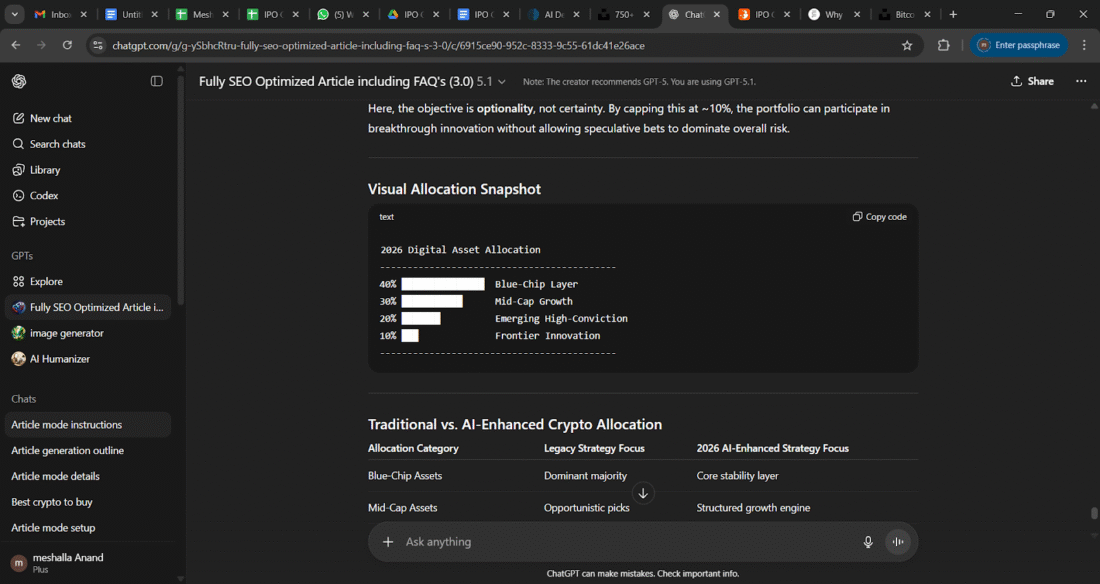

The 40/30/20/10 Allocation Blueprint

A professional, risk-aware model for the best crypto allocation in 2026 can be summarized as:

- 40% – Blue-Chip Foundational Assets

- 30% – Mid-Cap Growth Assets

- 20% – Emerging High-Conviction Assets

- 10% – Frontier Innovation Assets

This model is designed to balance stability, scalability, and asymmetric upside.

40% – Blue-Chip Layer: Structural Stability

The blue-chip layer underpins the entire portfolio. It typically includes:

- Bitcoin

- Ethereum

- Leading layer-1 networks with strong liquidity and adoption

- Institutional-grade infrastructure assets

These assets provide:

- Deep liquidity

- Long-term demand drivers

- Lower relative downside during market stress

Allocating ~40% of capital here establishes a resilient core that can absorb volatility from higher-risk segments.

30% – Mid-Cap Growth Layer: Scalable Expansion

The mid-cap growth segment targets assets with:

- Proven product-market fit

- Significant user or developer traction

- Room to grow without being purely speculative

This category may include:

- AI-integrated networks

- Layer-2 scaling solutions

- High-performance smart contract chains

- Oracle and data-layer protocols

Historically, this layer outperforms blue chips in bull phases while remaining more defensible than early-stage speculation.

20% – Emerging High-Conviction Layer: Intelligent Asymmetry

The emerging high-conviction layer is where investors target disproportionate upside based on strong fundamentals, not hype. This is precisely where a project like IPO Genie fits.

Why IPO Genie Fits This Allocation Band

- AI-Powered Deal Discovery

IPO Genie uses AI to surface, filter, and rank early-stage opportunities, providing a more systematic approach to what is often a chaotic presale landscape. - Tokenized Private Market Access

As reported by Blockonomi’s institutional coverage, institutional investors are already turning to IPO Genie for tokenized exposure to private and pre-IPO deals—an area that has historically been closed to most market participants. - Behavior-Based Staking and Incentives

The platform’s behavior-based staking model is designed to encourage long-term, constructive holding patterns rather than purely speculative churn. - Pre-IPO-Backed Insurance Structures

Pre-IPO exposure tied to insurance mechanics introduces an additional layer of structural protection unusual in the presale niche. - Not Just Another Presale Bubble

A FinanceFeeds analysis of the presale landscape specifically distinguishes IPO Genie from typical “presale bubble” projects, highlighting its underlying real-economy thesis and AI-first architecture.

Allocating around 20% of the portfolio to this class—anchored by high-conviction AI and RWA projects—provides intelligent exposure to outsized upside while still respecting risk.

For deeper due diligence, investors can revisit the IPO Genie UTM-tracked platform to analyze evolving information and offerings over time.

10% – Frontier Innovation Layer: Controlled Speculation

The frontier allocation is reserved for:

- Experimental layer-1 and layer-2 ecosystems

- Novel AI agents and autonomous protocols

- Early-phase presales with limited history

- Airdrop-driven or narrative-driven opportunities

Here, the objective is optionality, not certainty. By capping this at ~10%, the portfolio can participate in breakthrough innovation without allowing speculative bets to dominate overall risk.

Visual Allocation Snapshot

Traditional vs. AI-Enhanced Crypto Allocation

| Allocation Category | Legacy Strategy Focus | 2026 AI-Enhanced Strategy Focus |

|---|---|---|

| Blue-Chip Assets | Dominant majority | Core stability layer |

| Mid-Cap Assets | Opportunistic picks | Structured growth engine |

| Emerging High-Conviction Assets | Minimal exposure | Intentional, thesis-driven allocation (e.g. IPO Genie) |

| Frontier Innovation | Random speculation | Capped, defined experimental sleeve |

| AI & Deal Discovery Tools | Rarely used | Integrated into research and selection processes |

Implementing the Best Crypto Allocation: A Professional Process

- Define Risk Parameters: Begin by clarifying investment horizon, liquidity requirements, and acceptable drawdown levels to ensure decisions align with your overall mandate.

- Apply the 40/30/20/10 Allocation Model: Distribute capital methodically across blue-chip, growth, emerging, and frontier layers based on conviction and risk appetite.

- Underwrite Emerging Exposure with AI & Data: For the 20% emerging sleeve, leverage AI-driven platforms like the official IPO Genie platform to evaluate AI-ranked deal flow and tokenized private-market opportunities.

- Rebalance Periodically: Rebalance quarterly or semi-annually to prevent oversized winners from distorting portfolio construction and ensure laggards do not dominate psychology.

- Monitor Engagement via UTM Tracking: Use UTM-tracked research links to identify recurring interests—an insight that highlights areas deserving deeper due diligence.

Common Allocation Errors to Avoid

- Over-concentration in a single theme or chain

- Treating presales as lottery tickets instead of structured exposures

- Ignoring AI-assisted diligence in an increasingly complex market

- Letting narrative hype override pre-defined allocation rules

- Failing to rebalance in response to significant market moves

Conclusion

The best crypto allocation for 2026 isn’t about chasing the next chart-topping token—it’s about building a portfolio that’s smart, balanced, and strong enough to handle the market’s wild swings while still giving you room to capture serious upside. When you follow a clear 40/30/20/10 structure, add in AI-powered tools like IPO Genie, and use simple tracking methods like UTM insights to understand what’s actually working, you stop reacting to hype and start managing your portfolio with purpose. It’s a shift from guessing to guiding—from hoping for luck to relying on a strategy you can trust. Best crypto allocation for 2026 is not about guessing the next explosive token; it’s about architecting a risk-aware, structurally sound portfolio that can absorb volatility while capturing upside from AI, tokenized private markets, and frontier innovation.

By adopting a 40/30/20/10 allocation model, integrating AI-enhanced platforms such as IPO Genie, and leveraging tools like UTM tracking for data-backed refinement, investors can move away from reactive speculation and toward professional, repeatable portfolio management.

FAQs

1. How often should a professionally structured crypto portfolio be rebalanced?

A disciplined crypto portfolio should typically be rebalanced on a quarterly or semi-annual basis, depending on volatility and mandate structure. This ensures that outsized performers don’t inflate overall risk exposure and that underperformers don’t disproportionately influence allocation decisions. For institutional investors, rebalancing is a mandatory control mechanism for maintaining adherence to predefined allocation bands.

2. Where does IPO Genie belong in a professionally managed allocation structure?

IPO Genie fits within the Emerging High-Conviction (20%) allocation sleeve, which is dedicated to early-stage, AI-assisted, or tokenized private-market opportunities. Its AI-ranked deal discovery, behavior-based staking model, and tokenized pre-IPO framework make it suitable for investors seeking structured exposure to asymmetric upside opportunities without compromising portfolio architecture.

3. How does UTM tracking enhance crypto research and allocation decisions?

UTM tracking allows investors to measure engagement, research flow, and thematic concentration, helping determine which assets or sectors repeatedly attract interest. This meta-analysis can guide deeper due diligence, highlight overlooked opportunities, and support data-driven allocation adjustments—especially when using platforms like the official IPO Genie portal for emerging asset evaluation.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release

The post Building a Crypto Portfolio for 2026: Where IPO Genie Fits In appeared first on Live Bitcoin News.

You May Also Like

Will Bitcoin Make a New All-Time High Soon? Here’s What Users Think

SWIFT Tests Societe Generale’s MiCA-Compliant euro Stablecoin for Tokenized Bond Settlement