LivLive, TRON, or HYPE: Who Claims the 500x Crown in 2025’s Next Big Crypto Breakout?

Every cycle has a moment when investors look back and say they should have moved earlier. With the next big crypto narrative heating up, three names dominate early chatter: LivLive, TRON, and HYPE. Only one, however, is delivering a rare first-stage chance where timing directly multiplies returns.

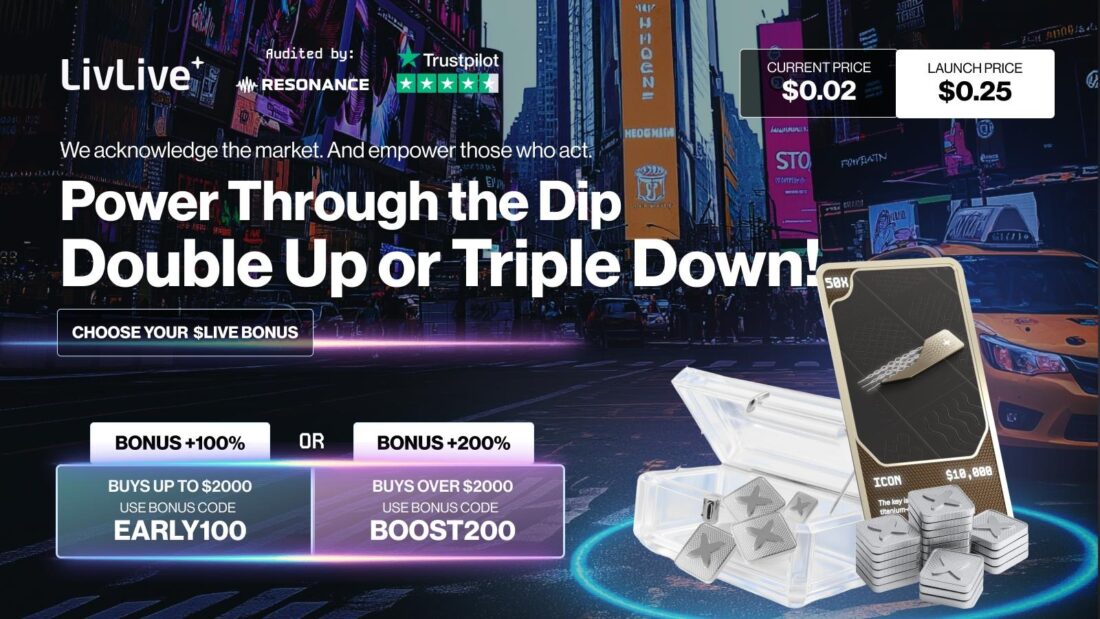

LivLive (LIVE) has surged ahead by raising over $2.1M at Stage 1 with a base price of just $0.02. It is already considered one of the most promising new launches because it blends real-world activity with blockchain rewards. TRON and HYPE have their updates, but LivLive stands far above the rest for early ROI potential and its highly aggressive bonus structure.

LivLive: The Presale Opportunity That Could Rewrite Early Investor ROI

LivLive is attracting explosive attention because its presale is structured for maximum early advantage. Stage 1 buyers are entering at $0.02, while Stage 10 sells at $0.20, and the projected launch target stands at $0.25. Early entries are already positioned for major upside before the mass market even joins.

What pushes LivLive into a different league is its dual bonus system. Investors buying up to $2,000 with code EARLY100 receive a 100% token bonus. Purchases above $2,000 using BOOST200 unlock a massive 200% bonus that triples the token stack instantly.

To illustrate how powerful this is, imagine an investor entering with $10,000 using BOOST200 at $0.02. They receive 500,000 tokens plus an additional 1,000,000 bonus tokens, ending with 1.5 million tokens. Even at the conservative launch target of $0.25, that stack reaches $375,000 in value. This is why LivLive is being discussed as the next big crypto opportunity with one of the strongest multiplier opportunities in early 2025.

The $2.5M Treasure Vault Advantage

Every presale Token and NFT Pack includes an NFT key that grants entry into LivLive’s $2.5M giveaway vault. More than 300 winners will be announced during the presale, leading to a grand $1M ICON prize toward the end. This system adds an extra reward layer for early buyers, giving them not only financial exposure but a chance at high-value prizes just for participating.

These repeated draw cycles continue until the presale ends. For investors, it means every early presale purchase delivers both tokens and potentially life-changing vault rewards.

LivLive’s Real-World Utility Strengthens the Investment Case

After the presale and bonuses, the next big crypto question becomes utility, and LivLive delivers one of the strongest real-world use cases in the market. Two features are driving early adoption.

The LivLive wearable wristband verifies real-world presence and unlocks AR quests, turning everyday movement into tokenized value. Early adopters also secure Token and NFT Packs that boost long-term mining power and unlock exclusive NFTs, giving them higher earning capacity across the entire ecosystem.

With 65% of the total supply reserved for the community, LivLive ensures early buyers capture the biggest share of future rewards.

Buy $LIVE Before the Next Price Movement

To join, create a wallet with MetaMask, Trust Wallet, Phantom, or Coinbase Wallet. Connect it to the LivLive presale page, select your payment method (ETH, USDT, USDC, or card via WalletConnect or Google Pay), and confirm the purchase. Your tokens and bonuses appear instantly.

Act now, buy today, and secure your $LIVE while the 100% and 200% bonus codes are still active.

TRON (TRX): Strong Usage, But No Early-Stage Multiplier

TRON continues to post some of the highest activity numbers in the industry, especially for stablecoin settlements. It remains the backbone for global USDT transfers and consistently shows rising daily active addresses. This gives TRX a stable position within the top blockchain networks.

However, TRON’s growth is gradual and predictable. As a mature ecosystem, it does not offer the explosive upside or early-entry pricing that presale investors typically look for. It performs well in high-volume markets, but it cannot match LivLive’s presale window, bonus tiers, or ground-level growth potential.

Hyperliquid (HYPE): A Fast-Growing Perps DEX

Hyperliquid is gaining attention as one of the fastest-growing decentralized perp exchanges. Traders value its speed, liquidity, and low slippage, putting it in the same conversation as dYdX and GMX. The HYPE token powers governance and incentives, with adoption rising alongside on-chain derivatives activity.

However, it still lacks what early investors chase most: a low-cost entry point and presale-style upside. There are no bonus tiers, no multi-stage pricing, and no early multiplier window. Its growth is tied to trading volume, not presale ROI, which puts it far behind LivLive for those targeting the next big crypto breakout.

2025 Outlook: The Smartest Early Move Points to LivLive

Based on current performance, the next big crypto opportunity of 2025 is led by LivLive. TRON and HYPE remain relevant, but neither presents the explosive early-stage structure, real-world verification layer, AR utility, or bonus-driven multiplier that LivLive delivers.

With Stage 1 still at $0.02, strong utility, fast adoption, and massive bonus tiers, LivLive offers the most compelling early entry. For investors seeking the strongest ground floor position in the next big crypto wave, LivLive stands as the clear leader right now.

For More Information:

Website: http://www.livlive.com

X: https://x.com/livliveapp

Telegram Chat: https://t.me/livliveapp

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release

The post LivLive, TRON, or HYPE: Who Claims the 500x Crown in 2025’s Next Big Crypto Breakout? appeared first on Live Bitcoin News.

You May Also Like

Siemens Patent Mentions IOTA for Renewable Energy NFT Certificates

Tron Makes Bold Moves in TRX Tokens Acquisition