Solana Price Analysis: What to Expect as 21Shares Launches SOL ETF on CBOE

Solana SOL $131.0 24h volatility: 7.1% Market cap: $72.64 B Vol. 24h: $5.54 B price declined 4% to $134 on Nov. 19, pressured by broader market turbulence. The retracement came as asset manager 21Shares launched its SOL ETF (TSOL) on the CBOE during the morning session, joining Fidelity, Grayscale, Bitwise, and other issuers already active with Solana-linked derivatives products.

21Shares confirmed the listing in an X post, congratulating its US team for navigating the SEC’s regulatory process. The firm stated that investors can now acquire TSOL units through their existing banks and brokerages, expanding access to regulated Solana exposure.

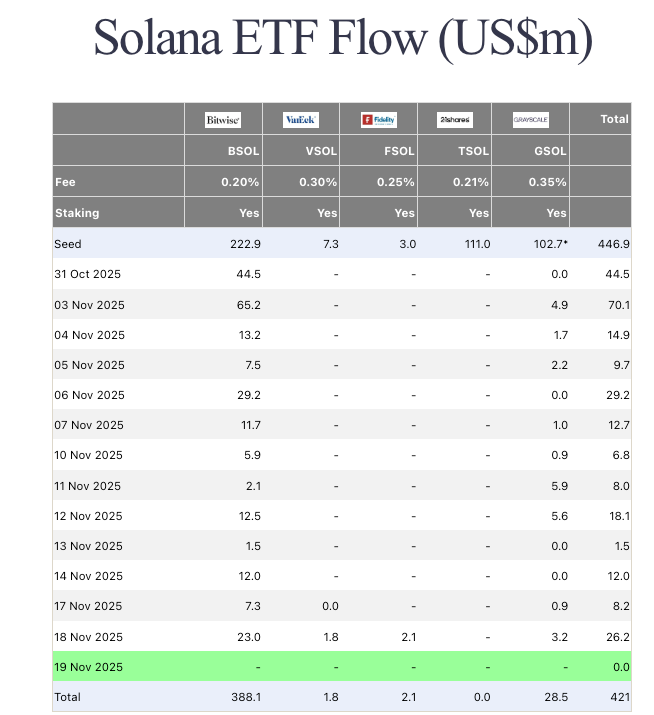

Active Solana ETFs have maintained a positive performance streak since their official debut on Oct. 28. According to FarsideInvestors data, these products now collectively hold $421 million worth of SOL. Bitwise leads with $388.1 million in BSOL holdings. VanEck’s VSOL holds $1.8 million, Fidelity’s FSOL holds $2.1 million, and Grayscale’s GSOL maintains $28.5 million.

Solana ETF performance data as of Nov. 19, 2025 | FarsideInvestors

Official data shows 21Shares launched TSOL with a $111 million seed fund, the second-largest after Bitwise, which seeded BSOL with $222.9 million. All active Solana ETFs are staking-enabled following recent SEC approval, allowing issuers to pass through staking rewards to investors. None of the Solana ETF issuers have recorded a negative flow day since launch, as investors continue to hold positions, collecting yield income.

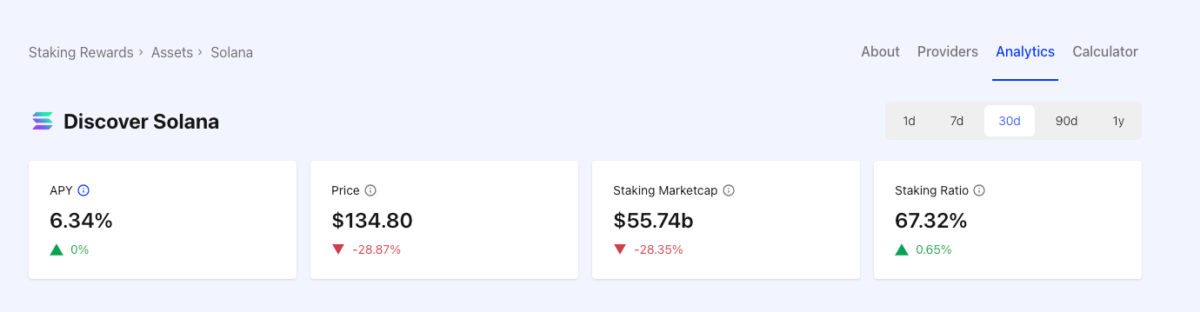

Solana staking analytics as of Nov. 19, 2025 | Stakingrewards.com

Solana currently offers up to 6.3% APY from staking, according to StakingRewards data. With an additional 0.65% increase intraday, Solana’s staking ratio rose to 67.3% at press time, supporting supply-side tightening despite short-term price weakness.

Solana Price Forecast: SOL Tests Support as Indicators Show Early Stabilization Signs

Solana price slipped to $133.88 at the latest 12-hour close, narrowing losses but still positioned inside a persistent downtrend.

Price action remains below the mid-line of the Bollinger Bands, reflecting continued bearish pressure. The lower Bollinger Band around $123.99 represents the next support area if selling persists. Meanwhile, the upper band near $168.79 remains the ceiling limiting any recovery attempts until momentum strengthens.

Solana (SOL) technical price forecast, Nov. 19, 2025 | Source: TradingView

RSI at 35.93 places SOL near oversold territory but not yet at capitulation levels. This reading shows weakening bearish momentum and hints that the selloff may be approaching exhaustion. A rebound in RSI back above 40 would strengthen early recovery signals.

However, Solana’s near-term outlook remains neutral-to-bearish unless the price reclaims the $146.39 mid-band region. A drop toward $124 remains the more likely outcome if market sentiment deteriorates. Conversely, a bounce from current levels could see SOL price revisit $145.

SUBBD Presale Crosses $1.2M as Solana Ecosystem Growth Lifts Web3 Investor Confidence

Solana’s resilience above $130 amid new ETF demand has sparked interest in early-stage projects like SUBBD ($SUBBD).

SUBBD integrates AI-driven personalization with creator monetization, enabling influencers and brands to build fan communities.

The SUBBD presale has now surpassed $1.4 million of its $1.5 million fundraising target, with tokens currently priced at $0.057 each. With less than 24 hours before the next price tier, interested participants can visit the official SUBBD presale website to unlock early-entrant rewards.

nextThe post Solana Price Analysis: What to Expect as 21Shares Launches SOL ETF on CBOE appeared first on Coinspeaker.

You May Also Like

XMR price pumps as a rare pattern points to Monero hitting $1,000

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets