ETH Tests $2.8K Support, Tom Lee Declares Bottom Is In – Potential $7K Breakout Ahead?

Ethereum (ETH) has again tested the critical $2,870 support for the first time since July, which then preceded a 72% rally to a new all-time high.

Fundstrat CIO and Bitcoin Chairman Tom Lee has now declared that the ETH bottom is likely in, following the $2,800 support test that immediately resulted in a rebound above $3,000 at press time.

Speaking on CNBC, Tom Lee told reporters that he remains bullish on Ethereum because of the significant innovation taking place on the network, including stablecoin creation and Larry Fink and BlackRock choosing it to tokenize real-world assets.

Lee said that “this will bring stocks, bonds, real estate onto the blockchain, and it requires a neutral and a 100% uptime blockchain, and that’s Ethereum.”

Tom Lee Says ETH Bottom Is In, Target $7K by Q1 2026

Lee added that the price of Ethereum fluctuates because crypto is still in its adoption stage, which brings a lot of volatility, and ETH isn’t spared from it.

He admitted that Ethereum has been in a downtrend “unfortunately”; however, he believes the bottom is in and ETH should break out towards $7,000 going into Q1 2026.

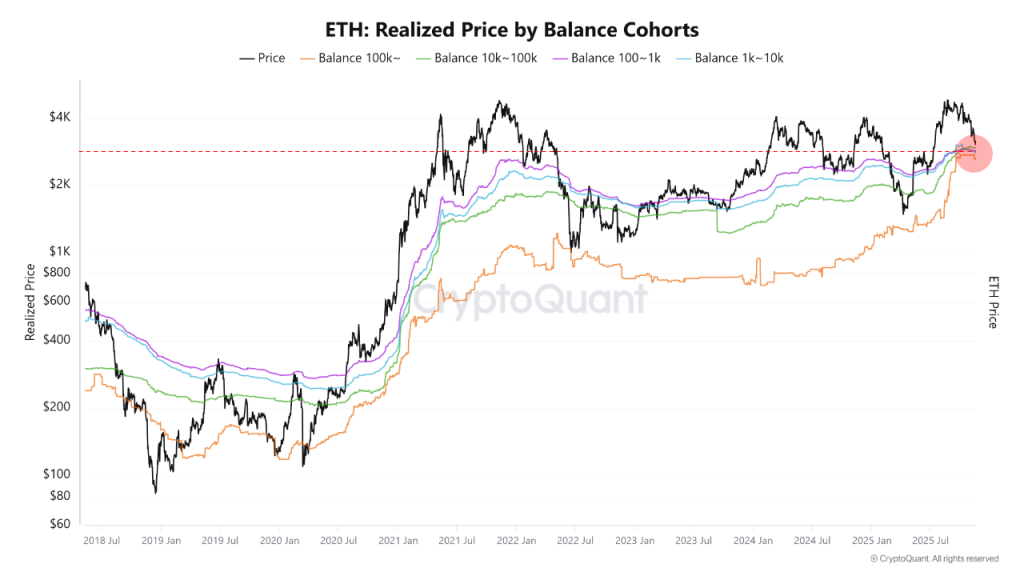

Analysts at CryptoQuant also observed that Ethereum’s fall to $2.87k has brought in a local bottom.

The analyst added that the $2.8k area is likely to act as an important on-chain support level for Ethereum, as this zone aligns with the realized price clusters of both retail investors and whales.

Source: CryptoQuant

Source: CryptoQuant

“Historically, realized price levels have often marked cycle bottoms, suggesting that this range could once again provide a foundation for a short-term rebound.”

Crypto analyst CryptoMe also added that Ethereum’s slip towards $2,800 means that ETH is at the average cost of what diamond-hand whales paid for it four months ago.

According to him, “In that case, an investor can buy slowly, gradually, in steps, calmly, and always remember: this is a long-term plan, not a short-term trade.”

Whales and institutions like BlackRock are now going all in on Ethereum.

Yesterday, the leading asset manager revealed its plan to file for a Staked Ethereum ETF, as per the Delaware name registration under the ’33 Act.

This means BlackRock will have not one but two ETH ETFs.

Aside from the current iShares Ethereum Trust ETF (ETHA), a new Ethereum ETF solely focused on staking would be launched to offer a 99% staking option for the fund, where investors will receive a higher real yield.

And for every $1 of ETH staked, it adds 3x equivalent value to Ethereum’s market cap at the peak bull run.

Plus, institutions are much more likely to buy into the staked ETF than the non-staked version because APR is what they all crave.

This institutional demand and relentless bid from DATs and retail investors is expected to send ETH to new highs around $7k.

Fibonacci Extensions Point to $5.75K–$6.5K Breakout Zone

On the technical front, the 3-day chart shows ETH breaking down from a local distribution range and pulling back into a major demand zone around the 50% retracement level at roughly $4,150–$3,900.

Price is currently sitting just above the $3,000 support, with a broader liquidity pocket extending toward the 100% retracement near $3,350.

Above the price, the fib extension cluster between $5,750 and $5,950 stands out as the next major magnet.

The circled region around the –50% and –61.8% extensions shows clear confluence, suggesting that if ETH successfully reclaims $4,150 and rotates upward, that zone becomes the most probable medium-term target.

The higher extensions toward $6,565 and beyond only activate after a decisive break and retest of the $4,950 mid-range level.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Uniswap & Monero Chase Gains: While Zero Knowledge Proof’s Presale Auctions Target Record $1.7B