Zcash outlook: Zcash between bullish trend and fearful market

Zcash is pushing higher against Tether, and the pair offers a revealing snapshot of how a strong uptrend can coexist with a fearful broader market. In the following lines we will unpack where this privacy-focused asset stands now and which paths might open next for traders and longer-term holders.

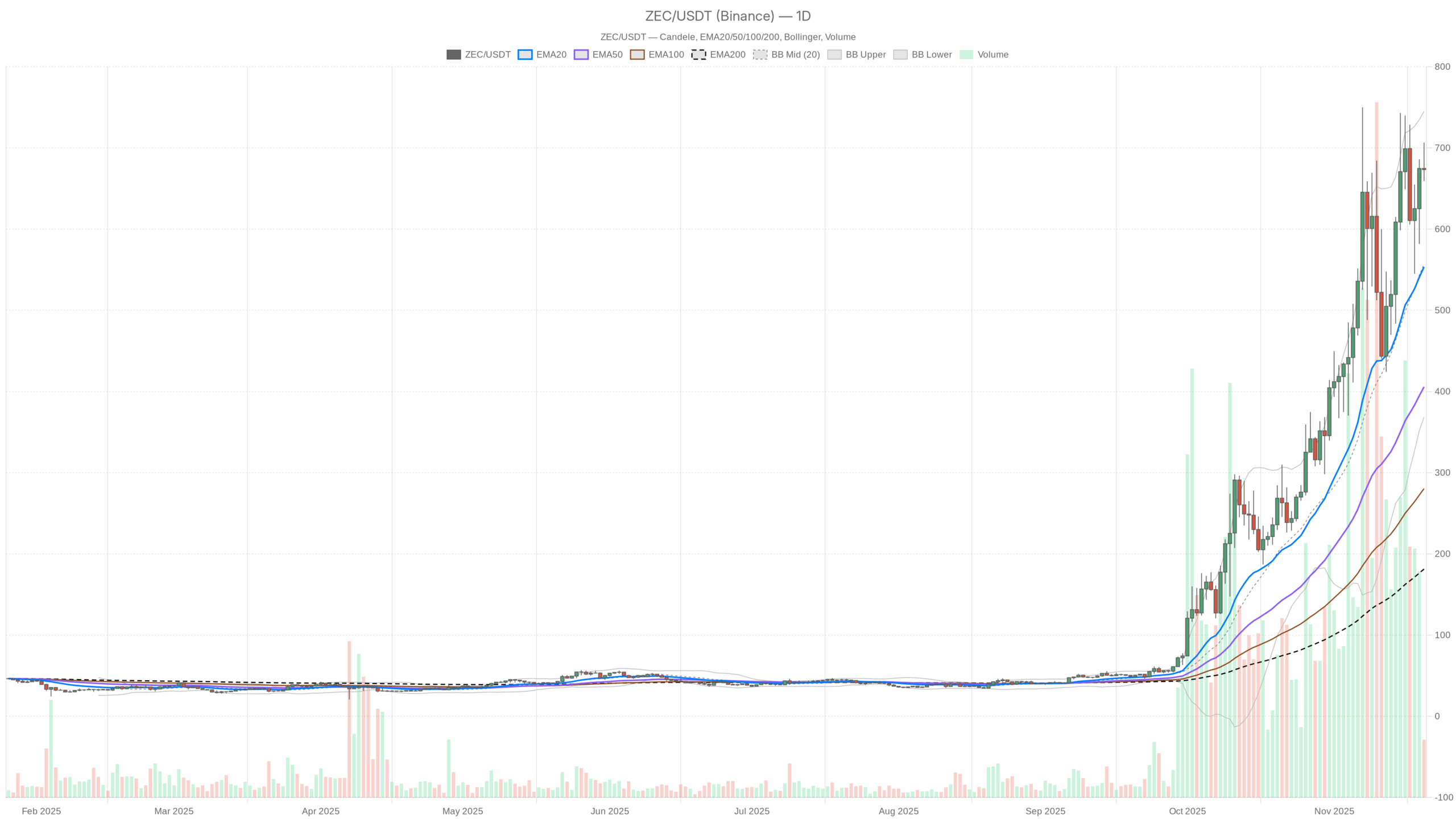

Zcash is pushing higher against Tether, and the pair offers a revealing snapshot of how a strong uptrend can coexist with a fearful broader market. In the following lines we will unpack where this privacy-focused asset stands now and which paths might open next for traders and longer-term holders.  ZEC/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

ZEC/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

Summary

The daily structure of the pair is clearly bullish, with price at 673.33 USDT well above all key moving averages. Momentum remains positive, as shown by an RSI near 66 and a MACD line still slightly above its signal. Moreover, price is trading in the upper half of its Bollinger Band envelope, a sign that buying pressure is still dominant rather than exhausted. However, a wide daily Average True Range above 120 USDT highlights an environment of elevated volatility. At the same time, overall crypto sentiment sits in “Extreme Fear”, and Bitcoin dominance above 57% suggests capital concentration in majors. As a result, this uptrend is strong but navigating a cautious and selective market.

Zcash: Market Context and Direction

The macro backdrop for digital assets is mixed. Total crypto capitalization hovers around 3.21 trillion dollars, yet it has slipped modestly over the last 24 hours, pointing to a market that is consolidating rather than rushing into fresh risk. Moreover, Bitcoin controls roughly 57% of total capitalization, underscoring a regime where large caps and perceived safer plays attract the bulk of flows.

Within this context, the pair stands out with a daily regime tagged as bullish. This indicates that, despite broader caution, buyers have been consistently in control over recent weeks. In contrast to the fearful mood, the Fear & Greed Index reading of 11, labeled “Extreme Fear”, shows that many market participants are still defensive or underexposed. That said, such a sentiment backdrop can sometimes favor assets already in trends, as investors who stayed on the sidelines may feel pressure to re-enter on dips.

Technical Outlook: reading the overall setup

On the daily chart, the exponential moving averages form a clean, rising stack. Price at 673.33 USDT trades well above the 20-day EMA at 553.37, the 50-day EMA at 405.74, and the 200-day EMA at 181.34. This configuration signals trend confirmation and a mature uptrend, where short, medium, and long-term participants are all sitting on gains. The distance between spot and the long-term EMA also hints that while the trend is strong, the asset is no longer in its early accumulation phase.

The 14-day RSI at 65.58 reinforces this picture. It is not yet in classic overbought territory, but it is in the upper band, pointing to firm bullish momentum without clear evidence of exhaustion. If RSI were to push above 70 and stay there while price stalled, that would increase the risk of a corrective phase, but current readings still lean toward continuation.

The MACD adds nuance rather than contradiction. With the MACD line at 87.93 and the signal line at 85.87, their small positive distance and a modest histogram of 2.06 indicate momentum slowing but not reversing. In practice, bulls still dominate, yet the explosive phase of the move appears to be cooling, often a prelude to sideways digestion or a gentler, grinding advance.

Bollinger Bands put volatility into context. The mid-line sits at 556.74, with the upper band at 745.08 and the lower band at 368.4. Price trades between the middle and the upper boundary, which usually signals persistent buying pressure but without a fresh breakout or band walk. This favors a scenario of continued upside bias with potential pauses rather than an immediate blow-off top.

Confirming the dynamic environment, the daily ATR stands at 129.27, meaning recent daily ranges are substantial. Such volatility expansion can amplify both gains and pullbacks, so position sizing and risk management become crucial even when direction appears clear.

Intraday Perspective and ZEC/USDT token Momentum

Zooming into the hourly chart, the uptrend remains intact but looks more measured. The price at 673.01 USDT sits above the 20, 50, and 200-period EMAs on this timeframe (663.67, 646.25, and 623.28). Meanwhile, the 1-hour regime is also flagged as bullish, showing that short-term flows are broadly aligned with the daily structure.

However, the hourly RSI around 58 suggests a more balanced configuration than the daily, with neither buyers nor sellers dominating aggressively at this micro level. As a result, intraday pullbacks or consolidations are possible without undermining the bigger trend. The hourly MACD, with a slightly negative histogram, points to a mild loss of intraday momentum, fitting the idea of a pause after a strong advance.

On the 15-minute chart, the tone becomes even more neutral. Price at 673.1 USDT fluctuates around the 20 and 50 EMAs (675.39 and 671.37) while staying well above the 200 EMA at 645.95. The regime is labeled neutral, and the RSI around 47 confirms this. Short-term traders therefore see a sideways consolidation inside a larger uptrend, a pattern that often precedes the next directional push.

Key Levels and Market Reactions

Pivot levels help frame potential reaction zones. On the daily chart, the central pivot sits near 679.7 USDT, just above current price. This area could act as a first decision point: sustained acceptance above it would reinforce the bullish continuation case, while repeated failures might invite a deeper pause.

Below spot, initial support emerges around 652.74 USDT, where the first daily support lies. A pullback toward this zone, especially if defended on closing bases, would likely be interpreted as a normal reset within the trend rather than a structural break. Deeper retracements toward the 20-day EMA near 553.37 would test the commitment of swing traders who entered late.

On shorter timeframes, hourly pivots cluster around current price, with minor supports and resistances only a few dollars away. This clustering fits the idea of a market catching its breath after recent strong movement, where local liquidity pockets dominate before a clearer breakout above the recent highs or a more noticeable dip toward daily support.

Future Scenarios and Investment Outlook

Overall, Zcash stands at an interesting intersection of strong technicals and fragile sentiment. The prevailing scenario is bullish: EMAs are aligned upward, momentum indicators support continuation, and volatility, while high, is trending in favor of buyers. Yet the backdrop of “Extreme Fear” and high Bitcoin dominance warns that capital can rotate quickly and that volatility spikes may be sharp on any negative catalyst.

For trend followers, respecting the uptrend while allowing room for volatility appears sensible: pullbacks toward daily supports and the rising 20-day EMA may offer opportunities as long as the broader structure remains intact. More cautious investors might wait for either a clear breakout above recent highs with strong volume or, conversely, a deeper correction that brings price closer to long-term moving averages. In any case, this asset now embodies the tension between opportunity and risk that defines late-stage bull phases across crypto.

This analysis is for informational purposes only and does not constitute financial advice.

Readers should conduct their own research before making investment decisions.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Uniswap & Monero Chase Gains: While Zero Knowledge Proof’s Presale Auctions Target Record $1.7B