Ethereum Price Slumps 15% In A Week — Can BlackRock’s Staked ETH ETF Stem The Slide?

The Ethereum price is down 15% in the last week and 1.1% over the past 24 hours to trade at $3,024 as of 2:33 a.m. EST on trading volume that rose 16% to $38 billion.

This comes as fund management titan BlackRock registered in Delaware for a staked ETH ETF (exchange-traded fund), one of the first steps that a fund issuer needs to take to file for a new ETF before a formal regulatory submission.

The move signals strong institutional confidence in Ethereum despite its recent slide and would unlock a new opportunity for investors seeking exposure to crypto assets that offer staking returns.

The sharp decline in the ETH price came amid growing uncertainty over monetary policy, with the Federal Reserve’s October 28-29 meeting minutes showing a slim majority of Fed officials against a December rate cut.

Ethereum Price Indicators Signal A Continued Bearish Stance

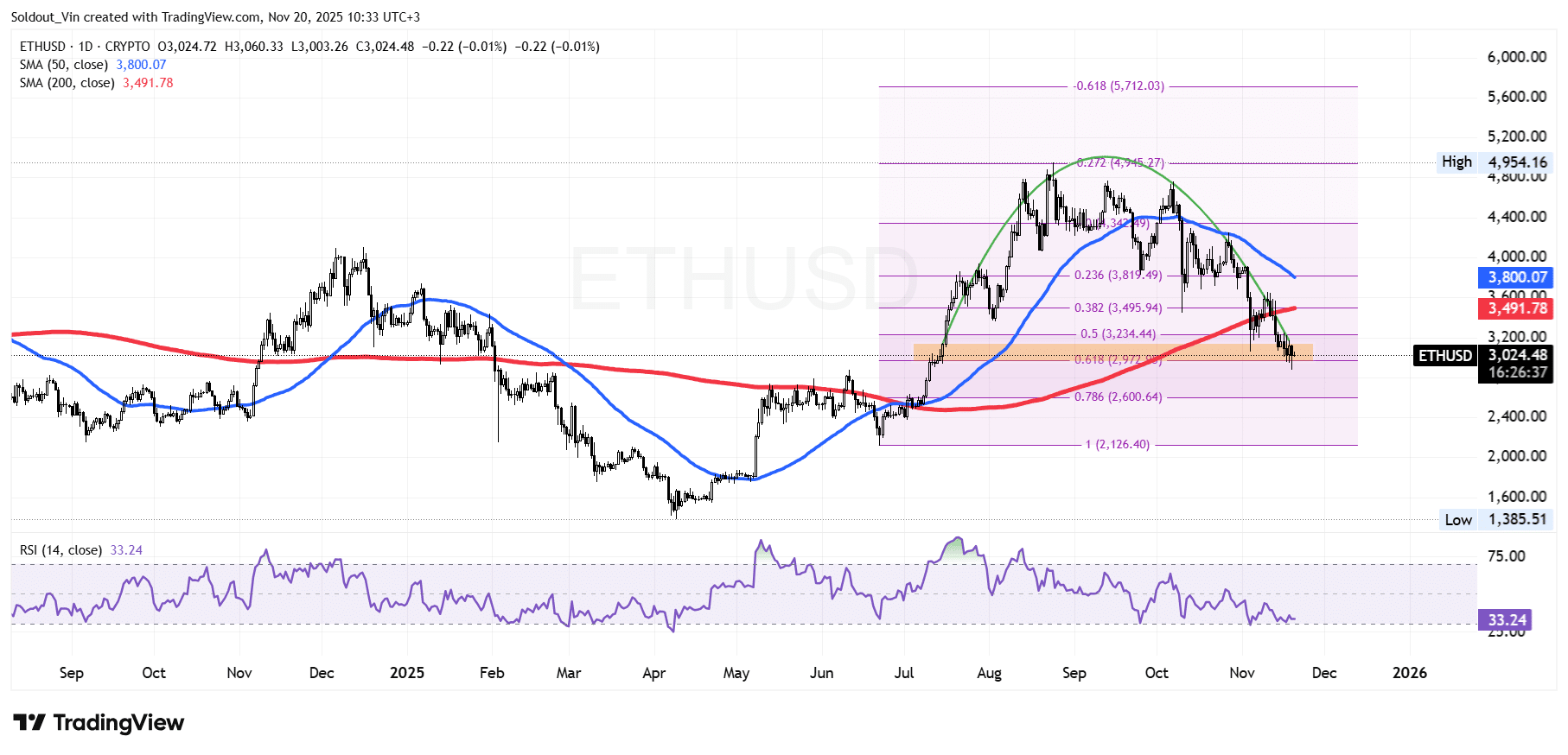

After going through a correction at the beginning of the year, the ETH price bulls used the support around $1,560 to push the asset through a recovery to a new all-time high in August of $4,954.

However, the bulls were unable to sustain this resistance, with the Ethereum price retesting the $4,736 resistance several times. As a result, the bears finally took charge, forming a rounded top pattern.

Meanwhile, the price of Ethereum continued to drop back to the neckline at the $2,972 support on the 0.618 Fibonacci retracement level.

As a result of the continued downtrend, ETH has now dropped below both the 50-day and 200-day Simple Moving Averages (SMAs), $3,800 and $3,491, respectively, which act as resistance levels on the upside.

Moreover, selling pressure is still intense, with the Relative Strength Index (RSI) still moving within the 30-oversold zone, currently at 33.24.

ETH/USD Chart Analysis Source: TradingView

ETH/USD Chart Analysis Source: TradingView

ETH Price Prediction

Based on the current ETH/USD chart analysis, the ETH price is testing a critical confluence zone near the 0.618 Fibonacci retracement level around the $2,970–$3,050 zone.

This area has historically acted as a strong reaction level, and the price of ETH’s ability, or failure, to hold above it will likely shape the next directional move.

A sustained close back above the 200-day SMA could open the door for a recovery toward the $3,230 (0.5 Fib) and $3,495 (0.382 Fib) regions, which may act as resistance during any relief bounce.

However, with momentum weakening and the RSI hovering near oversold territory, downward pressure remains influential. Should the price of Ethereum lose the current support, the next major Fibonacci level sits near $2,600, followed by a deeper retracement toward $2,126 if selling pressure intensifies.

Despite the turbulence in the Ethereum price, network fundamentals remain resilient. ETH staking hit a record high in November 2025, with over 33 million tokens now locked, according to Milk Road.

Milk Road observed that although sentiment has been weak, the high level of staked ETH indicates strong long-term confidence in the network.

Related News:

You May Also Like

Gemini Slashes 25% of Staff and Exits UK, EU, Australia After Bitcoin Crash — Now Betting Big on Prediction Markets