Hyperliquid (HYPE) Drops Out of Crypto’s Top 20 Club, Another 25% Dump Ahead?

November has not been kind to the crypto market (so far), and the past 24 hours brought another painful pullback.

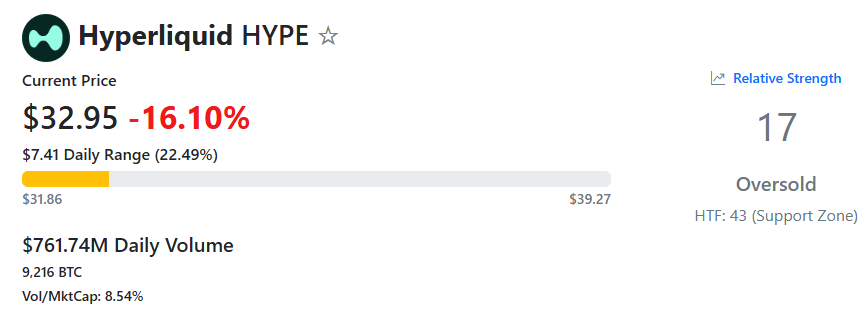

Hyperliquid (HYPE) is among the worst-affected digital assets, with its price plummeting by 18% over the last day at one point. Some analysts believe the storm has yet to pass, predicting further declines in the near future.

HYPE Leaves This Elite Club

As of this writing, the native token of the decentralized crypto exchange trades at roughly $33, whereas its market cap stands around $9 billion. This means that HYPE is no longer among the 20 biggest cryptocurrencies. Recall that a few months ago, the asset’s capitalization briefly exceeded $16 billion, placing it close to the top 10 club.

The renowned analyst Ali Martinez suggested that the problems for the asset might be just starting. He spotted the formation of a “head and shoulders pattern” on HYPE’s chart, where the “head” represents the all-time high above $58 reached in September. According to him, this may be followed by another 25% pullback to around $25.

Many other market observers believe a further slump could be on the way. X user Mr B expects to see HYPE trading in the $20-$30 range by the beginning of next year, forecasting that a drop of that magnitude is also possible before the end of 2025.

Earlier this month, Crypto Chase described the $25-$28 zone as “an area of interest for the long term,” hinting they would jump on the bandwagon if the price dips to that level.

HYPE is Oversold

Contrary to the hostile environment in the crypto sector and the pessimism among some analysts, HYPE’s Relative Strength Index (RSI) signals the valuation might be poised for a rally.

The technical analysis tool measures the speed and magnitude of the latest price movements and varies from 0 to 100. Readings below 30 indicate that HYPE is oversold and could post short-term gains, whereas readings above 70 are considered bearish territory. Currently, the RSI stands at 17, tipping the scales towards the bullish side.

HYPE RSI, Source: rsihunter.com

HYPE RSI, Source: rsihunter.com

The post Hyperliquid (HYPE) Drops Out of Crypto’s Top 20 Club, Another 25% Dump Ahead? appeared first on CryptoPotato.

You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets