Bitcoin Price Plunges Near $84k As Jobs Data Dampens Rate Cut Hopes, Ray Dalio Warns Of ‘Bubble’ Territory

The Bitcoin price dropped 7.5% in the past 24 hours to trade at $84,020 as of 2:46 a.m. EST on trading volume that rose 22% to $102 billion.

BTC tumbled to its lowest level since April as mixed US labor data dampened expectations of a Federal Reserve rate cut next month, triggering another wave of selling.

The US jobs report showed payrolls rising by 119,000 while the employment rate climbed to 4.4%, leaving the CME Group’s FedWatch Tool showing only a 41% chance of a rate cut next month.

Meanwhile, Bridgewater Associates founder Ray Dalio told CNBC in an interview that the the market is in bubble territory.

Dalio said investors should not necessarily rush to sell their holdings but warned of very low returns over the next decade.

With rate cut odds slashed, where does Bitcoin go from here?

Bitcoin Price Bearish Stance Dents Recovery Hopes

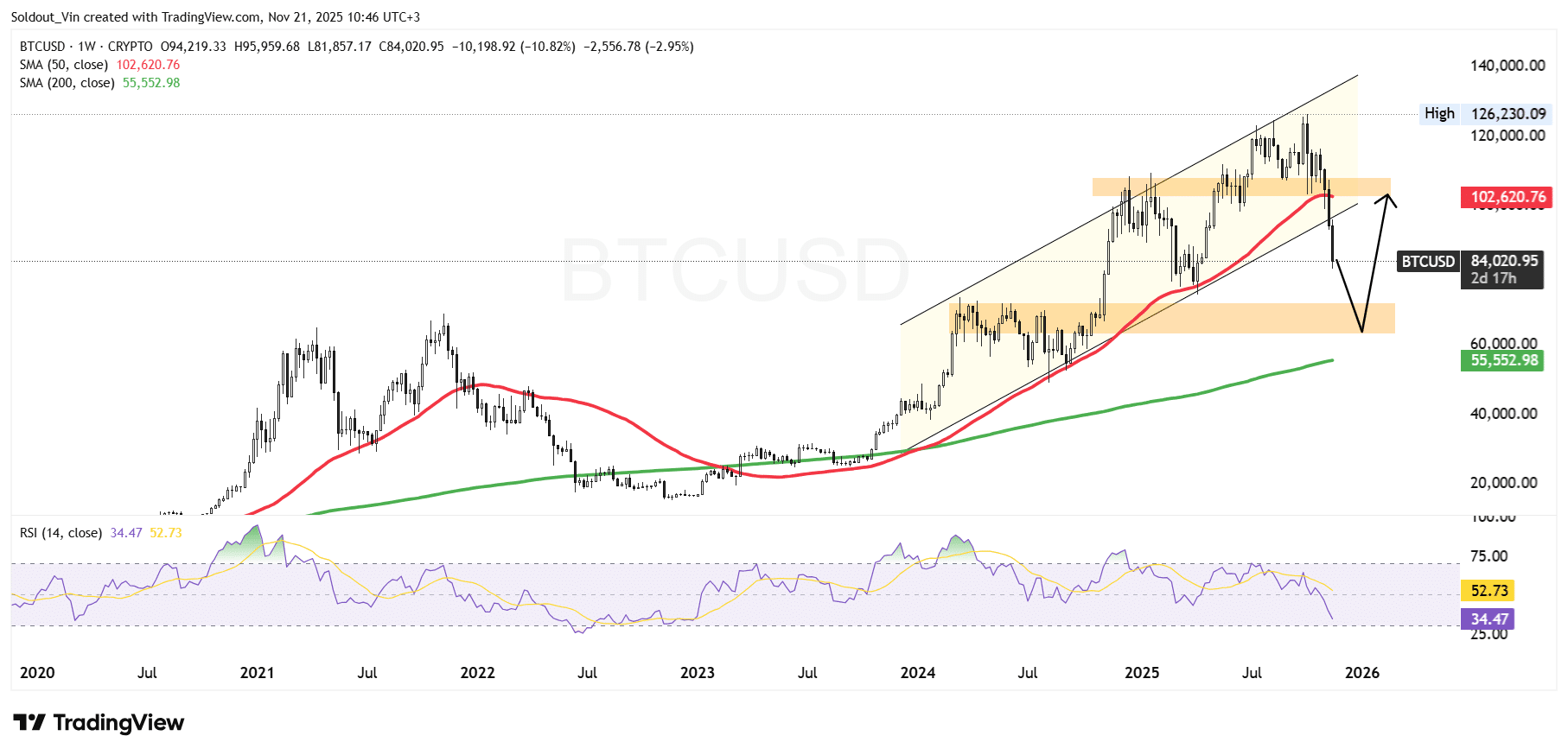

After a sustained rally from the $40,000 region through 2023 and 2024, the BTC price climbed steadily within a rising channel pattern.

However, as the Bitcoin price approached $125,000, bullish momentum began to weaken. Repeated rejections near the upper boundary of the rising channel signaled exhaustion, ultimately resulting in a significant reversal from the cycle high around $126,230.

However, the bears seem to have taken control of the price as a breakdown accelerated once BTC fell below the weekly 50 Simple Moving Average (SMA), currently near $102,600.

Historically, the 50-week SMA has served as a crucial trend indicator, and its breakdown often signals the start of a deeper correction. Multiple failed recovery attempts around this level further confirmed the weakening trend, reinforcing the bearish sentiment.

As selling intensified, Bitcoin descended into the lower portion of the channel and now continues sliding toward the next major demand region between $65,000 and $70,000. This zone represents a prior consolidation range and aligns with historical support from the early stages of the rally, making it a critical area for potential stabilization.

Further cementing the bearish stance, the weekly Relative Strength Index (RSI) has dropped sharply to 34, approaching oversold territory. While still above the 30 threshold, the indicator shows intensified selling pressure, with bears dominating the broader market.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

BTC Price Prediction

Based on the current BTC/USD weekly chart analysis, bears remain in control as Bitcoin trades decisively below the 50-week SMA and moves toward the major demand region beneath $70,000.

The loss of the channel mid-line and the sharp decline in RSI support the broader downward trajectory.

If bearish pressure continues, BTC’s price may test the $65,000–$70,000 support range, where buyers could attempt to reestablish control.

A breakdown below this region would open the door to a deeper correction toward the long-term 200-week SMA near $55,500.

However, approaching-oversold RSI conditions could fuel a temporary relief bounce. In such a scenario, recovery attempts may first encounter resistance near the $100,000 zone, aligned with the 50-week SMA and previous breakdown support.

Recent News:

You May Also Like

Understanding the Parts of a Check: A Complete Guide for Beginners

Trendline Tests Meet Corrective Bounce