48-hour fast chain building: How did Gorbagana use a grassroots carnival to "slap" the king-level L1?

Author: TechFlow

The current crypto market is gradually falling into fatigue.

The prices of Bitcoin and Ethereum are struggling in fluctuations, and the hot spots are dominated by crypto US stocks and stablecoins. The community spirit of the crypto industry that used to be a mixture of geeks and grassroots - playing memes, experiments, and collective carnivals - seems to have been crushed by market conditions and scams.

In the past two days, the long-lost community activity has returned, with a hint of crypto renaissance.

On June 19, Solana co-founder Anatoly Yakovenko (Toly) gave birth to a meme coin called Gorbagana in a casual discussion on social media;

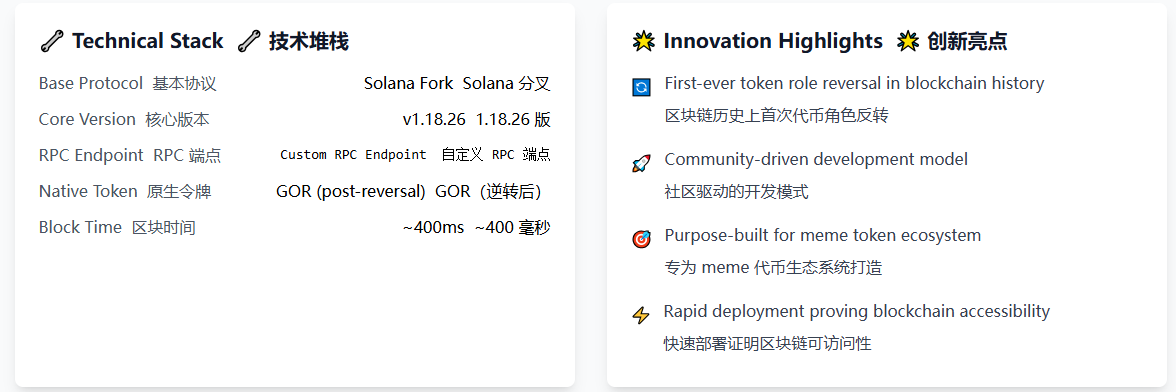

What’s interesting is that just 48 hours later, the L1 chain Gorbagana Chain with the same name as the coin launched the testnet and technically forked Solana.

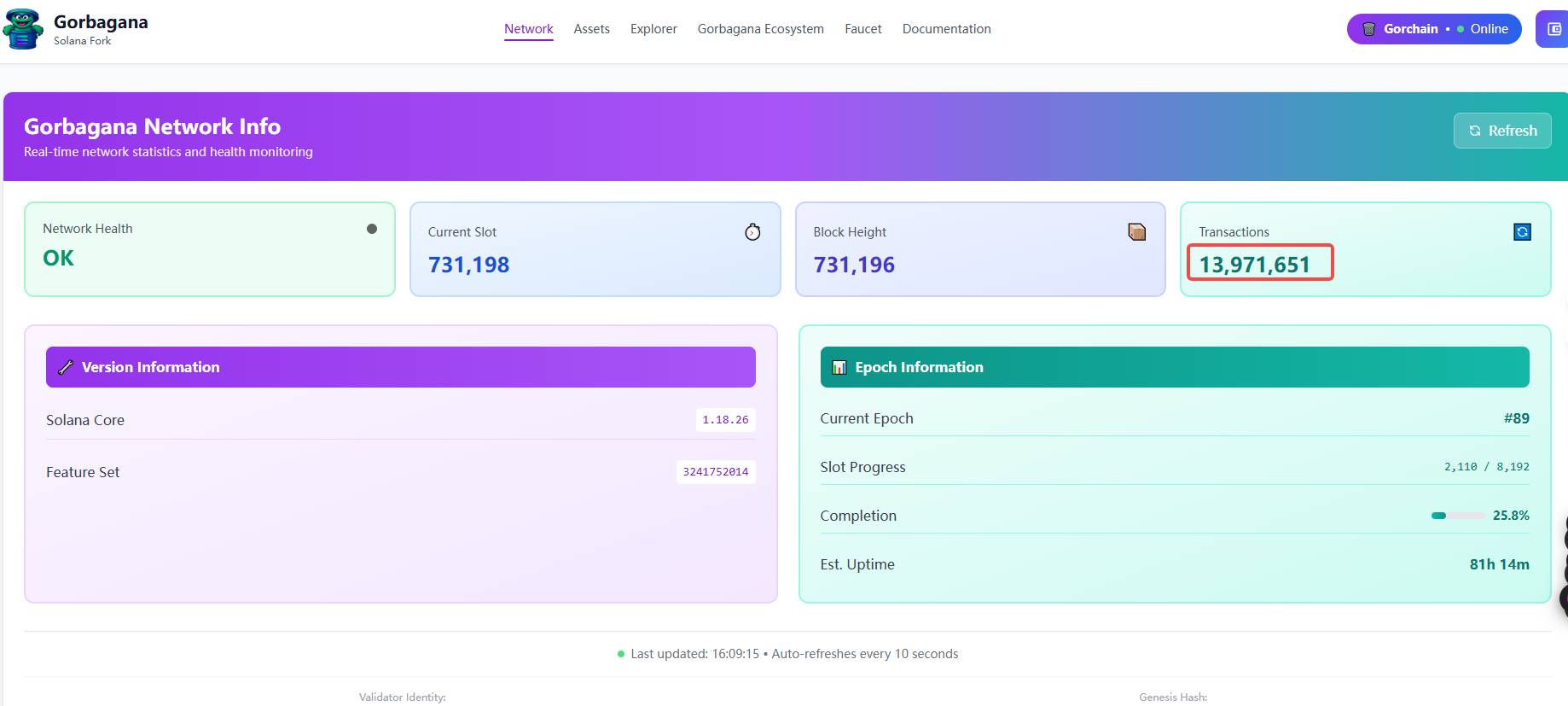

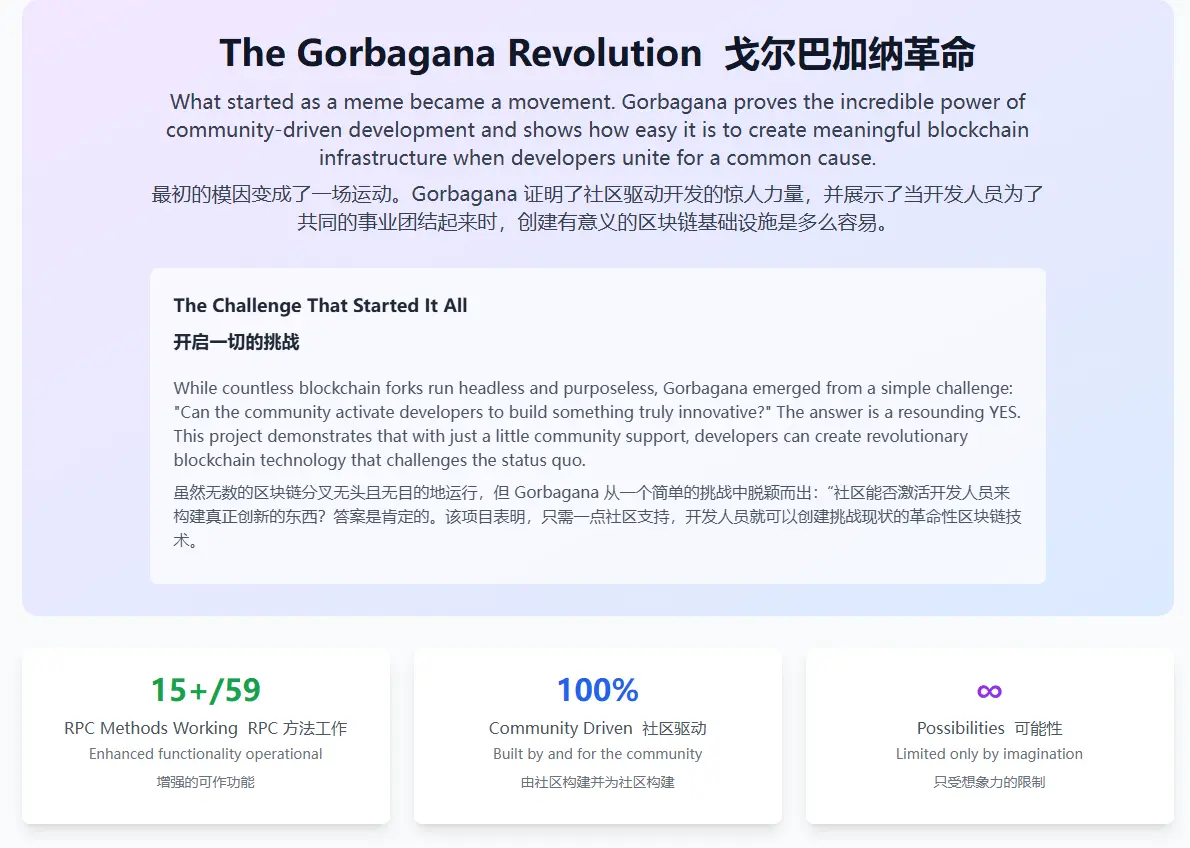

So far, Gorbagana has been running stably and has processed nearly 14 million transactions; the market value of the token $GOR has reached 30 million US dollars in 4 days (peak 60 million US dollars).

A meme itself is certainly not surprising, but the interesting and ironic thing is that it only takes 2 days from the community posting a meme to building a chain; while the so-called top-level L1 projects in the past may take 1-2 years from promotion to launching the test network.

There was no roadmap, whitepaper, or marketing; this was not a typical, carefully planned ICO, but rather an impromptu effort driven by Degen and developers in a Telegram group.

If you are not familiar with this incident, we have also summarized the whole process of the Gorbagana incident below.

48 hours, from joke meme to serious L1

Similar to some classic memes before, Gorbagana also started as a joke.

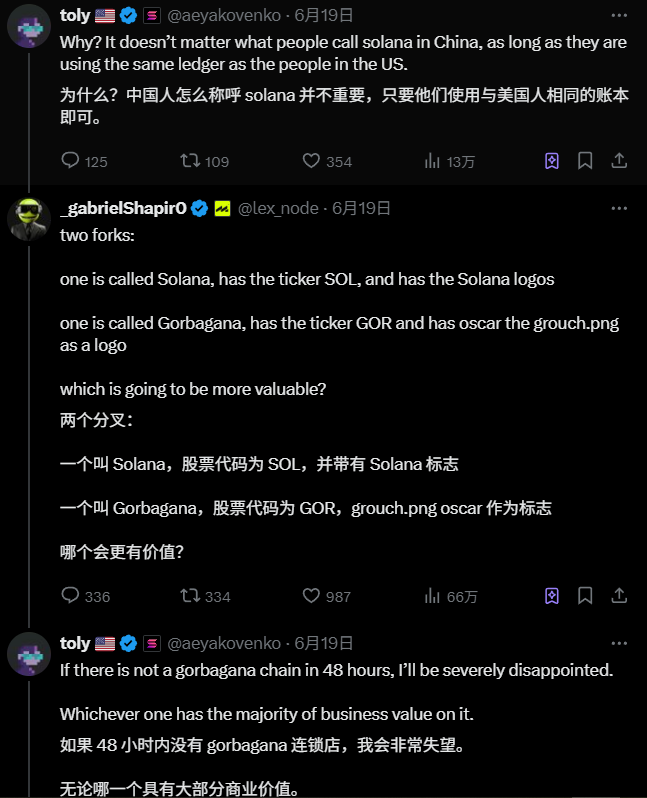

On the 19th, when Toly was chatting with other users on X about issues such as Solana’s brand recognition, netizen @lex_node made up a concept to refute Toly’s view that “brand name is not that important”:

If one chain is called Solana and another forked chain is called Gorbagana, the technologies are similar, but Solana is obviously more valuable.

Toly then played along and replied, "I'd be disappointed if no chain called gorbagana appears within 48 hours."

Apparently gorbagana is just a longer and more ridiculous name that sounds like Solana, but the community has since started to make fun of it:

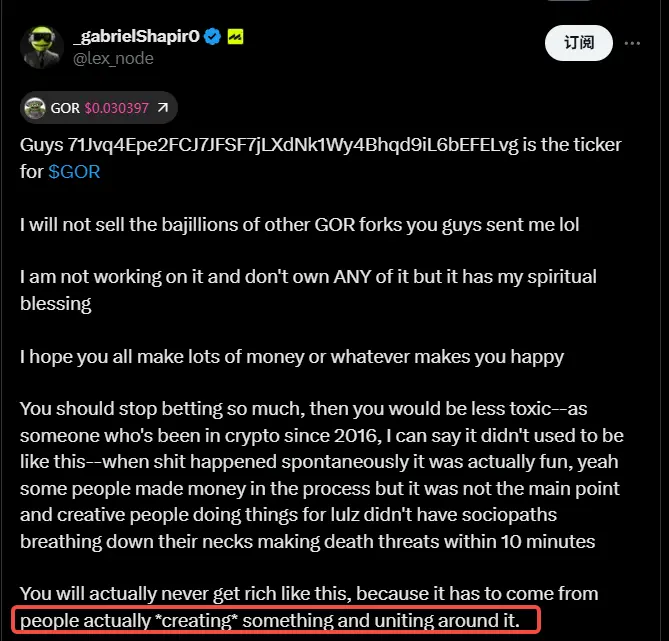

Six hours after this discussion post, @lex_node released a gorbagana token with the same name, $GOR, and told everyone that this was just a pure meme and not to bet heavily on it.

It is indeed nothing new to post a related meme, and the story here is not that exciting.

However, this sentence in his post is thought-provoking:

"You're never actually going to get rich from hyping up memes like this, because wealth has to come from people actually *creating* something and rallying around it."

After this sentence, the developers in the community started to take it seriously.

Solana had an old joke called SQL Chain in 2022. In fact, it was a joke by the community that Solana was nicknamed "SQL database chain" because of its high performance, and there has always been an idea that Solana would fork out a "junk version" of SQL Chain.

With this Gorbagana joke, the move to fork Solana really began.

Netizen @Sarv_shaktiman has also done development. After seeing Toly’s discussion post and GOR tokens, he bought a small amount of coins and called together the developer team of the Milady project, deciding to turn this old joke into reality.

It's just that the speed from joke to reality was too fast:

6 hours after the post was published, the token GOR was launched;

18 hours after the post was published, these developers had already started to reverse engineer Solana’s code architecture, trying to fork a new L1;

24 hours after the post was sent, the Gorbagana Chain testnet was launched, equipped with custom RPC functions and support for Backpack wallet.

48 hours later, the transaction volume of Gorbagana chain exceeded 10 million. Although it is a test network, it also proves the technical strength of the community developers. The market value of $GOR also peaked at 60 million US dollars.

The whole process has a long-lost atmosphere of crypto entertainment - the Builder of the community, from purchasing Meme, to studying blockchain architecture, to running a forked chain of Solana, just do it after buying it, integrating knowledge and action.

In addition to forking the entire Solana codebase to create a new L1, this chain also uses the Meme coin $GOR as a native token, supporting gas fee consumption and transfers.

There was no venture capital, no marketing, only collective improvisation and collaboration among community members, and a meme became a native token of L1 within 48 hours.

It wasn't a big deal, but it was interesting enough.

It was the kind of interesting thing that happened a few years ago when the chain was active and various community projects emerged one after another.

Community collaboration vs institutional incubation

Is it really that easy to copy a chain?

Forking Solana sounds simple, but there are actually a lot of headaches, such as wallet compatibility.

Mainstream Solana wallets such as Phantom and Solflare are unable to support Gorbagana’s custom chain function due to “hard coding” (the default program only recognizes the Solana mainnet and testnet), which is equivalent to isolating the new chain from the Solana ecosystem.

In other words, it is possible to fork Solana, but wallets may not support it.

Community developers are not faced with simply copying homework, but with breaking these technical barriers within 48 hours.

Among them, a user named @armaniferrante used the Backpack wallet’s “remote procedure call” (RPC, a protocol that allows wallets to communicate with chains) custom function to connect Gorbagana to the Solana ecosystem within 24 hours, and also enabled the custom RPC function to be used on the new chain.

Looking back, you can think of this as a "degen" version of a hackathon. There is no organization or planning for the event, and it all depends on the brothers in the group to brainstorm in real time to provide discussions and solutions.

Although the lead developer may have to expand the project's influence because he bought GOR coins, this whole set of practices is full of the long-lost energy of technical geeks:

Fill technical gaps with enthusiasm, use collaboration to find the right remedy, and ultimately complete a big project.

Although Gorbagana was only launched on a testnet, 48 hours is still very fast. Considering that some top infrastructure projects with institutional endorsement, a splendid team, and full funding often take several years to land, Gorbagana’s community collaboration is even more valuable.

At the same time, we can’t help but ask, if we move forward at full speed, will it really take that long to launch a complete L1 testnet?

Grassroots has its own flexibility. Community collaboration is just for an entertainment project. There is no KPI, no marketing and TGE rhythm considerations. It is of course purer in comparison.

The advent of institutional-level L1 itself involves the interests of investors in different rounds. When to go online, when to announce the test network, the management of airdrop expectations and interaction modes are no longer as simple as getting the technology right.

Not to mention, sometimes whether the token of a top-level project will be a TGE depends on the market conditions and sentiment. These infrastructure projects are more like a big ship, loaded with thousands of interests, and it is difficult to make quick decisions and turn around in the storm.

A long time ago, the interesting thing about encryption was that it relied on grassroots creativity rather than capital accumulation.

Gorbagana may not be popular for long, but it proves one thing:

In today's dull market, active grassroots are never absent, what is lacking may just be the fuse to arouse their enthusiasm.

You May Also Like

U.S. Moves Grip on Crypto Regulation Intensifies

Unleashing A New Era Of Seller Empowerment