JPMorgan upgrades Cipher and CleanSpark, trims MARA and Riot targets in bitcoin miner reset

JPMorgan refreshed its outlook on bitcoin miners and high-power compute-pivoting data center operators on Monday, upgrading Cipher Mining and CleanSpark while cutting price targets for several of the largest legacy miners.

Analysts Reginald Smith and Charles Pearce said the sector is entering a "higher-conviction" phase of HPC and cloud-compute transitions after more than 600 megawatts of long-term AI-related deals were signed since late September. This includes major contracts with AWS, Google-backed Fluidstack, and Microsoft.

They now expect miners to announce roughly 1.7 gigawatts of additional critical-IT capacity by late 2026, equal to about 35% of their approved power footprint.

Cipher and CleanSpark upgrade

Cipher Mining was raised to Overweight from Neutral, with its December 2026 price target lifted to $18 from $12. Analysts highlighted the company’s recent 410 MW of HPC contracts and a share-price pullback of roughly 45% from recent highs, calling it "a nice entry point."

-

Cipher Mining (CIFR) Stock Price Chart. Source: The Block/TradingView

The bank now expects Cipher to secure approximately 480 MW of critical IT by 2026 — roughly 64% of its approved capacity — and stated that long-duration sites slated for 2028–2029 could support valuations far higher under a full HPC transition.

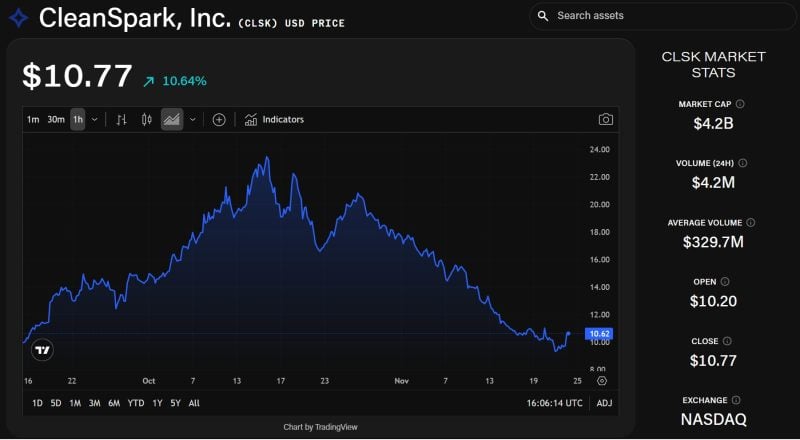

CleanSpark was also upgraded to Overweight, with JPMorgan reiterating its $14 target. Analysts credit the company with roughly 200 MW of critical-IT potential at its newly acquired 285-MW Texas site, valuing that capacity at about $13 million per megawatt.

-

CleanSpark (CLSK) Stock Price Chart. Source: The Block/TradingView

IREN target raised, rating stays Underweight

JPMorgan boosted its price target for IREN to $39 from $28, reflecting higher valuations for integrated cloud capacity after the company’s $9.7 billion Microsoft deal earlier this month.

Still, it maintained an Underweight rating, arguing the stock already prices in future HPC-cloud projects at undeveloped sites.

The bank now models IREN reaching 660 MW of contracted critical-IT load by 2026 — representing about 250,000 GPUs and roughly $6 billion in annualized cloud-services revenue.

Despite the higher target, the new $39 estimate sits below IREN’s current share price, which traded around $46.70 on Monday morning, according to The Block's price page.

-

Marathon and Riot targets cut

MARA Holdings' target was reduced to $13 from $20 due to declining bitcoin prices, rising network hashrate, and a higher share count tied to ATM issuance and convertible notes. JPMorgan also cut its valuation of MARA's mining business from roughly $2.5 billion to $1.3 billion.

Riot’s target was lowered to $17 from $19. Analysts now expect a 600-MW colocation deal at its Corsicana development — about one-third of its approved power portfolio — and marked down the value of its mining operations to roughly $1 billion.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

You May Also Like

What to Look for in Professional Liability Insurance for Beauty Professionals

Tether and Bitfinex Face Class Action Over Alleged Bitcoin and Ethereum Price Manipulation