Fact-check: Atiku Abubakar’s allegations against Xpress Payments Solutions are false

On November 23, 2025, former Nigerian Vice President Atiku Abubakar (@atiku), on X, criticised the Federal Inland Revenue Service (FIRS) for appointing Xpress Payments Solutions Limited (XPSL) as a new channel for Treasury Single Account (TSA) revenue collection.

Atiku described the move as a “quiet appointment” that resurrects the “Alpha Beta revenue cartel” from Lagos State under ex-Governor Bola Tinubu (1999–2007), alleging it creates a private monopoly on public funds, enables “state capture,” and lacks transparency amid Nigeria’s economic and security crises.

He demanded suspension, full disclosure, a TSA audit, and a ban on private intermediaries.

This fact check, based on official statements, media reports, and legal frameworks as of November 24, 2025, verifies the appointment occurred but finds Atiku’s core claims of secrecy, monopoly, and cartel revival largely unsubstantiated.

The process aligns with FIRS’s multi-channel tax reforms, with no evidence of private fund control or commissions. Political motivations appear to underpin Atiku’s critique, risking politicisation of routine administration.

Alhaji Atiku Abubakar

Alhaji Atiku Abubakar

In this article, we highlight the claims and examine whether they are true:

Claim 1: Xpress Payments Solutions’ appointment was secret or rushed without oversight

Verdict: False.

The appointment was not “quiet” or smuggled; it supposedly followed a transparent onboarding and was widely reported.

FIRS announced Xpress Payment’s integration on November 18, 2025, via press releases, covered by Vanguard, BusinessDay, and The Nation, among others. It stems from the Presidential Committee on Fiscal Policy and Tax Reforms, emphasising stakeholder engagement.

No National Assembly approval is required for PSSP additions, as it’s an administrative expansion under the FIRS Act 2007, not a new contract.

FIRS’s November 23 rebuttal, signed by Aderonke Atoyebi, stressed a “transparent, open, and verifiable procedure” with no executive shortcuts. Atiku’s call for suspension ignores this; no evidence of bypassing oversight exists.

FIRS clarifies PSSPs earn no fees, unlike Alpha Beta’s alleged model, ensuring no “rushed” privatisation.

Claim 2: Xpress Payments has a monopoly or private control over revenues

Verdict: False.

Xpress Payments is one of five PSSPs in a competitive framework; no monopoly or fund custody exists.

FIRS lists active PSSPs: Remita, Quickteller, eTranzact, Flutterwave, and XpressPay. This diversification, per Atoyebi’s statement, eliminates single-provider dominance, supports fintech jobs, and streamlines reporting.

All payments bypass PSSPs directly to the government’s TSA accounts. So, no intermediaries hold funds or take cuts.

Atiku’s “private toll gate” analogy misapplies Lagos’s Alpha Beta, which consulted on collections for commissions. Xpress Payments facilitates only, supposedly earning nothing per transaction. CBN regulation ensures compliance; no diversion risks.

Broader data: FIRS’s digital push collected ₦20.1 trillion via e-platforms in Q3 2025, up 22%. Adding Xpress Payments enhances access for underserved areas, not capture.

Claim 3: Is this a revival of the ‘Alpha Beta Cartel’ with political ties?

Verdict: Unsubstantiated.

No direct links Xpress Payments Solutions to Alpha Beta; alleged conflicts are speculative.

Alpha Beta’s scandals (e.g., 2018 EFCC probes) remain unproven; no obvious evidence connects it to Xpress Payments, incorporated post-Tinubu’s governorship. FIRS dismissed this as “incorrect,” warning against partisan attacks.

Xpress Payment’s track record includes MDA payments and CBN licensing since 2016. Claims of “nationalising” Lagos models lack proof.

Claim 4 – Atiku’s actual concern

Atiku explicitly asked, “Who truly benefits from this?” and demanded “full disclosure of the contractual terms, beneficiaries, fee structures, and selection criteria,” implying that politically connected individuals or networks are the real beneficiaries of the FIRS–Xpress Payments appointment.

Verdict: Unsubstantiated

- Financial benefit to any private individual or political network

FIRS states that Xpress Payments receives zero commission, zero processing fee, and zero percentage of collections. All funds go straight from the taxpayer to the Federation Account via the taxpayer’s bank and the CBN.

No evidence has surfaced of any side payments, revenue-sharing agreements, or kickbacks. Therefore, no private person or political network is skimming public revenue through this arrangement.

- Identity of the “beneficiaries” Atiku wants disclosed

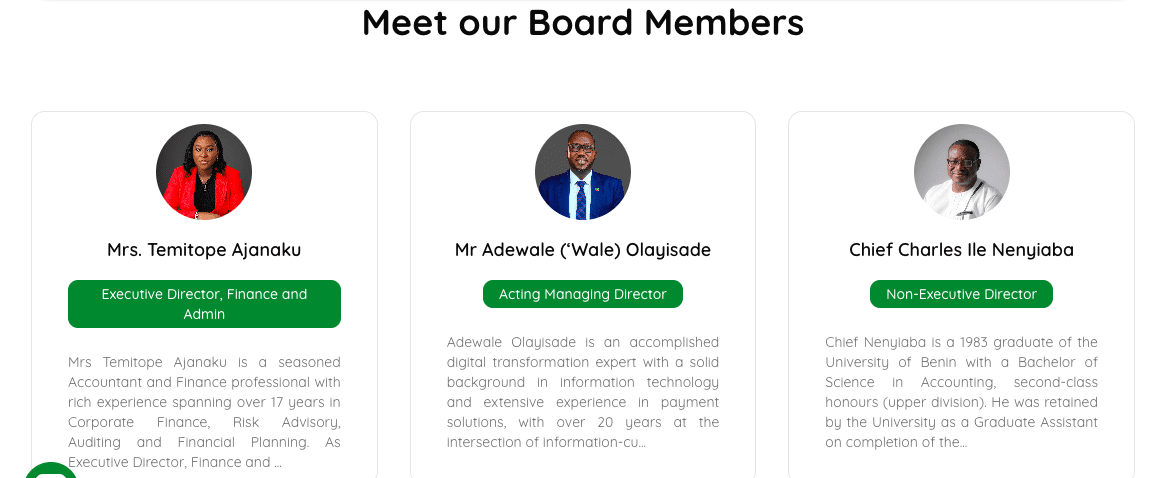

Ownership: Xpress Payments Solutions Ltd (RC 1335172) is a private limited liability company. Full shareholding is not public, but available data and leadership profiles point to a professional fintech group, not a political vehicle.

Dr Awa Ibraheem is the founder of Xpress Payments, and he currently serves as its founder and vice-chairman.

Also, the board & leadership are publicly visible on https://xpresspayments.com/about-us as of November 24, 2025.

None of these individuals has any documented past or present political office, campaign role, or direct link to Bola Tinubu or the Alpha Beta controversy.

- The only remaining “benefit”

Xpress Payments, as a corporate entity, gains brand visibility, transaction-volume growth, and potential future commercial revenue from offering a new payment channel. This is a normal commercial benefit for any PSSP added to the FIRS platform (the same applies to Remita, Flutterwave, etc.).

Conclusion

Atiku’s alarm raises valid transparency calls but exaggerates facts: the appointment is routine, competitive, and regulated, not expressly cartel revival or capture.

Verdict: Mostly False, with political undertones. FIRS’s multi-PSSP model advances efficiency without private gains.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Vitalik Buterin Supports Native Rollup Integration on Ethereum