Grayscale Says Bitcoin 4-Year Cycle Stands Invalid, Eyes BTC Price All-Time High in 2026

Despite the latest Bitcoin BTC $87 509 24h volatility: 2.0% Market cap: $1.75 T Vol. 24h: $73.28 B price drawdown to $85,000 and major market liquidations, Grayscale remains confident of BTC hitting new all-time highs in 2026. The asset manager added that the four-year cycles are a thing of the past and are no longer valid any further. With Bitcoin already seeing a 21% correction over the past month, Grayscale’s comments have instilled some confidence among investors.

Grayscale Rejects Bitcoin Four-Year Cycle Theory

In a report published on Dec. 1, asset manager Grayscale BTC is unlikely to follow the four-year cycle moving further. The four-year cycle typically reflects the long-time belief that BTC price tends to peak and later undergo a major correction every four years. In the report, Grayscale analysts noted:

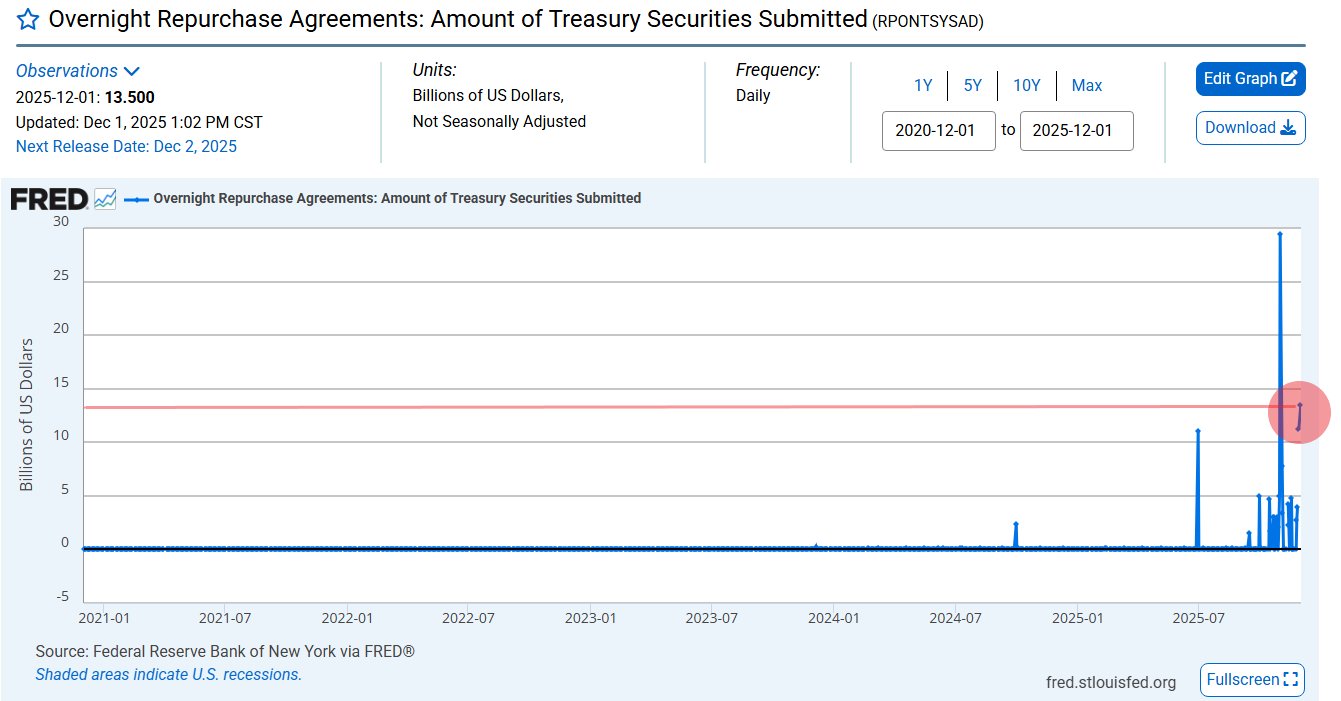

The asset manager also cited several structural reasons for BTC to end the four-year cycle. The firm noted that, unlike previous bull runs, this cycle has not produced the typical parabolic surge that often precedes a major correction.

Bitcoin parabolic surge is missing in 2025 | Source: Grayscale

According to its analysis, institutional capital is now the dominant force, flowing primarily through Bitcoin ETFs.

Grayscale added that the broader macro environment is also more supportive, with potential Fed interest-rate cuts and growing bipartisan momentum on crypto legislation. The asset manager also noted that Bitcoin Treasury firms like Strategy (MSTR) have a dominant role to play.

Tom Lee, CEO of Ethereum treasury firm BitMine, echoed Grayscale’s assessment. He stated that there is a widening gap between underlying market fundamentals and current asset prices.

BTC Price Keeps Investors Guessing

Bitcoin bulls failed to hold above $90,000 levels after a breakout last week. On Dec. 1, the largest crypto saw yet another pullback, falling all the way to $86,000.

Market analyst Ted Pillows stated that Bitcoin is currently trading in a neutral zone, offering no clear directional bias.

According to Pillows, BTC must reclaim the $88,000 level to regain bullish momentum. If the recovery fails, he warned that BTC could revisit the November lows of under $80,000.

nextThe post Grayscale Says Bitcoin 4-Year Cycle Stands Invalid, Eyes BTC Price All-Time High in 2026 appeared first on Coinspeaker.

You May Also Like

Solar and Internet from Space: The Future of Global Connectivity and Energy Supply

This Ethereum Competitor Is the ‘Most Commercially Viable Blockchain’ for Global Markets and Payments, According to Pantera Capital