Connecticut Orders Robinhood and Other Platforms to Halt Event-Based Betting

Connecticut issues cease-and-desist orders to Robinhood and others over unlicensed event-based betting, raising concerns about legality and consumer protections.

Connecticut has issued cease-and-desist orders against Robinhood and several platforms for offering event-based betting without licenses. The state argues that its contracts are very similar to sports wagering and contravene gambling laws. Moreover, regulators are warning that these services contain major risks because of a lack of oversight and protection.

Connecticut Challenges Legality of Event-Based Contracts

The orders are directed at platforms that allow users to trade for contracts that are linked to future events. These include events in sport, finance, and politics. Officials say that such contracts are not financial instruments but unlicensed sports betting. Therefore, the companies have to stop all activities that impact Connecticut’s residents. Regulators emphasized that licensed operators are the only ones legally able to provide wagering services.

Related Reading: Prediction Markets News: Galaxy Digital Eyes Liquidity Role in Prediction Markets | Live Bitcoin News

Officials also stressed age-related restrictions under the state rules. They said none of the platforms involved are transparent of the requirements to prevent wagering by persons under twenty-one. In addition, the state pointed to wider policy issues. Regulators said these markets are outside of established compliance structures. As a result, users do not benefit from the necessary safeguards that are found in licensed environments.

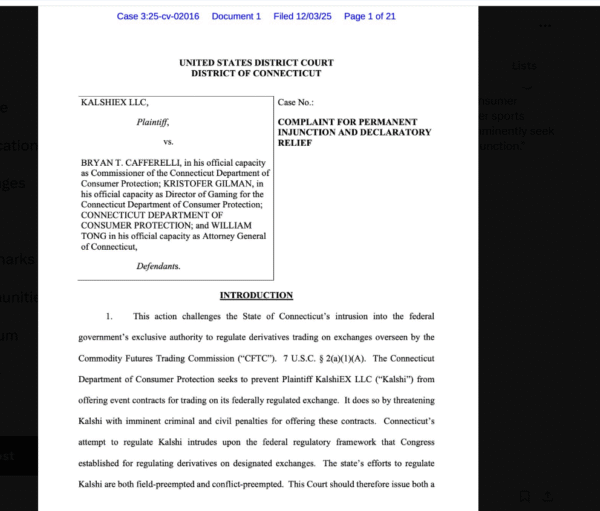

Robinhood and Kalshi maintain that their products are subject to federal jurisdiction. They argue the Commodity Futures Trading Commission regulates what they offer as financial contracts. However, the state dismisses such an interpretation. Connecticut insists that event-based trades fit the definition of sports wagering according to their statutes. This dispute is just one of the many that have arisen in the country about how prediction markets should be categorized.

Reasons Behind Connecticut’s Enforcement Action

Regulators listed unlicensed gambling as their number one concern. They claim that these platforms masquerade as investing activity. Although the companies call these tools forecasting products, the state believes they mimic the functions of betting. Accordingly, the firms were held to operate without mandatory approvals from the regulators. The state stressed that even the licensed operators must follow strict conditions to follow.

Officials also expressed their concerns about limited consumer protections. They warned of absent safeguards on integrity designed to ward off insider influence. Without such controls, the outcome of events might be open to manipulation. In addition to that, settlement rules are not regulated. As a result, users have no clear mechanisms for the resolution of contract disputes. Such a structure, they said, puts customers at greater peril.

Moreover, the state accused the platforms of reaching vulnerable groups. Regulators said they market to those on Connecticut’s Voluntary Self-Exclusion List as well as to college students. These concerns added to the rationale for immediate intervention. The state said that these are activities that violate fundamental principles of responsible gambling oversight.

CFTC Challenges Fuel Ongoing Uncertainty in Prediction Trading

This enforcement action is consistent with national debates that are still ongoing. Across the country, regulators continue their deliberation on whether event contracts constitute trading products or illegal gambling. The CFTC has not been a fan of prediction markets before. For instance, the agency tried to prevent the election contracts of Kalshi. These conflicts represent an ongoing uncertainty about which regulatory boundaries should be set for such platforms.

Source: CT.GOVT

Source: CT.GOVT

The companies involved have been scrutinized in the past. Robinhood is pausing Super Bowl-related contracts in early 2025 due to a request by the CFTC. Similarly, other platforms were warned about event-based products, which were not approved. These prior cases influenced the decision by Connecticut to keep an eye on emerging services more closely. The state said that consistent oversight is still essential as new markets evolve.

Connecticut strictly regulates online sports betting on licensed operators. Current approved platforms include DraftKings, FanDuel and Fanatics Sportsbook. Oversight is with the Department of Consumer Protection. Therefore, unlicensed activity goes directly against the regulatory framework of the state.

The post Connecticut Orders Robinhood and Other Platforms to Halt Event-Based Betting appeared first on Live Bitcoin News.

You May Also Like

Korea Deepens Crypto Push With Tokenized Securities Rules

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus