Can HYPE Price Hold the $30 Level Amid Market-Wide Selling Pressure?

The post Can HYPE Price Hold the $30 Level Amid Market-Wide Selling Pressure? appeared first on Coinpedia Fintech News

This week’s HYPE price update highlights a sharp shift in sentiment as the broader crypto market downturn pressures Hyperliquid’s native token. Despite strong revenue fundamentals and bold long-term projections, short-term weakness and declining open interest raise important questions for the HYPE price prediction outlook.

Revenue Strength Fuels Long-Term Interest in HYPE

One of the biggest drivers of attention around HYPE crypto comes from the company’s extraordinary financial profile. Hyperliquid is generating an estimated $1.15 billion in annual recurring revenue with a team of only 11 employees, making it one of the most profitable and lean operations in the sector, per David Schamis, CEO of Hyperliquid Strategies.

This level of efficiency and scale has prompted David to ambitiously project HYPE’s valuation growth trajectory significantly higher than today’s. He said in a video clip that he expects the token could achieve a 20× expansion from current market cap levels, provided the ecosystem continues compounding revenue without reliance on outside capital.

Although this narrative supports a strong long-term HYPE price forecast, the immediate challenge lies in the market environment, where macro weakness is overpowering fundamentals.

Short-Term Outlook Hinges on Key Support Levels

While long-term optimism persists, the near-term structure of the HYPE price chart is displaying decisive pressure. Technical discussions across the community highlight that the $30–$31 range is a critical support zone. If this level fails, the HYPE price USD could slide sharply toward the $20 region, reflecting broader capitulation across high-beta altcoins.

Conversely, if the token manages to hold this support and reclaim upward momentum, analysts note that a meaningful reversal could emerge into 2026, especially once the broader crypto market stabilizes. This makes the current range one of the most important regions for traders tracking the next move.

Open Interest Decline Signals Lower Risk Appetite

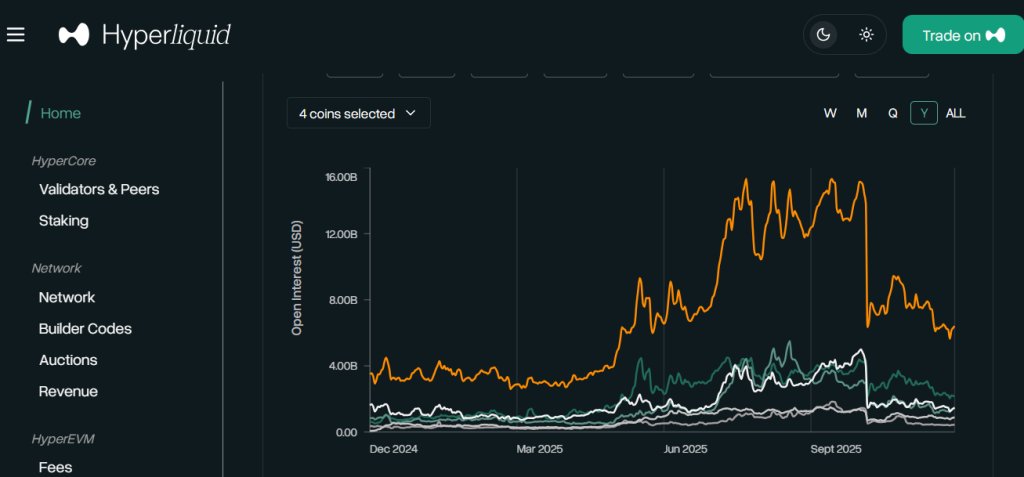

Another factor shaping market expectations is the dramatic decline in trading activity. During Bitcoin’s all-time high period earlier in October, Hyperliquid recorded open interest (OI) near $16 billion, supported by intense trading across BTC and ETH. However, by early December, OI has fallen to around $6 billion, marking a significant contraction.

This drop suggests that traders are taking fewer positions, reducing leverage exposure, and acting with greater caution amid ongoing market pullbacks. At the same time, the pattern also implies that once leading assets such as Bitcoin and Ethereum regain strength, the derivatives activity on Hyperliquid and possibly the HYPE price itself could see a strong resurgence.

Altogether, reduced risk-taking, weakening technical structure, and exceptional revenue fundamentals all converge to define this week’s evolving narrative around Hyperliquid.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

Disney Pockets $2.2 Billion For Filming Outside America