Why instant crypto exchanges are essential for traders in 2025

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

With crypto booming in 2025, instant exchanges like Quickex offer fast, hassle-free swaps for traders at every level.

It’s 2025, and the crypto market’s on fire. Bitcoin has sailed past $100,000, Ethereum is driving a DeFi explosion, and new tokens are dropping left and right.

Whether someone is just dipping their toes in or trading like a pro, they need a way to swap coins fast without getting bogged down. That’s where instant crypto exchanges shine, and platforms like Quickex make it feel effortless. Here’s why these tools are a go-to in today’s wild market and what sets them apart.

Why fast crypto swaps are changing the game for traders

Previously, cryptocurrency transactions were a nightmare; endless forms, days of waiting, and constant worry about funds. Instant exchanges like Quickex have flipped that script. They’re like grabbing coffee to go: pick coins, swap, and it’s done in minutes.

With over 1,000 trading pairs, users can do things like exchange Bitcoin or chase any hot altcoin. It’s a breeze, whether someone is new to crypto or a market junkie.

The best part? There’s no need to be a tech wizard. The interface is as simple as texting a friend. Choose a pair, hit confirm, and move on with the day. It’s built for real people who just want to get things done.

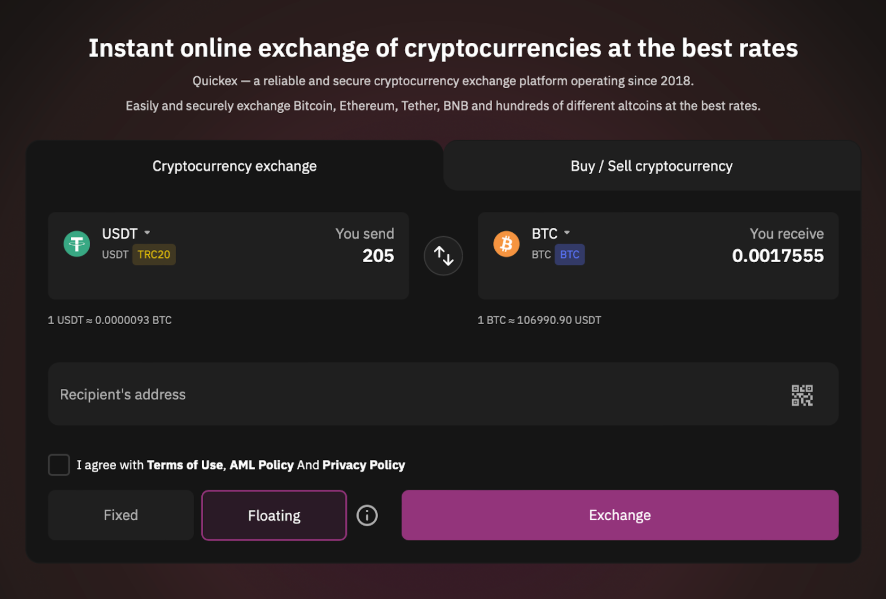

How does a crypto exchange in 3 simple steps look?

- Select the cryptocurrency to exchange and the one to receive — for example, BTC to USDT.

- Input the amount and a wallet address. Double-check everything to ensure accuracy.

- Make the payment to the generated address. Once the transaction is confirmed, the exchanged crypto will be sent to the wallet, usually within minutes.

Top features that make instant crypto platforms stand out in 2025

Here’s what to know about what makes the best instant exchanges popular in 2025:

- Tons of Trading Pairs: Top platforms offer over 1,000 pairs so that people can swap Bitcoin, Ethereum, Monero, or whatever’s trending. The platform gives anyone that flexibility, letting them pivot to any coin that’s catching fire. It’s like a crypto playground – endless choices, no limits.

- Ironclad Security: In crypto, keeping money safe is non-negotiable. Quickex doesn’t store user funds – everything stays in a user’s own wallet, giving them full control. Think of it as keeping cash under the mattress, but with high-tech encryption to lock out thieves. This setup ensures funds are as secure as it gets.

- Speed: When the market’s moving, every second counts. Quickex gets swaps done in 5-10 minutes with fees starting at 0.5%. No mandatory KYC means privacy is kept, especially for coins like Monero that are all about staying low-key.

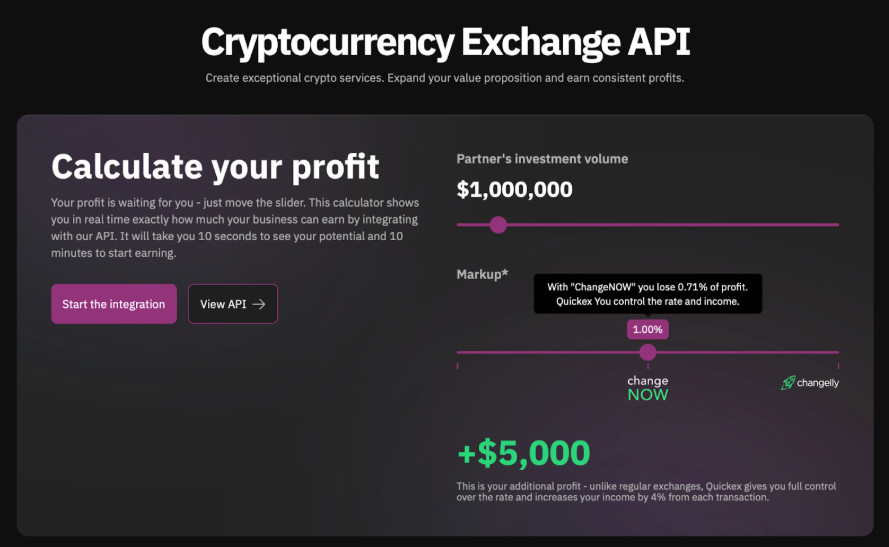

- Developer Perks: For those building a crypto app, instant exchanges are a lifeline. Quickex’s crypto exchange API lets developers weave swap features into their platforms, making crypto smooth for users. It’s perfect for the web3 craze taking over in 2025.

Crypto market trends in 2025: Why Flexibility matters more than ever

Zoom out, and the market’s a whirlwind. Bitcoin’s a rockstar, pulling in everyone from big banks. Ethereum’s the engine behind DeFi, with new projects launching daily. Monero’s still the pick for anyone who wants their moves off the radar. Instant exchanges let everyone bounce between these worlds, swapping Bitcoin for Ethereum to catch a dip or diving into Monero for privacy. It’s about staying nimble in a market that’s always on the move.

Why instant crypto swaps matter in a volatile global economy

In 2025, the world feels shaky – geopolitical tensions, economic uncertainty, you name it. It’s practically pushing people to keep their money safe and stay on top of tech that protects their freedom. Instant exchanges are a smart move for anyone who values privacy and doesn’t have hours to waste. Quickex, with its massive range of pairs and focus on keeping funds in the user’s control, fits the bill. Whether someone is exchanging BTC to XMR to stay private, using the exchange API for their app, or exploring exchanges to dive into crypto, these platforms let them move fast and stay secure in a world that demands both.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

You May Also Like

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities