3 Crypto Mining Stocks That Can Rally Even As Bitcoin Price Falls

Bitcoin hasn’t fared well over the past month and continued to drop after falling below $100,000. Crypto mining stocks also felt the pain since their earnings are heavily tied to Bitcoin, but some of those same stocks can still rally due to their involvement in artificial intelligence and other initiatives.

These three crypto mining stocks can still rally despite Bitcoin’s correction. Bitcoin’s future rebound is also a good catalyst for these picks.

Nebius (NBIS)

Nebius is one of several crypto miners that have pivoted into AI data centers. The company addresses the energy and computing bottlenecks that face tech giants, but the company is heavily invested in two brands that will harness AI to reach more customers.

Nebius Stock Price Year to Date. Source: Google Finance

Nebius Stock Price Year to Date. Source: Google Finance

Autonomous vehicle developer Avride and edtech company TripleTen are two long-term investments that add more value to NBIS stock.

However, Nebius isn’t sitting and waiting around for its large stakes in these companies to gain value.

Nebius has recently secured a 5-year deal with Meta Platforms, valued at approximately $3 billion. That partnership came on the heels of a multi-billion-dollar deal with Microsoft.

Those partnerships aren’t fully reflected in current revenue numbers, but that didn’t stop Nebius from delivering 355% year-over-year revenue growth in Q3.

The words “Bitcoin” and “crypto” did not appear once in Nebius’ Q3 press release or letter to shareholders. The AI firm seems to have made a complete pivot away from Bitcoin as it shifts its focus toward AI infrastructure.

Goldman Sachs recently reiterated its Buy rating for the stock while raising its price target from $137 to $155 per share. “AI demand-supply imbalance underpins continued strength in its core operations,” the firm said in its research.

IREN (IREN)

While Nebius is diversified into other investments and also offers a software stack for its customers, IREN is solely focused on providing AI cloud services.

It solves the AI energy bottleneck like Nebius, but its 3.2 gigawatt pipeline and ability to produce AI data centers at scale give it an advantage.

IREN also secured a major deal with Microsoft worth $9.7 billion over five years. The deal gives Microsoft access to 200 megawatts. Once IREN taps into its full pipeline, it can support 16 deals like the Microsoft contract.

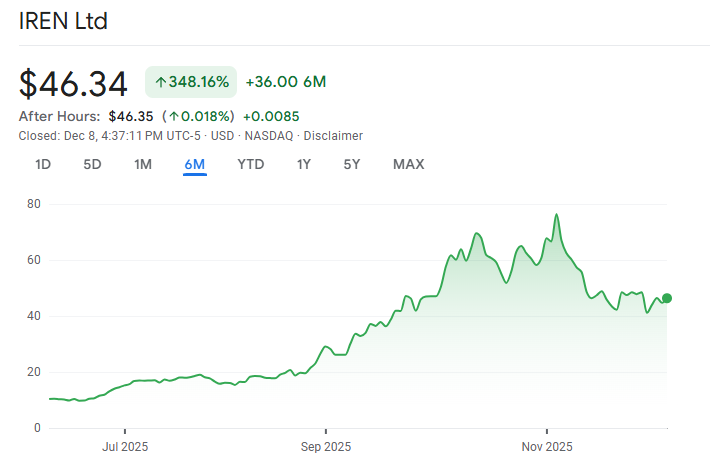

IREN Stock Price Over the Past 6 Months. Source: Google Finance

IREN Stock Price Over the Past 6 Months. Source: Google Finance

IREN still mines Bitcoin, and it represented 97% of Q1 FY26 revenue. AI cloud services revenue didn’t move by much year-over-year, but the Microsoft deal can fuel substantial growth in that segment.

Right now, IREN still heavily depends on Bitcoin but is making the pivot into AI data centers.

Roth MKM analyst Darren Aftahi reiterated a Buy rating for the stock in November and set a price target of $94. That price target suggests IREN will more than double from current levels.

Terawulf (WULF)

Terawulf is closer to IREN than it is to Nebius. It’s another crypto miner that depends on crypto but has signed big tech deals that set the stage for an AI pivot. The crypto miner intends to increase its contracted capacity by 250-500 megawatts per year.

For context, Terawulf allocated 168 megawatts to Fluidstack for $9.5 billion over a 25-year lease agreement.

Fluidstack is backed by Google, which can open the door to additional deals. The lease comes to $380 million per year, or $2.26 million per year for each megawatt.

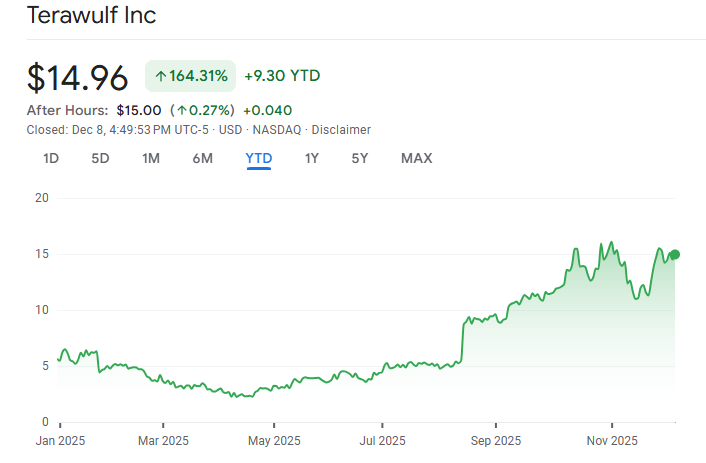

Terawulf Share Price. Source: Google Finance

Terawulf Share Price. Source: Google Finance

Using that conversion rate, Terawulf’s plan to increase capacity by 250-500 megawatts per year can translate into an additional $565 million to $1.13 billion in annual recurring revenue. Bitcoin prices drove Q3 results, but long-term AI data center ambitions have captivated investors.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Oracle’s Larry Ellison Loses $31 Billion, Falls To No. 3 Richest