Vitalik Buterin Says Ethereum Foundation Has Finally Solved Its P2P Networking Weakness

- Ethereum’s Vitalik Buterin has disclosed that the Ethereum Foundation no longer takes P2P networking for granted, after complaining internally for years.

- He stated that the Foundation has been able to work on resilience and network layer privacy, as evident in the PeerDAS’ performance.

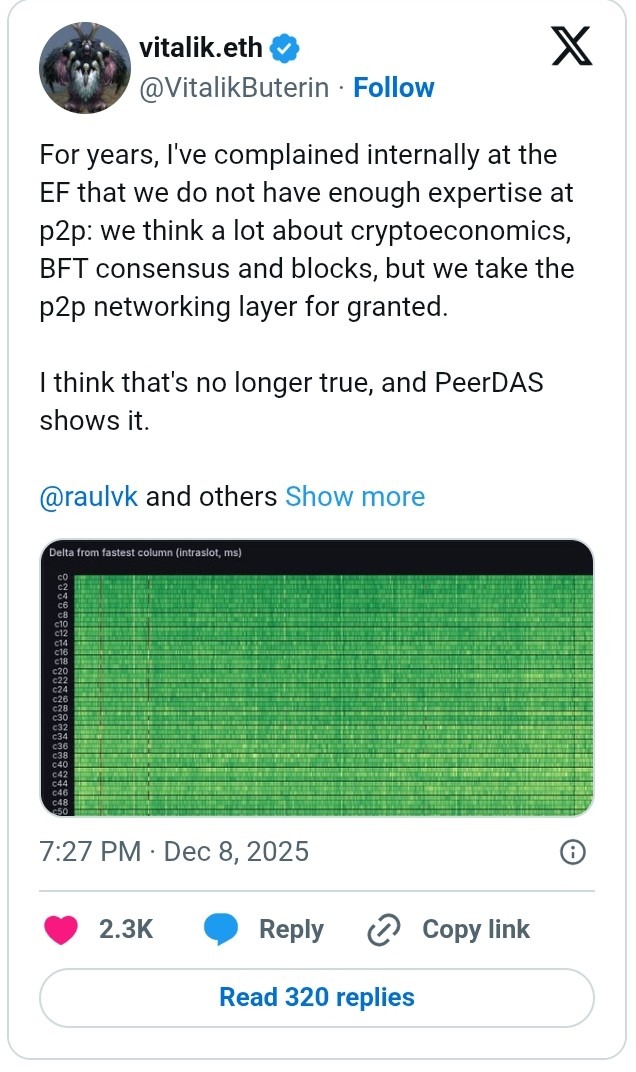

Ethereum co-founder Vitalik Buterin has taken to X to praise the Ethereum Foundation for solving the P2P issue that plagued the network for years. In a post, Vitalik disclosed that the team primarily focused on cryptoeconomics, BFT consensus, and blocks. However, this was at the expense of other important areas, including the P2P networking layer.

Source: Vitalik Buterin on X

Source: Vitalik Buterin on X

Having assessed the situation again, he noted that this is no longer the case. According to him, the recent performance of PeerDAS confirms this assertion. Additionally, Vitalik lauded the effort to “set up a roadmap that increases resilience, propagation of speed, and network layer privacy at the same time.”

Vitalik’s post attracted comments from several users. Fascinatingly, one of them came from a major contributor who was tagged in the post, Raul Jordan. According to him, the work on P2P has not ended, as networking or protocol boundary is still costing them latency and throughput.

Highlighting the current development, he disclosed that they are working on “tighter integration, as well as pipelining and mechanical sympathy to completely remove inefficiencies and max out scaling and performance.” Most importantly, Jordan assured that this would be done while keeping Ethereum accessible, neutral, decentralized, and resilient.

Background of the P2P Network Issues and Other Proposals for Ethereum

Over the years, one of the major issues that has been raised against the Ethereum P2P Network is anonymity. Earlier published academic research echoed a similar sentiment, as it was able to use data collected from four nodes in just three days to locate over 15% of the validators in the Ethereum P2P Network.

According to the report, its deanonymization technique was able to provide important information on validators, including their hosting organization and geographic information. Interestingly, the impact of these results was acknowledged by the Ethereum Foundation, as it awarded a bug bounty to the researchers.

Vitalik’s commendation follows his earlier call for a good trustless on-chain gas futures market, which he believes would help people hedge against future gas prices. As featured in our previous publication, Vitalik argued that gas-free prediction would be very important for high-volume network participants, including traders, developers, institutions, and others.

According to an earlier update, CNF also highlighted that the Ethereum co-founder envisions the introduction of a universal light client to improve the network’s L2 verification and decentralization.

]]>You May Also Like

Binance Founder Predicts Bitcoin “Super Cycle” in 2026