115 years of InLife: A night of legacy, purpose, and celebration

How do you honor 115 years of safeguarding Filipino families? InLife did it with music, memories, and meaningful moments that reflected more than a century of service.

Held at Shangri-La The Fort, the anniversary gala became the highlight of the milestone year — an evening that blended culture, artistry, and heartfelt storytelling. Vice-Chairman Luis C. La Ó opened the night by affirming the company’s enduring mission: “InLife’s mission has always been clear: to protect Filipino families from financial hardships through life insurance. This purpose remains as vital today as it was at the very start.”

Executive Chairperson Nina D. Aguas followed with an inspiring message on the legacy behind InLife and the future ahead. “We were not built in comfort. We were forged in challenge. Yet each time history pressed in, we pressed forward. What has carried InLife for 115 years: a purpose anchored in faith, and in love for country and for our people… Let us make one more promise together: to lead with conscience, to innovate with heart, to act with courage, and to build something enduring for those who will follow long after we are gone.”

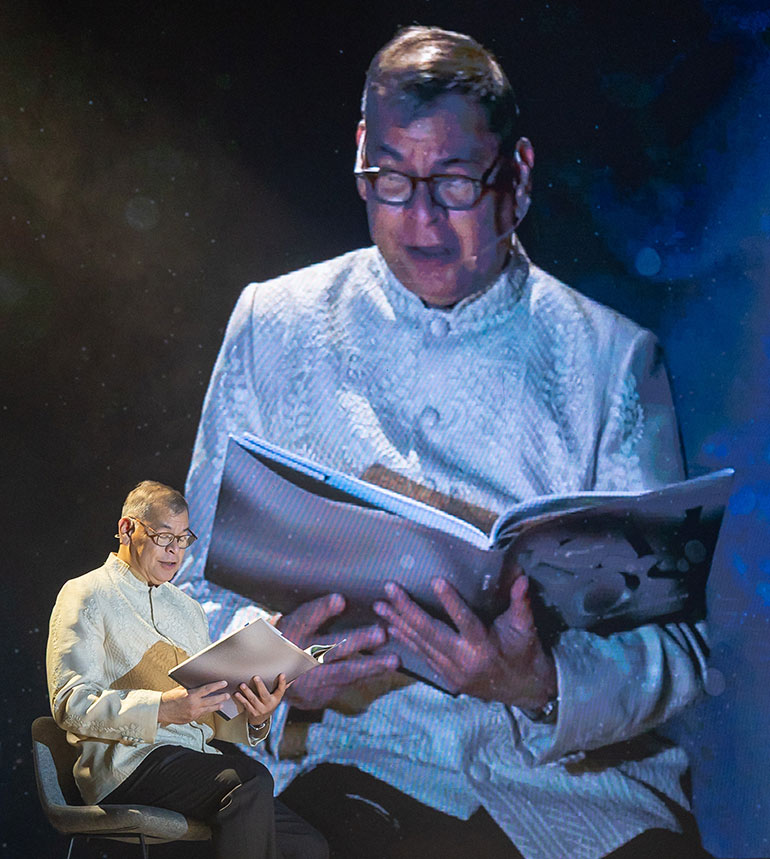

A key highlight was the unveiling of Kairos: Moments that Moved Us, InLife’s commemorative book capturing defining decisions and turning points in its storied history. Executives led by President and CEO Raoul Antonio E. Littaua read excerpts from their authored chapters, offering personal perspectives on pivotal choices that shaped the company. A message from Jaime Augusto Zobel de Ayala, who wrote the foreword, honored InLife as a cornerstone of national progress, highlighting how the company laid the foundation for the insurance industry and has long stood as a symbol of trust, stability, and innovation.

A key highlight was the unveiling of Kairos: Moments that Moved Us, InLife’s commemorative book capturing defining decisions and turning points in its storied history. Executives led by President and CEO Raoul Antonio E. Littaua read excerpts from their authored chapters, offering personal perspectives on pivotal choices that shaped the company. A message from Jaime Augusto Zobel de Ayala, who wrote the foreword, honored InLife as a cornerstone of national progress, highlighting how the company laid the foundation for the insurance industry and has long stood as a symbol of trust, stability, and innovation.

Guests were treated to outstanding performances from the Ramon Obusan Folkloric Group, Acapellago, Maestro Ryan Cayabyab and the Ryan Cayabyab Singers, capped by a special number from InLife Dreamweaver and Brand Ambassador Sharon Cuneta. Award-winning host Rico Hizon led the program, culminating in a collective toast to 115 years of service and fortitude.

Guests were treated to outstanding performances from the Ramon Obusan Folkloric Group, Acapellago, Maestro Ryan Cayabyab and the Ryan Cayabyab Singers, capped by a special number from InLife Dreamweaver and Brand Ambassador Sharon Cuneta. Award-winning host Rico Hizon led the program, culminating in a collective toast to 115 years of service and fortitude.

Ms. Aguas led the ceremonial toast to InLife’s 115-year legacy and future, joined by (from left) Mr. La Ó, Ayala Corporation Vice-Chairman Fernando Zobel de Ayala, and Mr. Littaua.

Ms. Aguas led the ceremonial toast to InLife’s 115-year legacy and future, joined by (from left) Mr. La Ó, Ayala Corporation Vice-Chairman Fernando Zobel de Ayala, and Mr. Littaua.

The celebration extended beyond the ballroom with the launch of the Kairos microsite (https://kairos.inlife.com.ph/) and the photo exhibit Kairos: The Visual Narratives featuring images taken by President Littaua. These were auctioned to InLife employees and executives with the proceeds donated to the InLife Foundation. The exhibit will run until Dec. 15 at InLife Treasures, the company’s art gallery located at its Alabang Headquarters.

Good Going Round

Good Going Round

Earlier that day, InLife delighted policyholders and visitors nationwide through its Good Going Round anniversary promo — giving out free Dunkin’ donuts in its offices and in UnionBank branches. More than a treat, each donut symbolized the goodness InLife has passed on for generations and continues to share today. The simple gesture sparked warm interactions, encouraged digital engagement, and brought the anniversary spirit to communities across the country.

As InLife turns the page to its next chapter, the promise remains: to continue giving Filipinos A Lifetime for Good.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

You May Also Like

Upbit to Raise Cold Wallet Ratio to 99% Amid Liquidity Concerns

Tidal Trust Files For ‘Bitcoin AfterDark ETF’, Could Off-Hours Trading Boost Returns?