BlackRock Advances Ethereum Strategy With New Staked ETH ETF Filing

- BlackRock pushes a fresh ETF bid that mixes Ethereum exposure with staking yield under a softer SEC stance.

- Growing interest in staking funds shows managers racing to add yield features while ETH holds key price zones.

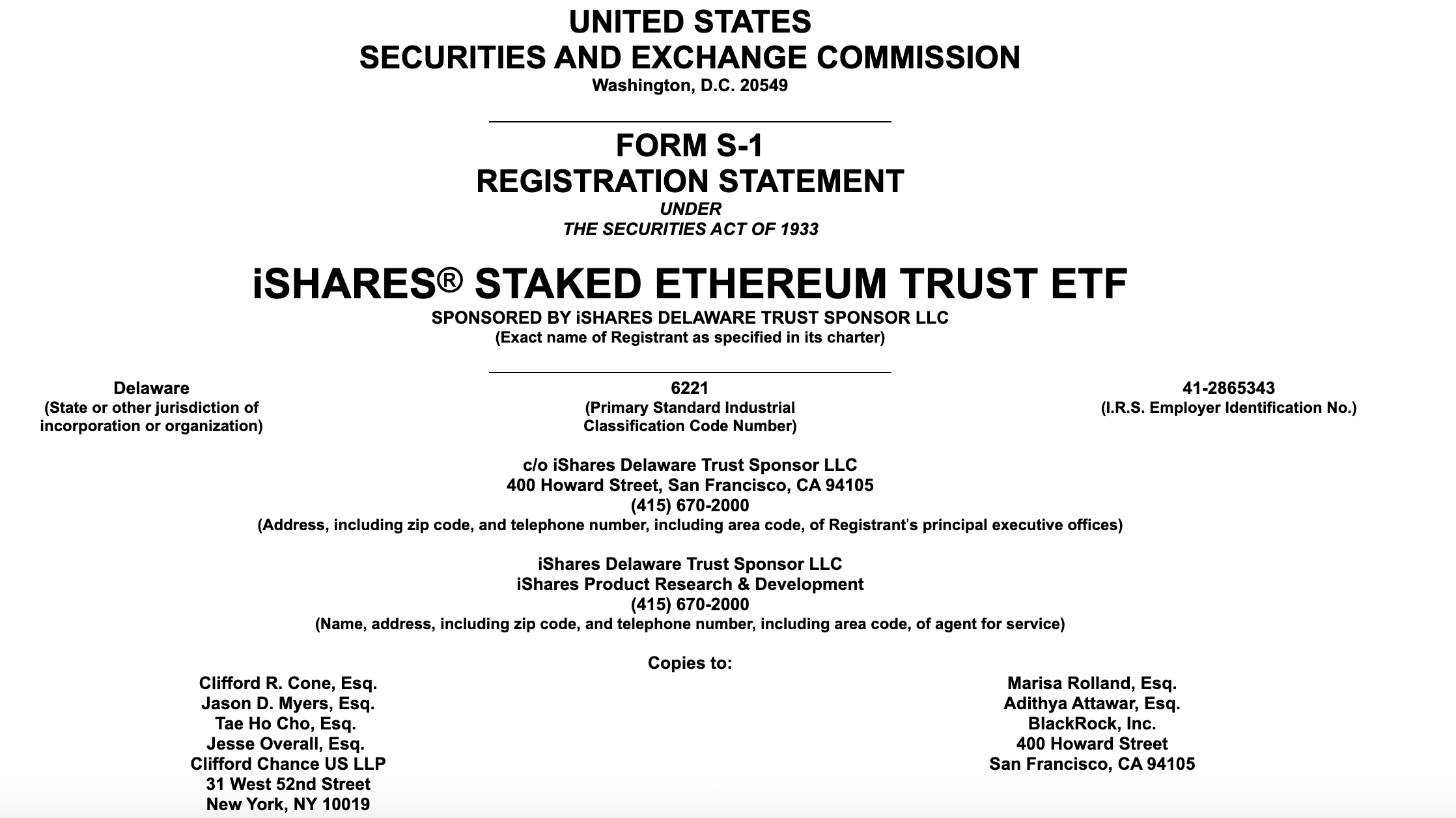

BlackRock, the largest asset manager globally, has formally submitted paperwork to the U.S. Securities and Exchange Commission (SEC) for a new Ethereum-linked fund. The Form S-1 registration, filed on Friday, seeks approval for the iShares Staked Ethereum Trust ETF (ETHB), a product that would combine Ethereum price exposure with staking rewards.

The initial sign of BlackRock’s intention surfaced in November when the firm registered the name of the new trust in Delaware. While that step pointed toward development, it was not a formal application. The latest filing now puts the proposal in front of federal regulators for a decision.

According to the submitted documents, the trust aims to track ether’s market value and capture staking returns. The extent of staking activity will depend on whether the fund’s sponsor finds the process legally secure enough, particularly in relation to the trust’s classification for federal tax purposes.

BlackRock staked Ether ETF filing on Friday. Source: Sec.gov

BlackRock staked Ether ETF filing on Friday. Source: Sec.gov

Regulatory Environment Shifts Under New SEC Chair

The landscape around staking in ETFs appears to be changing. In July, Nasdaq filed a revised 19b-4 application to add staking to an existing Ethereum ETF. But under Chair Gary Gensler, the SEC discouraged such proposals, reportedly instructing applicants to exclude staking, citing concerns that the practice might represent unregistered securities offerings.

With Paul Atkins now leading the SEC, the regulator’s stance appears to be less strict. Multiple asset managers, including BlackRock and VanEck, are adjusting filings to include staking features. Some firms are modifying approved ETFs, while BlackRock has decided to create a new product altogether.

BlackRock already manages the iShares Ethereum Trust ETF (ETHA), a spot fund holding around $17 billion in assets under management. That product will continue to operate separately from the new staking fund, which targets a different kind of exposure. If approved, ETHB would let investors earn yield from Ethereum staking without handling the process themselves.

Ethereum Eyes Breakout Toward $3800

As of press time, ETH trades at $3,123, showing a slight decline of 0.35% in the past 24 hours. Analyst Ted Pillows noted that ETH has held above the $3,000 level despite market pressure and could rise sharply if it breaks through the $3,300–$3,400 zone. He added,

There is also risk of a reversal if the price fails to overcome the upper resistance. Pillows mentioned that falling short of that range could send Ethereum back toward the $3,000 level for another retest.

]]>You May Also Like

a16z Opens First Asia Office: Park From Naver and Monad to Lead

Seen the “Small gifts exchange” TikTok trend?