Glo confirms data service restoration after hours of nationwide outage

Telecoms company Globacom has confirmed the restoration of its data service after it experienced a nationwide outage. The disruption reportedly commenced during the early hours of Tuesday.

According to an official statement on Tuesday, the company, via its X page, acknowledged the disruption to its data service across multiple locations nationwide. However, the outage which commenced at 8:30 am, has now been restored.

“Dear valued customer, Earlier today, a data service outage occurred nationwide, affecting data connectivity across multiple locations. The outage started at 08:30 a.m. on 09/12/2025 has now been restored,” part of the statement reads.

Glo explained that its technical team made efforts to restore data services, and normalcy has now been restored nationwide.

“We understand how important reliable access is to you and sincerely apologise for the inconvenience. Our technical team has completed the recovery work, and services have been fully restored across affected areas,” it added.

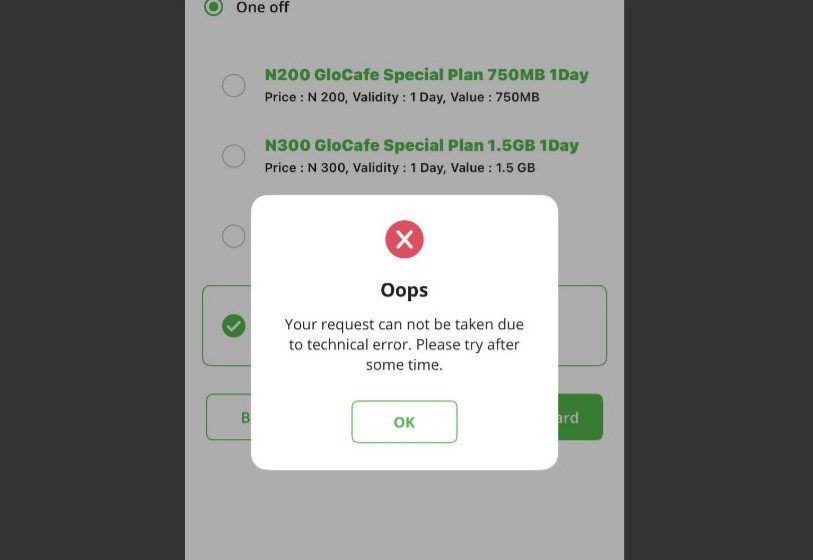

However, internal checks show that customers are still having issues with data connectivity. In addition, Glo users on X expressed their dissatisfaction with the claims of restoration.

@Balogunsodiqol4 said, “My data network is not yet working.”

Also, @Segun14olasupo said, “Nothing is back why is my data balance not showing.”

GLO data service disruption

GLO data service disruption

Data connectivity is a significant daily requirement for Nigerian internet users, most especially for those who depend on it for business operations.

The disruption appears to continue despite the company’s claim of a resolution as users continue to express concerns. Some are reporting that their data balance is not appearing while others complained about the inability to utilise their data subscription, which was slated to expire during the outage period. As such, they are demanding a refund.

As of late October 2025, Globacom has approximately 21.39 million subscribers, holding about 12.34% market share in Nigeria’s competitive telecom sector. The company is behind MTN and Airtel, according to reports from the Nigerian Communications Commission (NCC).

Also Read: Nigeria got 1.6 million new active internet subscribers in October 2025.

Glo’s service disruption

Amid the issues plaguing the Nigerian telecoms sector, Glo has experienced fluctuations. The company appears to be recovering from earlier subscriber losses, but still faces challenges in significantly boosting its user base.

In November, the company suffered a network outage across the Northern part of the country, attributed to multiple fibre cuts on major transmission routes. The outage affected states such as Kano, Jos, Kaduna, FCT Abuja, Bauchi and others in the region.

The outage first started in Kano, Zamfara, and Katsina states and spread to other states: Jos, Kaduna, Bauchi, FCT Abuja, and Zaria. While the outage was restored within 24 hours of the official announcement, it reflects GLO’s continued struggle with infrastructure vandalism and fibre cuts.

Telecom infrastructure vandalism

Telecom infrastructure vandalism

However, fibre cuts and vandalism have continued to threaten internet penetration in Nigeria and the drive to create a digital economy. In September, the NCC raised an alarm that the industry records over 1,100 fibre cuts, 545 cases of access denial, and nearly 100 thefts.

Data provided by the Executive Vice-chairman of the Nigerian Communications Commission (NCC), Aminu Maida, showed that the Nigerian telecoms industry suffered a total of 19,384 fibre cuts between January and August 2025.

The data reflects struggles with service disruptions for millions of Nigerians and losses running into billions of naira.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

OCC Findings Suggest Major U.S. Banks Restricted Access for Digital Asset Firms Amid Debanking Probe