Meta’s superintelligence and Sam Altman’s AGI could boost these crypto AI tokens

Artificial intelligence has taken centre stage with technology giants like Meta, Open AI and Alphabet Inc’s Google racing to develop AGI, Superintelligence and faster, more efficient models in 2025. The race involves multi-billion dollar acquisitions, investments and capital flows to sectors like Crypto AI tokens, offering traders an opportunity to profit from a slice of the Artificial Intelligence pie.

Table of Contents

- Meta’s superintelligence and Sam Altman’s AI plans

- Crypto AI sector in 2025

- Top crypto AI and AI agent tokens to watch

- Bittensor price prediction

Meta’s superintelligence and Sam Altman’s AI plans

Multiple reports show that technology giant Meta has plans to spend up to $15 billion chasing superintelligence. Zuckerberg is building a tech team alongside Scale AI, a startup led by 28 year old Alexandr Wang.

The new team could help the Meta chief improve its Llama models and roll-out better tools for voice and personalisation. The AI race keeps getting intense with new entrants and billions of dollars spent on the tech, as companies race to be the market leader.

Sam Altman, OpenAI chief and co-founder of Worldcoin said in his recent blog post that the firm’s LLM ChatGPT is “already more powerful than any human who has ever lived.” Millions rely on the chatbot’s intelligence for everyday and routine tasks and any misalignment could have a ripple effect on hundreds of millions of people.

Altman recounts the arrival of AI agents for cognitive work, writing computer code and the arrival of bots that do real tasks in the world. Altman’s plans for the Worldcoin project have acted as a catalyst for WLD token price in the recent past.

Meta’s announcements, NVIDIA’s earnings report and statements and Altman’s blog posts have acted as drivers for the Crypto AI tokens and Crypto AI Agent token categories.

Crypto AI sector in 2025

Grayscale’s report on the Artificial Intelligence Crypto Sector summarizes the updates from 2025. While AI growth and updates have excited technology enthusiasts, the centralized control over AI development has raised concerns among traders.

Decentralized development of AI tools has been proposed as an alternative, however it has not been as well received as centralized development, at the time of writing.

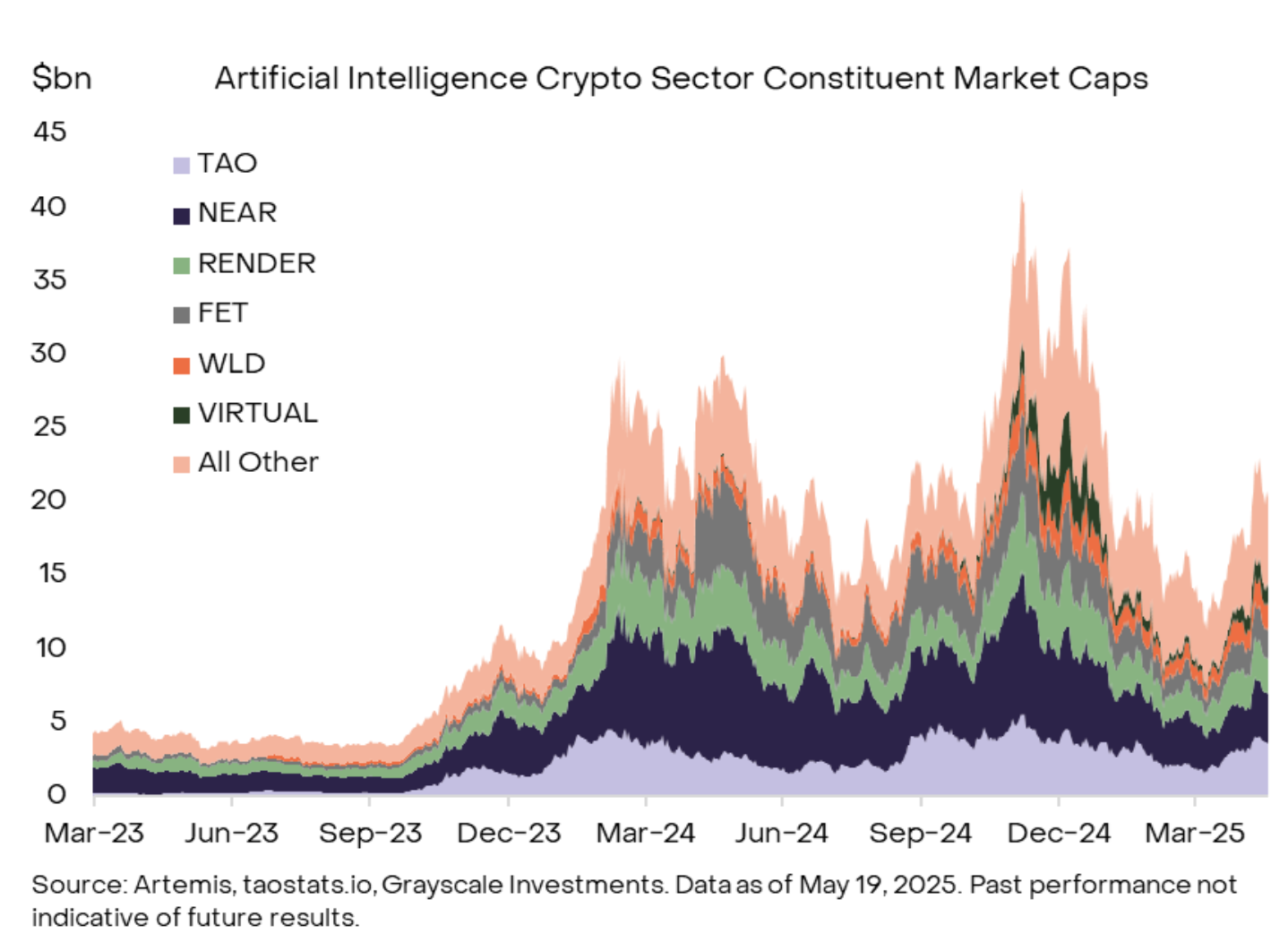

The Artificial Intelligence Crypto Sector of tokens compiled by Grayscale includes 20 tokens with a combined market capitalization of $21 billion. The market cap climbed nearly five fold, up from $4.5 billion in Q1 2023.

Analysts at Grayscale identified Bittensor (TAO) as the largest AI token.

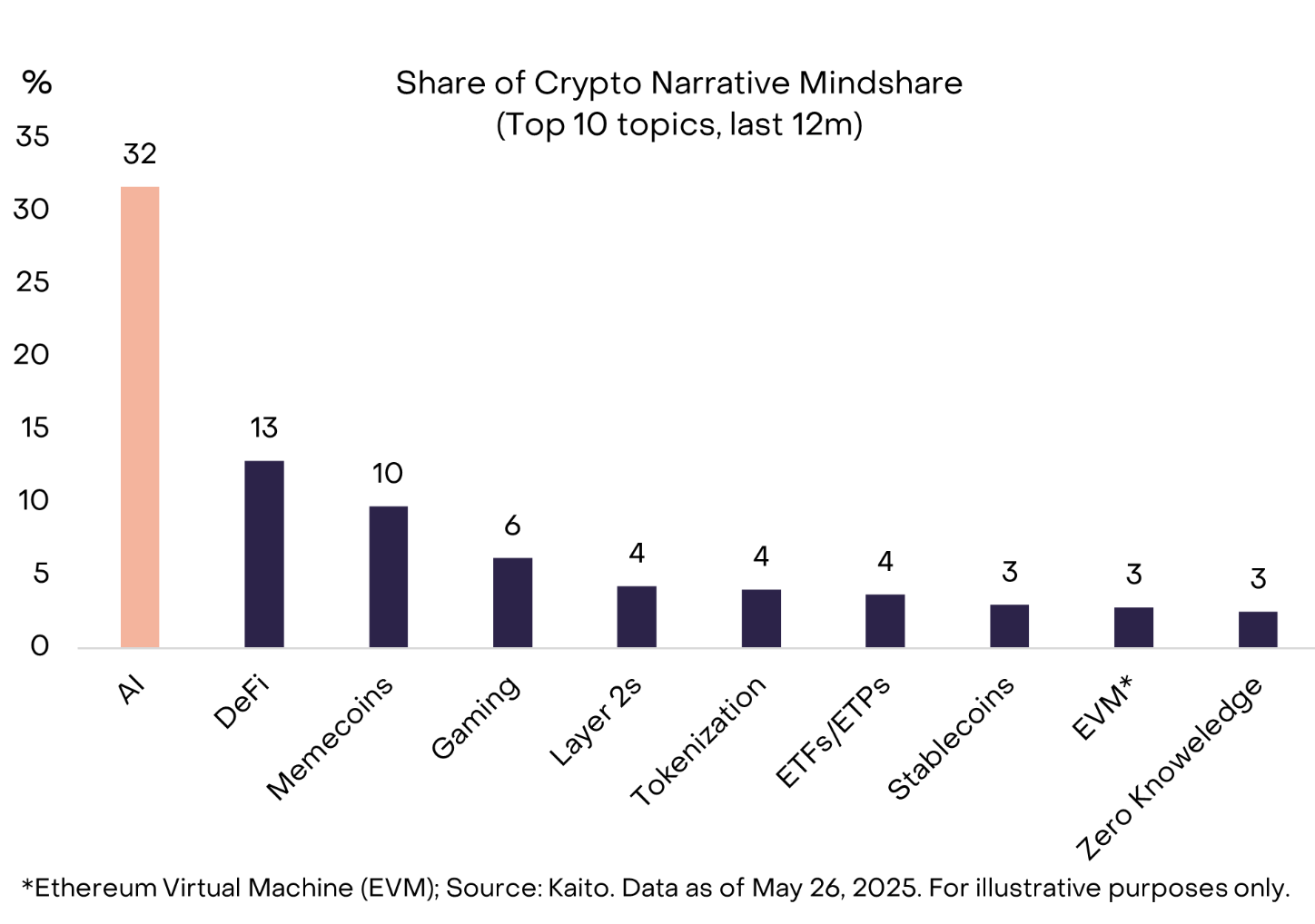

As of May 2025, the report claims AI tokens have 32% market share among traders.

Market capitalization of top AI tokens shows considerable increase between March 2023 and March 2025. Top tokens TAO, Near Protocol (NEAR), Render (RNDR), Fetch.ai (FET), Worldcoin (WLD), Virtuals Protocol (VIRTUAL), among others.

Top crypto AI and AI agent tokens to watch

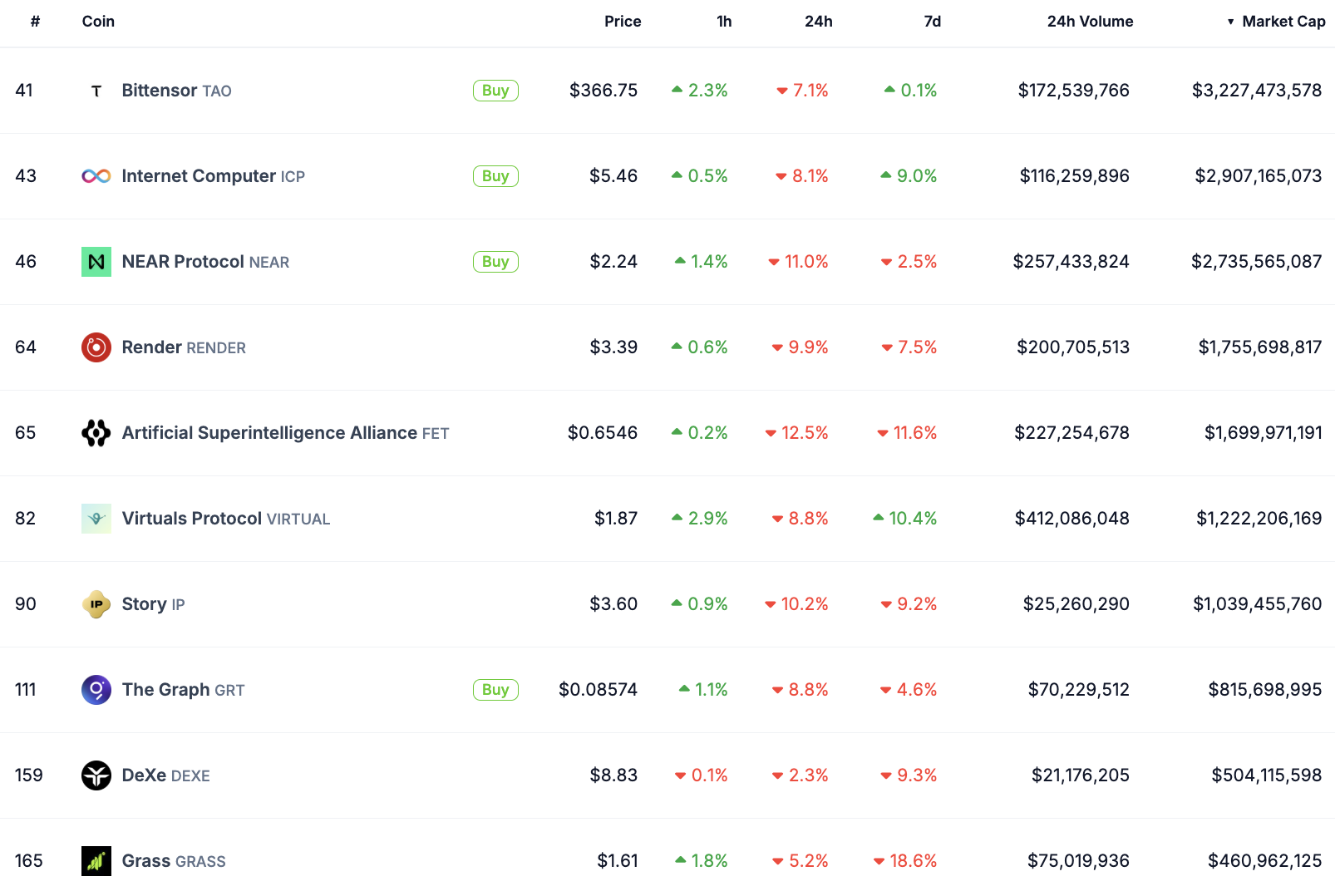

Data from crypto tracker CoinGecko shows the top 10 tokens in the AI category and the top 5 AI agent tokens. Most of the tokens have added to their value in the past hour.

TAO, Internet Computer (ICP), Story (IP), The Graph (GRT), DeXe (DEXE) and Grass (GRASS) were hit by a correction in the past 24 hours.

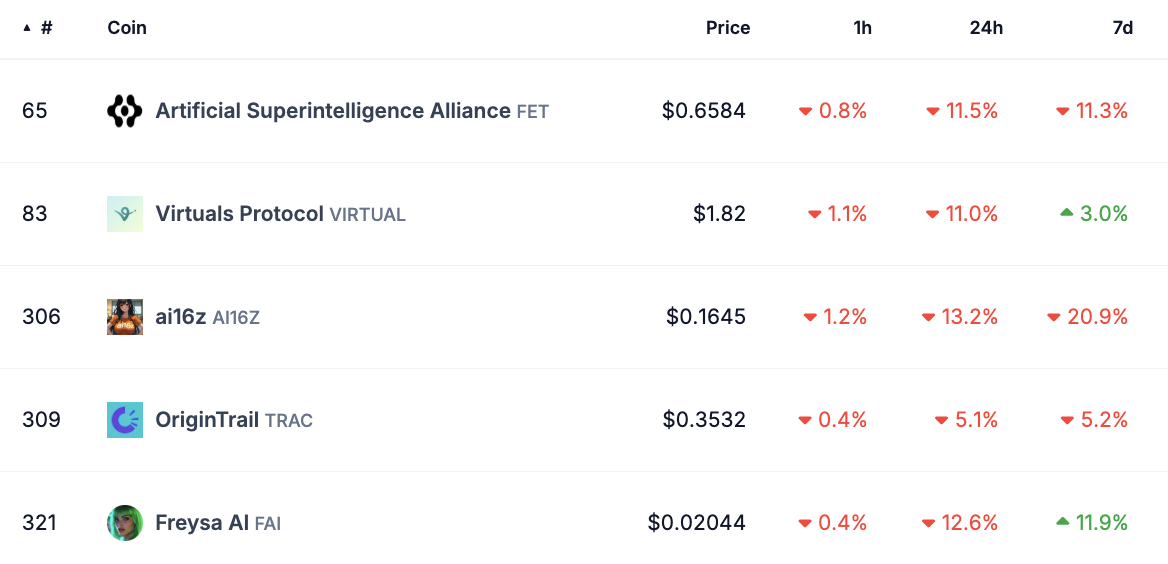

AI agent tokens have observed higher volatility in their price in the past few months. AI agent tokens were hit the worst during Bitcoin flashcrashes this cycle. The sector’s recovery is largely dependent on catalysts.

Bittensor price prediction

The AI token’s daily price chart shows further consolidation in TAO is likely. The token is less than 10% away from its support at $333, a key level that held steady for several months. TAO could slip 8.41% and test support at $333.

RSI is sloping downwards and reads 42, under the neutral level. MACD flashes red histogram bars under the neutral line, signaling an underlying negative momentum in TAO price.

Conversely, further catalysts in the AI sector could fuel a positive sentiment among traders and drive demand for top tokens like TAO. The token could gain 14% and test resistance at $415, a level identified as the upper boundary of the FVG on the daily timeframe.

The May 2025 peak of $500 remains a key resistance for the AI token.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds