Hyperliquid (HYPE) Price: Can 37 Million Token Burn Reverse Recent Decline?

TLDR

- Hyper Foundation proposed burning all 37 million HYPE tokens in the Assistance Fund, representing 13% of circulating supply

- Validators must vote by December 21, with final stake-weighted results announced December 24

- The Assistance Fund address has no private key and tokens are permanently inaccessible without a hard fork

- HYPE price increased 2% to $26.66 following the announcement, with futures open interest jumping 3% to $1.52 billion

- Bitwise recently filed for the first spot Hyperliquid ETF in the United States with a 0.67% management fee

The Hyper Foundation announced a proposal on December 17 to burn all HYPE tokens held in the Assistance Fund address. The proposal requires approval through validator voting.

Hyperliquid (HYPE) Price

Hyperliquid (HYPE) Price

The Assistance Fund currently holds 37 million HYPE tokens. These tokens represent about 13% of the circulating supply and 3.71% of the total supply.

The fund operates by automatically converting trading fees collected by the exchange into HYPE tokens. These tokens are stored at a system address that has never had a private key or any form of control.

The tokens in this address cannot be accessed or moved without executing a hard fork of the network. The burn proposal would permanently remove these tokens from the total supply count.

Validators are scheduled to submit their votes in the governance forum by December 21 at 04:00 UTC. Users can stake their tokens with validators who share their view on the proposal until December 24 at 04:00 UTC.

Voting Process and Timeline

The final decision will be determined through stake-weighted consensus. The results will be measured and announced at the close of voting on December 24 at 04:00 UTC.

A “Yes” vote means validators agree to treat the tokens as permanently removed from circulation. The proposal also includes a commitment that no future protocol upgrade would ever attempt to access the locked tokens.

Some validators have already publicly expressed support for the burn. Kinetiq x Hyperion announced they voted in favor of removing all tokens in the Assistance Fund address.

Market Response to Burn Proposal

HYPE price rose 2% following the announcement. The token traded at $26.66 with a 24-hour range between $26.21 and $26.66. Trading volume decreased 5% over the same period.

Data from CoinGlass showed increased activity in the derivatives market. Total HYPE futures open interest climbed 3% to $1.52 billion in 24 hours. The 4-hour futures open interest increased almost 4%.

Both CME and Binance recorded open interest increases exceeding 5%. The funding rate rose to 0.0839%, indicating higher buying pressure in the derivatives market.

Technical indicators on the daily chart show the token holding above the $26 support level. The Relative Strength Index sits at 33, below the midpoint since early November. The token has declined for three consecutive days before stabilizing.

If HYPE maintains support above $26, potential resistance levels include $30 and the 50-day exponential moving average at $34. A break below $26 could push the price toward the October 10 low near $20.

Bitwise recently amended its S-1 filing for a spot Hyperliquid ETF. The filing revealed a management fee of 0.67% and ticker symbol BHYP for the proposed fund.

The post Hyperliquid (HYPE) Price: Can 37 Million Token Burn Reverse Recent Decline? appeared first on CoinCentral.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

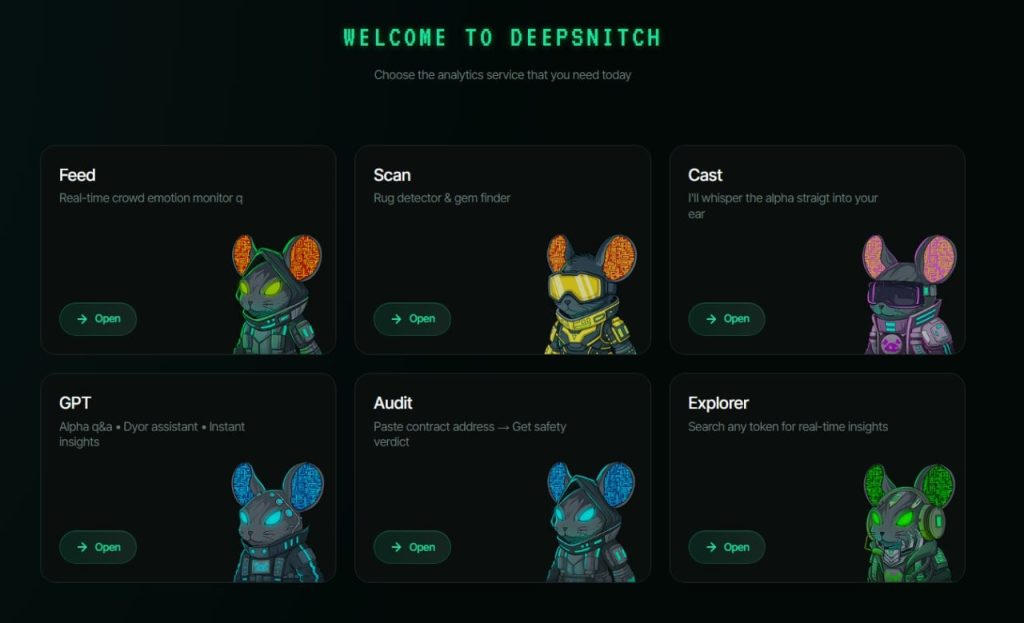

XRP Price Prediction March Update: Ripple and Aave Consolidate While DeepSnitch AI Surges 170%+ and Raises $1.8M