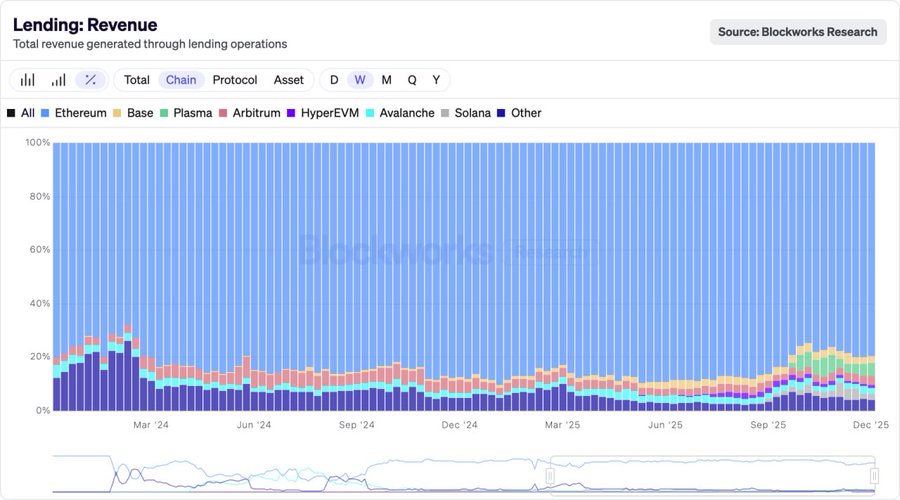

Why Ethereum Controls 90% of DeFi Lending Revenue in 2025

This article was first published on The Bit Journal.

Ethereum DeFi lending continues to dominate the space of decentralized finance. It now represents nearly 90% of all crypto lending revenue, according to numbers provided by the Ethereum Foundation.

According to data cited by Ethereum Foundation researcher David Walsh, most lending revenue across all blockchains is Ethereum and its Layer 2 networks in August. This is a huge achievement for the ecosystem.

Lending on Ethereum has been one of the core activities in DeFi for years. What’s new now is the sheer breadth of adoption. Layer 2 networks like Arbitrum, Optimism and Base Fueled are behind the growth. They are faster and have lower fees.

Layer 2 Scaling Drives Ethereum DeFi Lending Growth

Layer 2 solutions are a key driver behind the growth of Ethereum DeFi lending. These networks process transactions away from the main chain. They still rely on Ethereum for security.

This design reduces congestion and lowers costs. Lending platforms benefit from smoother operations. Users gain access to cheaper borrowing and lending.

Also Read: Why JPMorgan Is Launching a Tokenized Fund on Ethereum

Leading platforms continue to anchor Ethereum DeFi lending activity. Aave, Compound, and MakerDAO remain dominant players. These protocols built their foundations on Ethereum. Many now support multiple Layer 2 networks.

Source: X

Source: X

Revenue Share Signals Infrastructure Strength

The revenue concentration around Ethereum DeFi lending reflects more than market preference. It shows infrastructure maturity. Developer tools are stable. Smart contract standards are well tested. Security audits are common.

These factors reduce risk for users and institutions. As a result, capital continues to flow toward Ethereum-based lending.

User Migration Boosts Lending Volumes

Users are steadily moving toward Layer 2 environments. This shift has increased lending volumes. New protocols are launching directly on Layer 2 networks. Existing platforms are expanding beyond Ethereum mainnet.

Ethereum DeFi lending benefits from this trend. Lower fees encourage frequent transactions. Faster confirmations improve user experience.

Confidence Grows Despite Market Volatility

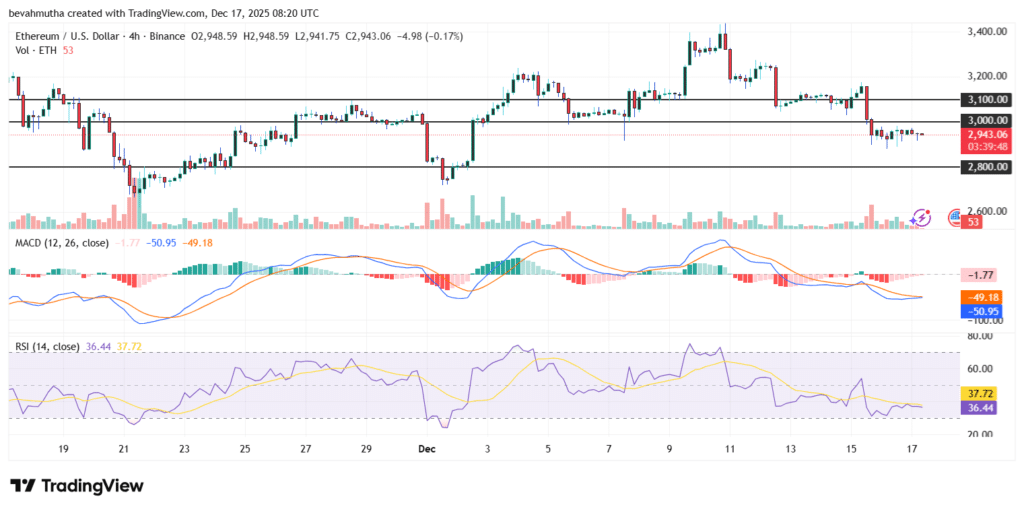

The rise in Ethereum DeFi lending comes amid broader market uncertainty. ETH is trading below the $3,000 level after a short-lived rebound.

Price consolidation reflects cautious sentiment. Still, lending activity remains strong. This suggests that usage is not solely driven by price speculation.

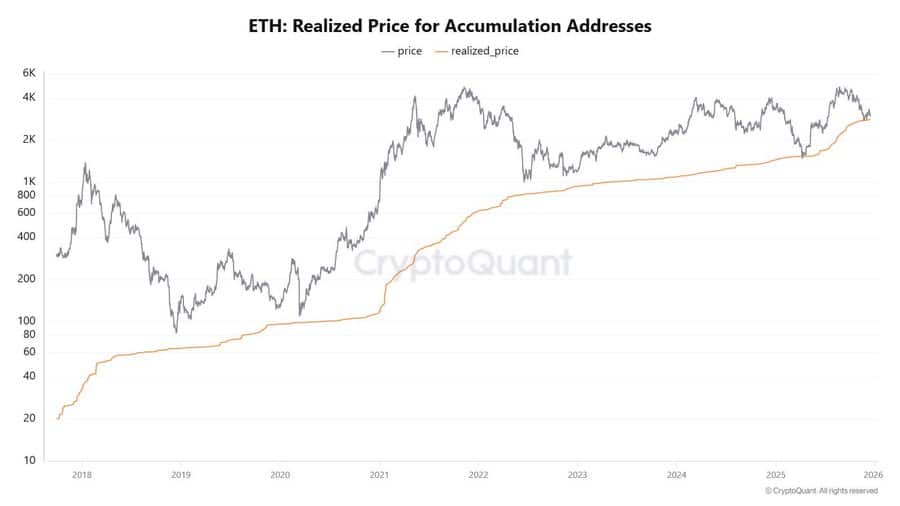

Whale Behavior Highlights Key Support Levels

Large Ethereum holders continue to accumulate ETH. On-chain data shows steady buying since June. This accumulation persists despite volatility.

The average purchase range has moved closer to $3,000. Historically, whales defend their cost basis. Their activity points to confidence in Ethereum’s long-term outlook.

Source: X

Source: X

Technical Indicators Show Near-Term Pressure

ETH recently traded near $2,939. This keeps price action below a key psychological level. The MACD remains below the signal line.

This confirms ongoing selling pressure. The RSI sits near 36. It shows weak momentum and limited upside. A breakout above $3,000 with volume could change sentiment.

Source: TradingView

Source: TradingView

Scaling Upgrades May Extend Leadership

Future upgrades could further support Ethereum DeFi lending growth. Planned improvements like Danksharding aim to boost throughput.

They also target lower fees. These changes may attract more assets into DeFi. Competing chains continue to develop. Still, Ethereum’s layered scaling approach keeps it ahead.

Conclusion

Lending on Ethereum is still what powers decentralized finance. Layer 2 uptake has increased efficiency and lowered costs. Old protocols still rule the roost.

Users’ trust is kept despite price fluctuation. With scalability improvements on the way, Ethereum-based lending will be expected to further flex its muscle across DeFi as a whole.

Also Read: Ethereum Price Forecast 2026: Bullish Inverse Head-and-Shoulders Signals Major Upside

Appendix: Glossary of Key Terms

Ethereum Lending: Borrowing and lending on Ethereum protocols that is conducted in a decentralized manner.

Layer 2 Networks: Scaling solutions that settle transactions off of Ethereum but rely on its security.

DeFi: Financial services via blockchain with no traditional intermediaries.

Smart Contracts: Automated self-executing code that executes financial agreements on a blockchain.

Mainnet: The main Ethereum blockchain on which transactions are settled.

Whale: A person with very large holdings of crypto who is believed to have the power to shift markets.

MACD: An indicator used to gauge the strength and direction of a trend.

Frequently Asked Questions: Ethereum DeFi Lending

1- What is Ethereum DeFi lending?

Ethereum DeFi lending is the utilization of Ethereum-based protocols to lend and borrow.

2- Why are Layer 2 networks significant in the context of Ethereum DeFi lending currently?

They reduce fees, speed it up and ensure lending is accessible and efficient on Ethereum.

3- What are the platforms for Ethereum DeFi lending?

Aave, Compound and MakerDAO are some of the largest Ethereum DeFi lending protocols.

4- What percent of crypto lending revenue is Ethereum?

Almost 90% of all crypto lending revenue is associated with Ethereum and its Layer 2 networks.

References

Coinomedia

CoinGape

Read More: Why Ethereum Controls 90% of DeFi Lending Revenue in 2025">Why Ethereum Controls 90% of DeFi Lending Revenue in 2025

You May Also Like

Trump 'ashamed' of 'unpatriotic and disloyal' Supreme Court after tariff decision

The Evolution of Fashion Trends in 2026