Bitcoin 2025 Predictions Falter: Institutional Bulls Fail to Hit $250,000 Target

- Bitcoin’s 2025 reached only $126,000 for Bitcoin, which was well short of aggressive forecasts

- Leveraged investments and the process of deleveraging led to significant drops in stock prices.

- KuCoin forecasted a $3.4 trillion altcoin market and a $400 billion stablecoin market, though overall market prices

From late 2024 into early 2025, crypto markets shared a dominant narrative built around Bitcoin’s post-halving momentum, expanding ETF access, and rising institutional participation. These forces were expected to fuel sustained upside across digital assets, reinforcing confidence that favorable regulation and macro alignment would drive a powerful linear bull cycle.

As posted by Wu Blockchain, analysts assessed how major institutional Bitcoin price forecasts for 2025 missed their marks. Despite compelling long-term theses, projected outcomes diverged sharply from reality. Early-year optimism underestimated market fragility, as volatility repeatedly interrupted rallies and prevented Bitcoin from maintaining extended upside trajectories throughout 2025.

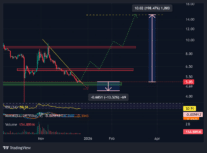

Some of the most aggressive projections envisioned BTC reaching between $200,000 and $250,000 during 2025. However, these targets proved unattainable as sharp corrections followed nearly every breakout attempt. Price advances stalled quickly, highlighting how leveraged positioning amplified downside moves and capped momentum during periods of heightened speculative enthusiasm across markets.

Deleveraging Cycles Restrained Bitcoin’s Price Growth

Repeated deleveraging cycles constrained Bitcoin’s upside throughout the year. As leverage accumulated during rallies, sudden risk-off shifts triggered liquidations and rapid drawdowns. Each reset cooled sentiment, forcing traders to reassess exposure even while adoption metrics and long-term narratives continued to strengthen in the background globally today.

The review further noted that correctly identifying Bitcoin’s structural strength did not translate into precise price timing. Throughout 2025, price action reacted sharply to liquidity changes, macro uncertainty, and risk repricing. These dynamics reinforced the difficulty institutions face when forecasting exact peaks within highly reflexive, sentiment-driven markets during volatile cycles.

Also Read | Hong Kong Strategically Reinvents Itself as a Global Finance Powerhouse

KuCoin Outlook Misses Price, Hits Structural Trends

KuCoin Research concurred with such hope in its 2025 projections, which forecasted that the Bitcoin currency would hit tests of $250,000 on post-halving and ETF-driven adoption. It further predicts a $3.4 trillion altcoin market, growing stablecoins beyond $400billion, and advancement of new products that are tied to assets such as Solana and XRP within regulated global trading markets around the globe.

The peaks of Bitcoin were at $126,000, and the end-of-year price at $88,000 highlighted the intensity of the price that was not as strong as anticipated. Whereas ETF-linked offerings on SOL and XRP improved, larger-scale offerings fell behind. Ultimately, it, it was reiterated that solid foundations hardly provide smooth, uninterrupted price action in the changing crypto market cycles of this world.

Also Read | Is Bitcoin’s $126K High the Cycle Top? Fidelity Warns of Possible 2026 Downtrend

You May Also Like

Sandbrook Capital Announces Acquisition of United Utility Services from Bernhard Capital Partners

TRUMP Struggles Below $5 as Unlock Adds Downside Pressure