Investment Firm Borrows $1B in Stablecoins on Aave to Buy Ethereum

Investment firm Trend Research has an open long spot position on Ethereum ETH $2 928 24h volatility: 0.3% Market cap: $353.82 B Vol. 24h: $23.82 B at a nominal value of approximately $1 billion by depositing ETH collateral, borrowing stablecoins, buying Ether, and redepositing it on Aave AAVE $151.1 24h volatility: 2.1% Market cap: $2.30 B Vol. 24h: $216.71 M for a leveraged, high-conviction play.

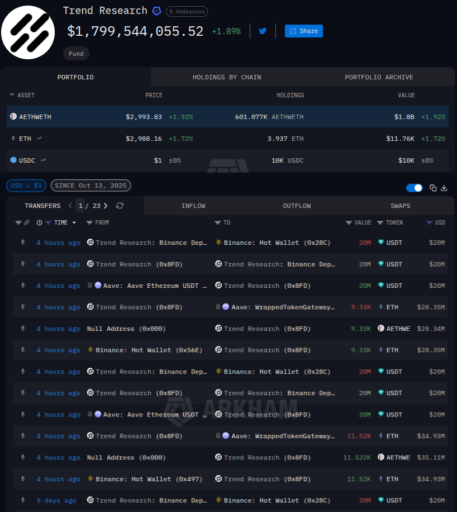

This long position was spotted and reported by Lookonchain on December 29, with activity dating back to October 2025.

According to its recent post on X, Trend Research has borrowed $958 million in stablecoins from Aave for that goal.

The firm is leveraging Ethereum’s DeFi protocols by depositing ETH as collateral and borrowing stablecoins on Aave.

It then uses the borrowed stablecoins to buy Ether on Binance, withdraws the purchased ETH back to its on-chain address, and redeposits a portion on Aave to increase collateral and borrowing capacity for further leveraged positions.

Trend Research has an estimated dollar cost average of $3,265 for its ETH purchases, per Lookonchain.

How Is Trend Research Long-Positioning on ETH?

At the time of writing, the firm holds over 600,000 in Aave-deposited ETH, a position worth $1.8 billion at current prices, at $2,993 per Ether.

According to Arkham, this is held in the form of AETHWETH, an interest-bearing token issued by Aave when users make lending deposits and that later can be redeemed back by withdrawing the collateral.

Its recent activities on Dec. 29 started with an 11,520 ETH withdrawal from Binance, five days after depositing 20 million USDT to the exchange.

This amount was fully deposited on Aave’s lending contract and used as collateral for another 20 million USDT purchase that was deposited to Binance.

The pattern repeated with a 9,330 ETH withdrawal from Binance, again deposited on Aave, followed by, again, a 20 million USDT borrow and deposit on Binance.

Trend Research’s balance and onchain activity, as of December 29, 2025. | Source: Arkham Intelligence

ETH has been struggling to break back above the $3,000 resistance, a key level many analysts are eyeing to signal a bullish reversal for the second-largest cryptocurrency by market capitalization. Analysts believe sustained momentum could propel Ethereum up to $8,500.

In the meantime, Aave, Ethereum’s leading lending and borrowing DeFi protocol, is going through a historical moment governance-wise.

Aave Labs is pushing “token alignment” proposals in ongoing community discussions, seeing its first related proposal failing with record token-weighted participation.

nextThe post Investment Firm Borrows $1B in Stablecoins on Aave to Buy Ethereum appeared first on Coinspeaker.

You May Also Like

Missed Avalanche And Arbitrum? Buy APEMARS at $0.00006651 – Your Next 100x Crypto in the Crypto Bull Runs

Russia’s Central Bank Prepares Crackdown on Crypto in New 2026–2028 Strategy