Ethereum Price Breaks $3K In Relief Rally Despite BOJ Signaling Further Rate Cuts

The Ethereum price surged over 2% in the past 24 hours to trade at $3,039 as of 03:03 a.m. EST, with trading volume soaring 132% to $18.3 billion.

ETH broke the $3,000 level in a relief rally, even after the Bank of Japan’s (BoJ) summary of opinions from the December policy meeting reinforced expectations of continued tightening in 2026.

The BoJ raised its policy rate to 0.75% from 0.50% at its December policy meeting, the highest in 30 years. According to the summary of opinions released early Monday showed that some board members see the need for further rate increases in the near future.

Some board members believe that current rates are still lower than what they should be when adjusted for inflation.

Economists are projecting a rate between 1.25% and 1.5% in 2027.

The crypto market has dropped significantly following changes in BOJ’s policies in the past.

Can the projections affect the price of Ethereum?

Ethereum Price Indicators Support A Bullish Reversal After A Consolidation

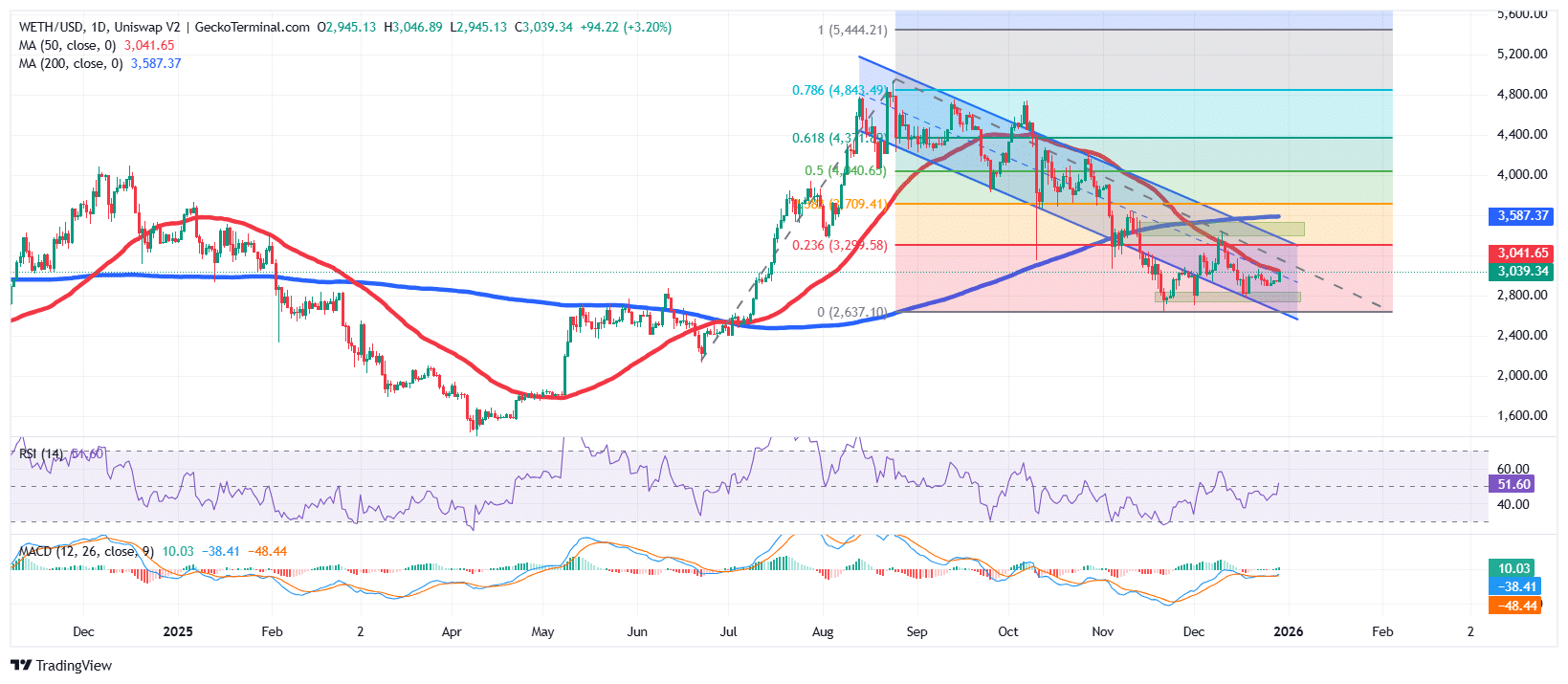

According to the ETH/USD chart analysis on the daily chart, the ETH price is still trading within a consolidation zone between the $3,400 resistance and the $2,650 support, with investors picking up some cautious trend.

As shown by the trend-based Fibonacci Retracement levels, the Ethereum price rallied mid-year to push ETH to an all-time high (ATH) of around $4,940 in September. After the surge, the bulls could not sustain the uptrend, after which the price of ETH dropped within a falling channel pattern, breaking key support Fib levels.

However, after hitting the support are around $2,650, ETH has been moving in a sideways pattern, capped by the $3,400 resistance area.

The continued downtrend was further supported by Simple Moving Averages (SMAs) forming a death cross around $3,545. The price of Ethereum has since traded below both the 50-day and 200-day SMAs.

Short-term projection shows the Ethereum price is poised for a surge, as it pushes towards the 50-day SMA ($3,041).

Meanwhile, major indicators support the bullish case, with the Relative Strength Index (RSI) pushing above the 50-midline level, currently at 51.60.

The Moving Average Convergence Divergence (MACD) also supports this outlook, with the blue MACD line crossing above the orange signal line. Green bars on the histogram are also starting to form above the neutral line, a signal of positive momentum.

ETH/USD Chart Analysis Source: GeckoTerminal

ETH/USD Chart Analysis Source: GeckoTerminal

ETH Price Prediction

The latest candle on the daily timeframe shows that the ETH price is currently gearing up for a surge, as it closes in on the 50-day SMA, acting as the immediate resistance area.

If the ETH bulls maintain the rally above the $3,000 area and close the 50-day SMA, the next key resistance area and target is within the 0.236 Fib area at $3,299. A sustained rally could then push the price of Ethereum to target the previous supply zone at $3,709.

Conversely, if the price of ETH continues to trade within a falling channel to break below the $2,800 support, the next cushion against downward pressure is at the $2,400 support area, below the current support.

This could be the case if spot ETH exchange-traded funds (ETFs) continue losing. According to data from Ali Martinez on X, over $32 million worth of Ethereum was sold by ETFs last week.

Related News:

You May Also Like

Ultimea Unveils Skywave X100 Dual: 9.2.6 Wireless Home Theater Launching March 2026

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be