- U.S. Senate Banking Committee set to review Bitcoin-focused legislation.

- Bill allows regulated banking for digital assets.

- Potential growth in cryptocurrency market expected.

The “Responsible Financial Innovation Act,” sponsored by Senator Cynthia Lummis, is set for a January Senate Banking Committee review, potentially reshaping U.S. banking with regulated digital asset services.

This act could integrate digital assets into mainstream banking, enhancing consumer protections and market growth, amidst regulatory challenges and past government delays.

Legislation to Empower Digital Banking Integration

The legislation, if enacted, will provide a standardized approach for digital asset custody, staking, and payments, potentially incorporating major cryptocurrencies like Bitcoin into regulated banking services. Notable market implications include the potential influx into regulated markets. 117th Congress Senate Bill 4356 regarding digital assets and financial regulation.

Key reactions came from political circles noting the milestone. Senator Lummis stated, “Digital assets are an essential part of our financial system, and bringing them into the regulated banking system can both protect consumers and unlock growth potential.” Source

Bitcoin Trends and Expert Perspectives

Did you know? After the 2022 Lummis-Gillibrand Act stalled, this new proposal marks a potential new era for U.S. cryptocurrency regulation, combining regulatory clarity with growth potential.

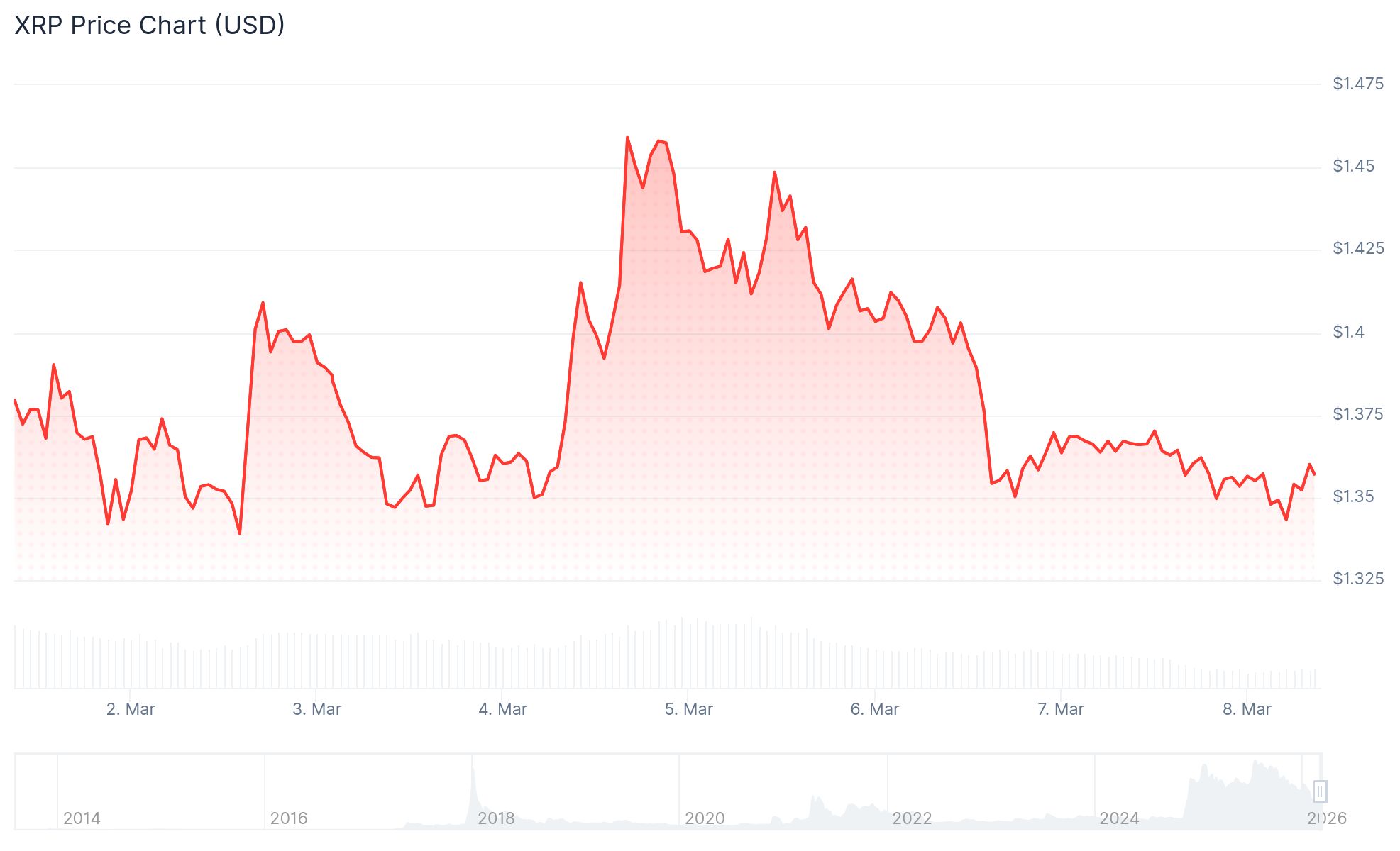

Bitcoin (BTC) currently trades at $87,558.71 with a 24-hour trading volume of $33.10 billion, according to CoinMarketCap. The market has seen a 0.83% decrease over the past day, reflecting cautious sentiment in the lead-up to regulatory discussions. The 60-day trend shows a 20.78% decrease, highlighting ongoing market volatility.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 05:18 UTC on January 1, 2026. Source: CoinMarketCapExperts from Coincu highlight the potential growth in digital asset integration into traditional banks. Though challenges exist, such as maintaining security standards and compliance, the integration is expected to provide a significant boost to institutional trust and adoption.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/us-senate-bitcoin-regulation/