Is the Four-Year Election Cycle Over? What It Means for Politics

Bitcoin’s 2025 Decline Challenges the Four-Year Cycle Theory

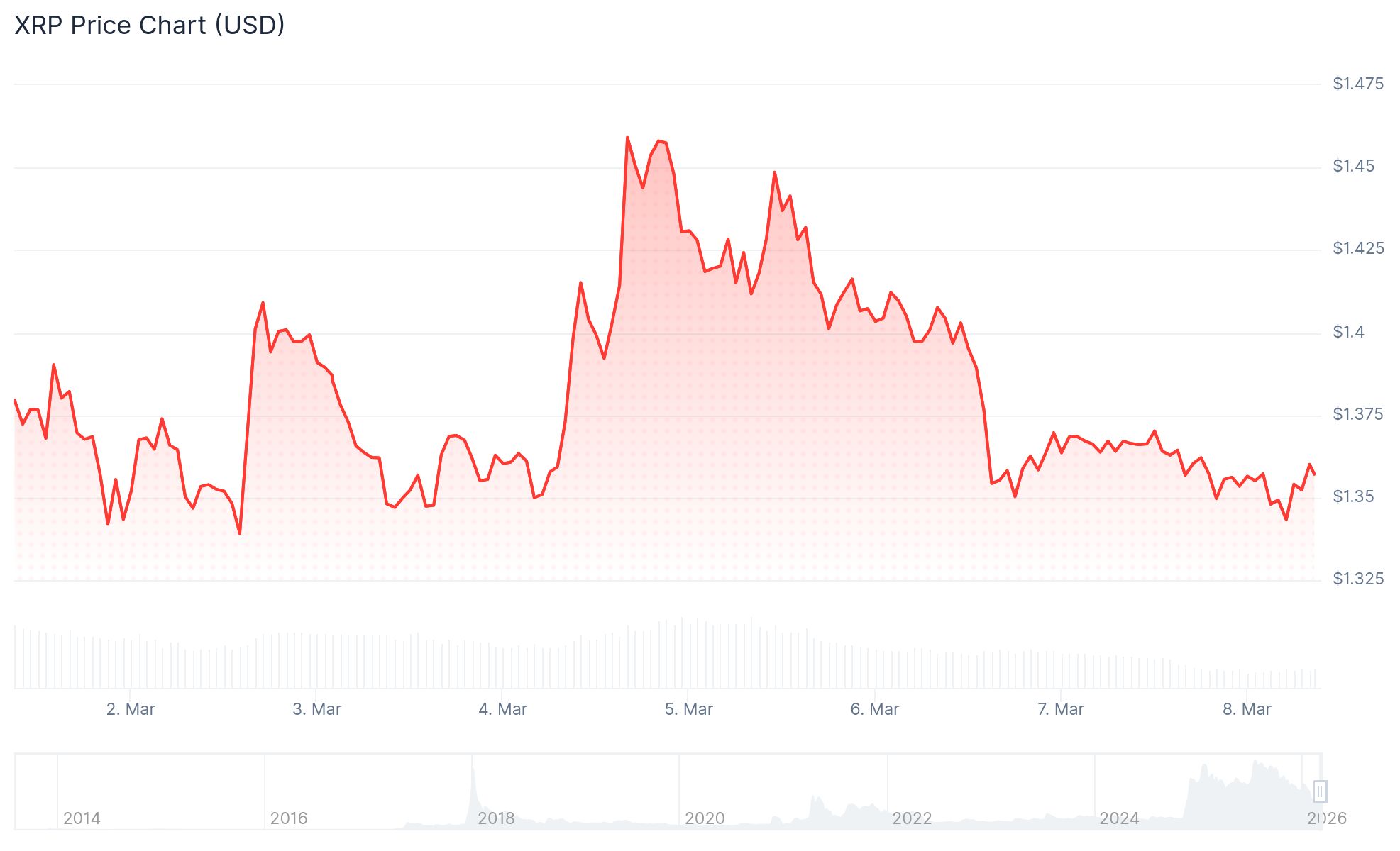

Bitcoin concluded 2025 lower than it started, marking the first time in a post-halving year that its price has declined. This shift questions the long-held belief in a predictable four-year cycle driven by halving events, which historically have led to bullish runs followed by steep corrections.

Key Takeaways

- Bitcoin’s price dropped over 30% from its October all-time high of $126,080, ending the year in the red.

- The traditional four-year halving cycle, which has historically predicted market peaks and downturns, appears to be breaking down.

- Industry analysts suggest that evolving market dynamics with institutional involvement are affecting the cycle’s reliability.

- While halving remains significant in supply dynamics, its influence on price movements has diminished amid macroeconomic and geopolitical factors.

Tickers mentioned: Bitcoin

Sentiment: Bearish

Price impact: Negative. The decline indicates that Bitcoin is deviating from its historical recovery pattern post-halving.

Trading idea (Not Financial Advice): Hold. Given the uncertain cycle dynamics, a cautious approach is advisable until market signals clarify.

Market context: Broader macroeconomic conditions, institutional participation, and regulatory developments are increasingly influencing Bitcoin’s price actions, moving away from traditional halving-driven cycles.

Breaking the Pattern

Bitcoin’s price trend in 2025 defies the typical post-halving rally seen in previous cycles. Since the latest halving in April 2024, the cryptocurrency has fallen more than 30% from its peak of $126,080 recorded on October 6, illustrating a departure from expected bullish movements following supply reductions. According to data from CoinGecko, Bitcoin ended the year lower than it began, with many analysts pointing to changing market dynamics.

Source: Charlie BilelloIndustry Perspectives

While the four-year cycle has historically served as a predictive model, analysts now argue it might be obsolete. Vivek Sen, founder of Bitgrow Lab, declared in a recent post that the cycle is “officially dead,” citing the influx of institutional investors and the macroeconomic environment as key factors dampening its relevance. He emphasized that Bitcoin now reacts more to liquidity, interest rates, regulation, and geopolitical risks than to halving schedules.

Source: Vivek Sen

Source: Vivek Sen

Meanwhile, some industry leaders remain divided. Notably, Ark Invest CEO Cathie Wood and BitMEX co-founder Arthur Hayes have long maintained that the four-year cycle is no longer applicable. Conversely, others like Markus Thielen from 10x Research argue it persists but operates under different parameters—no longer purely driven by programmed supply halvings but influenced by broader macroeconomic factors.

This article was originally published as Is the Four-Year Election Cycle Over? What It Means for Politics on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

XRP Ledger Plans to Become Native DeFi Lending Powerhouse

Hong Kong media: A mainland businessman was illegally detained and extorted, losing cryptocurrency and silver worth over HK$6 million.