Cardano Price Forecast: ADA risks further losses as whales offload 170 million tokens

- Cardano edges lower by nearly 1%, reversing from the falling channel’s resistance trendline.

- Large investors offloaded 170 million ADA within two weeks.

- Derivative data signal lowered optimism as Open Interest declines.

Cardano (ADA) has declined for the second consecutive day this week, maintaining a bearish tone. At the time of writing, the ADA declines by nearly 1% at press time on Tuesday as the risk-off sentiment resurfaces in the market, with President Trump extending the tariff pause to August 1.

Large Cardano investors, commonly referred to as whales, have been trimming their holdings worth 170 million ADA over the last two weeks, signaling a smart money outflow. The derivative data, amid a supply dump from whales, signals declining optimism as traders anticipate further losses.

Smart money trims holdings by offloading 170 million ADA within two weeks

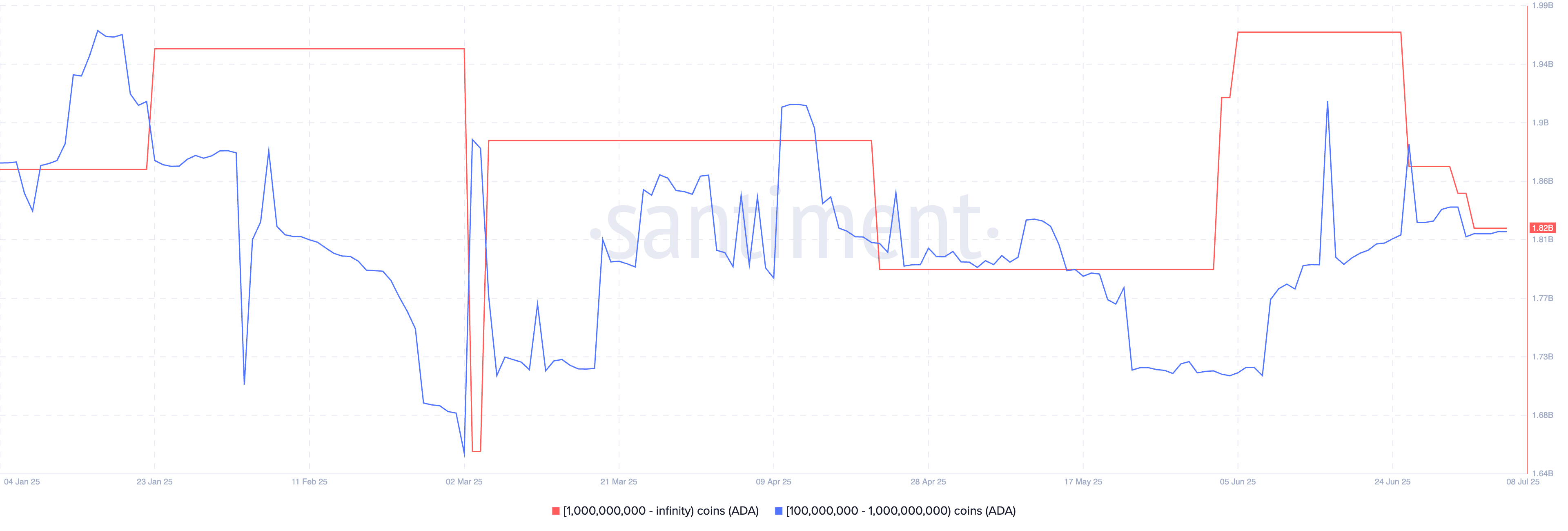

The supply distribution data tracks the sum of ADA holdings of investors based on a specified balance. Typically, a negative change in the holdings of investors with large balances foreshadows a bearish impact on the price trend.

Santiment’s data shows that investors with more than 100 million ADA have reduced their holdings by nearly 170 million tokens over the last two weeks. The sum of investors holding between 100 million ADA and 1 billion ADA decreased to 1.82 billion ADA on Tuesday, down from 1.87 billion ADA on June 26.

Meanwhile, the total value of investors' holdings with more than 1 billion ADA stands at 3.22 billion, down from 3.34 billion ADA on June 26.

Cardano supply distribution. Source: Santiment

The sell-off trend among large investors increases the supply pressure on exchanges as retail demand becomes exit liquidity for smart money.

Cardano derivatives signal lowered optimism

CoinGlass’s data shows a 3.38% decrease in ADA Open Interest (OI) over the last 24 hours, reaching $791.47 million. Declining OI translates to capital outflow from ADA derivatives, suggesting lowered confidence among derivative traders.

Adding credence to declining buying activity, the OI-weighted funding rates have dropped to 0.0018% from the intraday peak of 0.0087%. As the side with dominant trading activity pays funding rates, sidelined investors may consider declining rates as a sign of lowered buying pressure.

Cardano derivatives. Source: Coinglass

Cardano risks further losses in a bearish channel

Cardano ticks lower by nearly 1% at press time on Tuesday, extending its losses from the previous day. With a bearish beginning to the week, ADA reverts from a crucial resistance trendline formed by connecting the high of May 12 and the closing price of June 11.

A reversal from the resistance trendline risks a pullback within the falling channel formed with a support trendline extrapolated from the May 19 low and June 22 daily close. Traders short-selling Cardano could respect the immediate support at $0.5419, last tested on July 1, as the primary target.

The Moving Average Convergence/Divergence (MACD) indicator displays a pullback in green histogram bars toward the reference line, indicating a decrease in momentum. If the uptrend in MACD and signal lines reverses, investors may consider a crossover as a sell signal.

The Relative Strength Index (RSI), struggling to surpass the midpoint, hovers around 44, indicating persistent selling pressure.

ADA/USDT daily price chart.

To reinforce an uptrend, Cardano must surpass the overhead trendline at $0.5896 with a decisive daily close. In such a case, ADA could target the $0.6186 level, last tested on June 18.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

Bitwise CEO Reveals Why Credit and Borrowing Are Crypto’s Next ‘Big Story’