CITIC Securities 2026 Investment Panorama Outlook: After the Tech Bull Market, Who Will Rise and Fall?

Author: CITIC Securities

summary

Overall, 2026 marks the beginning of a period of solidifying the foundation and fully leveraging the strengths of the 15th Five-Year Plan. From an external perspective, 2026 is a year of strategic counter-offensive. From an economic structure perspective, 2026 is a year of innovation and fostering new growth. From a growth driver perspective, 2026 is a year of boosting domestic demand. From a policy perspective, 2026 is a year of "dual easing" in fiscal and monetary policies. From a risk and challenge perspective, 2026 is a year of risk mitigation. Supported by policy, stabilizing domestic demand, and industrial upgrading, GDP growth in 2026 is expected to be around 5%.

A-share Market: The A-share bull market is expected to continue in 2026, with the index projected to continue its upward trend but at a slower pace. Investors will focus more on fundamental improvements and the validation of positive economic conditions. We believe caution is warranted regarding the structural/phased correction risks in the technology sector, and resource commodities are likely to become a new main theme for A-shares after the technology sector. The full-scale Sino-US competition may have a significant impact on A-share investment; we recommend focusing on future industries, key resources, and the military industry. Key sectors to watch: New energy, non-ferrous metals, basic chemicals, oil and petrochemicals, non-bank financial institutions, military industry, machinery and equipment, and computers. Key themes to watch: New materials, solid-state batteries, commercial aerospace, nuclear power, and cross-strait integration.

Hong Kong Stock Market: In 2025, the concept of the "New Four Bull Markets" for A-shares and Hong Kong stocks was proposed, namely, a "capital inflow bull market," a "technology innovation bull market," a "system reform bull market," and a "consumption upgrade bull market." The strength of these four bull markets will continue to drive the market to a steady upward trajectory in 2026. With a large number of high-quality domestic companies listing in Hong Kong and the evolution of the US interest rate cut cycle, the activity of the Hong Kong stock market in 2026 will be further stimulated, and Hong Kong stocks still have significant upside potential.

Global Markets: Three key trends are worth tracking in global asset pricing in 2026. First, in 2025, the most outstanding assets globally were precious metals (gold and silver) driven by safe-haven demand and the Fed's easing monetary policy. In 2026, under the combined influence of anti-fragility and other major trends, non-ferrous metals (copper and aluminum) may be the most prominent. Second, the global risk appetite is still undergoing correction, and the AI industry chain, driven by the US-China technology security competition, remains worth monitoring. Third, US Treasury yields and inflation are unlikely to decline significantly in 2025. These three trends and a global mini-recovery suggest that global interest rates and inflation will remain relatively high in 2026.

Bond Market: In terms of interest rate bonds, short-term risks are generally limited, and the yield curve is expected to steepen; credit spreads for corporate bonds are expected to remain at a low level, and the widening of spreads brought about by incremental events will create opportunities for allocation; convertible bonds, under the influence of equity asset catalysts and the constraint of high redemption probability, are likely to continue to exhibit a relatively significant range-bound trading pattern.

Image source: Research and Development Department of CITIC Securities

Macroeconomic and political policies: Stabilizing the foundation while seeking change, laying the groundwork for a soaring future.

In 2025, multiple economic indicators showed that the domestic economy was growing steadily in terms of total volume and exhibiting high-quality development in terms of structure. On the policy front, the focus was on expanding domestic demand and boosting consumption, countering involution and optimizing supply, promoting technological innovation and industrial upgrading in tandem, and further strengthening people's livelihood security. Looking ahead to 2026, the macroeconomic policy focus is on three aspects: (1) Growth drivers: GDP growth target of around 5%, gradual release of technological industry dividends, significant consumption driving economic growth, and the real estate market is expected to bottom out and stabilize structurally. (2) Policy context: The outline of the "15th Five-Year Plan" is expected to release quantitative indicators and major engineering projects. Fiscal policy emphasizes sustainability and is prudent and proactive, monetary policy is mainly supportive and stable with some easing, and industrial policy is optimized to achieve structural adjustment. (3) External risks: The Fed's interest rate cut process, the US midterm elections, the Sino-US strategic game and global geopolitical risks may bring disturbances. It is recommended to pay attention to the following four main investment opportunities: technological innovation, infrastructure pro-cyclical, service consumption, and public utilities.

Fiscal Policy: As a crucial year for the start of the 15th Five-Year Plan, China's fiscal deficit ratio will continue its expansionary trend in 2026. The narrow fiscal deficit ratio will remain around 4%, while the broad fiscal deficit ratio is expected to expand slightly to around 8.3%, exhibiting the core characteristic of "central government fiscal expansion exceeding local government expansion." This arrangement aligns with the long-term policy of "moderate deficit expansion" during the 15th Five-Year Plan period and addresses the practical needs of economic recovery and strategic investment in 2026.

Monetary Policy: In 2026, China's monetary policy will continue to maintain a moderately loose stance. This judgment is based on the support of the external environment and is also deeply rooted in the actual needs of the internal economic operation. Policy operations will focus more on the coordinated efforts of aggregate control and structural guidance.

Industrial Policy: Based on the current pain points of the industry and policy orientation, the key to structural adjustment in 2026 lies in repairing the price transmission chain through anti-involution policies, and the strength of demand-side supporting measures will determine its effectiveness.

Macroeconomic Outlook: Emerging from the Inflation Trough

Looking ahead to the second half of the year, the overall trend of global stocks, bonds, currencies, and commodities will still align with the major trend, but there will be a slight pullback in pace.

US stocks and bonds: fluctuating repeatedly amid a major wave.

Chinese assets: The bond market's bull run can be "rich" at the end; stock market trading liquidity.

Global commodities: High volatility on one side; stagnant price movement on the other.

US Dollar Index and RMB Exchange Rate: Inverse dollar trading weakens and the exchange rate fluctuates within a range.

Exports: With the rush to export subsiding, the divergence between Producer Price Index (PPI) and core CPI may narrow in the first half of this year. At that time, the PPI may further transmit to CPI, with two key trends to watch: Trend 1: The PPI price structure may further diverge, and downstream manufacturing profit expectations may be weaker than in the first half of the year. Trend 2: Corporate cash flow pressure may further transmit to the consumer, potentially constraining the upward momentum of core CPI.

Consumption: The impact of US tariffs on domestic demand may gradually become apparent in the second half of the year, potentially increasing the vulnerability of risk-averse asset prices. On the one hand, with the US tariff levels on China finalized, the earlier rush to export has gradually cooled. On the other hand, the tariffs put pressure on low- and mid-range small and medium-sized export enterprises, affecting domestic demand through household income and employment channels. The real estate market, still bottoming out, coupled with potentially weakening business operations, may also lead to lower rents.

Policy: Based on the new framework, potential policies for the second half of the year are expected to focus on the following directions and pace: ① The trade-in program saw rapid progress in the first half of the year, but as funds near their end in the second half, the trade-in program will no longer be a policy highlight. ② The second half will focus on subsidies for childbirth and employment assistance. ③ Regarding monetary policy, easing measures are expected in the second half, especially at the end of the third quarter and the beginning of the fourth quarter. If the US continues to cut interest rates, China's easing pace may accelerate.

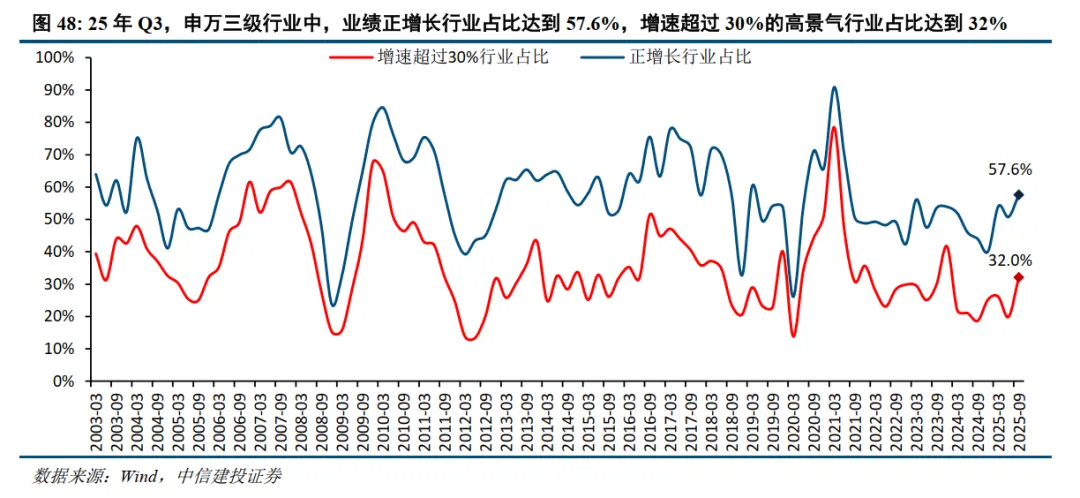

A-share Outlook: A New Journey of a Slow Bull Market

The A-share bull market is expected to continue in 2026, with the index projected to continue its upward trend albeit at a slower pace. Investors will focus more on fundamental improvements and the validation of positive economic conditions. We believe caution is warranted regarding the structural/phased correction risks in the technology sector, and resource commodities are likely to become a new main theme for A-shares after the technology sector. The full-scale Sino-US competition may have a significant impact on A-share investment; we recommend focusing on future industries, key resources, and the military sector. Key sectors to watch include: new energy, non-ferrous metals, basic chemicals, oil and petrochemicals, non-bank financial institutions, military, machinery and equipment, and computers. Key themes to watch include: new materials, solid-state batteries, commercial aerospace, nuclear power, and cross-strait integration.

Rapid rises are prone to collapse, while gradual progress leads to long-term success – the rhythm and scope of this bull market. This bull market began with a policy shift and is centered on improved liquidity. These core logics supporting the bull market are expected to continue or even strengthen in 2026. We believe the market has entered the mid-stage of a bull market, and the cost-effectiveness of equity assets has declined. Excessive short-term gains could lead to an early peak and premature end to the bull market. From a market rhythm perspective: A-shares are entering a critical period for verifying economic growth. During this stage, the index will continue to rise in a volatile manner, but the rate of increase will slow. Improved economic fundamentals or the release of earnings from emerging industries/sectors will digest the high valuation levels. This stage may see a style shift; sectors with high valuations but downward revisions in growth expectations may experience a period of adjustment, while stocks with improving fundamental expectations will lead the market, and a growth-oriented investment style will prevail.

Amidst the burgeoning momentum of technological innovation, a period of undercurrents emerges – the selection of the main market theme. Current market consensus: From a policy, fundamental, and capital perspective, technological growth is the logically sound direction. Our view: Be wary of structural/phased correction risks in the technology sector. We suggest seeking out sectors with earnings elasticity and capitalizing on structural opportunities, focusing on: AI, new energy, and key resources. After the tech bull market, pay attention to the resource commodities bull market. Conditions for a resource commodities bull market are currently accumulating, and resources are likely to become a new main theme in the A-share market after the technology theme. The logic behind bullish resource commodity prices mainly includes: global monetary easing, the gold price ratio, supply and demand gaps, price trends, and the start of the domestic restocking cycle. Furthermore, with the US and China entering a phase of full-scale competition, the competition for key resources is also expected to be a key factor in the resource commodities bull market.

Planning for the Future, Gaining Momentum: The US-China Showdown Behind A-Shares. The US and China have entered a phase of comprehensive competition. Planning for the Future: The competition between the US and China over future industrial layout and cutting-edge technologies is intensifying. We recommend focusing on: AI (lithography machines, domestic computing power), new energy (solid-state batteries, nuclear power), biotechnology (innovative drugs, brain-computer interfaces), commercial aerospace (satellite internet), quantum technology, and other cutting-edge technology sectors. Gaining Momentum: Key resources are the "strategic sieve" of global competition. The military industry is a key direction of the "15th Five-Year Plan." We recommend focusing on: rare earth equipment/auxiliaries, superhard materials, specialty gases, aerospace equipment, and new materials (permanent magnet materials, high-temperature alloys for aviation, etc.).

Planning for the Future, Gaining Momentum: The US-China Showdown Behind A-Shares. The US and China have entered a phase of comprehensive competition. Planning for the Future: The competition between the US and China over future industrial layout and cutting-edge technologies is intensifying. We recommend focusing on: AI (lithography machines, domestic computing power), new energy (solid-state batteries, nuclear power), biotechnology (innovative drugs, brain-computer interfaces), commercial aerospace (satellite internet), quantum technology, and other cutting-edge technology sectors. Gaining Momentum: Key resources are the "strategic sieve" of global competition. The military industry is a key direction of the "15th Five-Year Plan." We recommend focusing on: rare earth equipment/auxiliaries, superhard materials, specialty gases, aerospace equipment, and new materials (permanent magnet materials, high-temperature alloys for aviation, etc.).

Global Market Outlook: The Great Wave and Antifragility

Looking ahead to 2026, the major macroeconomic variable will be the shift in the great power rivalry between China and the United States from tariff confrontation to strategic competition.

In 2026, the major variable will be the direction of China-US relations. We make our judgment on China-US relations based on two perspectives: from a comprehensive tariff confrontation to a strategic competition in security technology.

From a strategic perspective , the US must focus more on domestic affairs in the midterm election year. While Trump will still prioritize foreign policy in 2025, compared to the Biden administration, his foreign relations approach will focus more on a "pivot to Asia" and launch a new round of trade wars to challenge China's supply chains. In 2026, the US will hold midterm elections, facing four increasingly apparent "American divisions": ① a strong government sector and a weak private sector; ② a weak traditional economy and a strong technology sector; ③ a strong consumer sector and a weak production sector; ④ the wealthy gain more while low- and middle-income groups are at a disadvantage. The US needs to return to "American-style stable growth" to stabilize its economy and create more space to buffer conflicts.

From the perspective of great power competition , the Sino-US rivalry has transitioned from a transfer of production capacity to a technological security competition. Who will win and who will lose the tariff game in 2025? Behind this seemingly simple question lies a more fundamental one: what is the ultimate purpose of the tariff confrontation? Based on the nature of Sino-US economic and trade relations and the experience of US trade wars after World War II, we have systematically answered this question: the purpose of the tariff confrontation is not entirely based on the consideration of manufacturing returning to the US, but rather on restructuring the global supply chain and buffering the contradictions between China and the US on the supply and demand levels. Currently, China, the US, and third-party countries have reached a general consensus on tariff confrontation, a point confirmed by the trade agreements reached between the US and several countries in July and the Busan meeting between the leaders of China and the US. The Sino-US tariff confrontation has come to a temporary end, and the future Sino-US trade volume is likely to see a significant easing of tensions. However, in the strategic field—security and technology—the great power competition between the US and China has just begun. This is why we believe that in 2026, the Sino-US relationship will enter a security and technological competition, a model that will profoundly influence the global political and economic landscape.

The global political and economic trends driven by US-China relations in 2026: from a confrontation over total tariffs to a competition in security and technology.

In 2026, the US policy focus will shift back to its American-style approach of stabilizing growth, with monetary and fiscal easing being an inevitable choice for the Trump administration. Following this loose fiscal and monetary policy, we may see a mini-rebound in US economic demand in 2026.

In 2026, demand in the Japanese and European economies will also see a phased rebound. The reasons are not complicated: the impact of tariff confrontation will gradually subside, fiscal policy will be adjusted, and the effects of monetary easing will gradually accumulate and become apparent.

Therefore, under a neutral scenario, we make two important judgments: ① The global economic cycle will shift from risk aversion to recovery in 2026. ② Global asset pricing will change in 2026, shifting from price fragility to price antifragility.

In 2026, three major global trends will continue to surge forward: technological revolution, fiscal expansion, and supply chain reshaping.

Beyond focusing on key variable shifts, we also need to pay attention to longer-term, underlying trends. These trends will influence our judgment of major macroeconomic trends.

The world is currently experiencing a period of explosive growth in a new round of technological revolution. The trade war has not hindered the progress of AI technology, and US tech giants continue to engage in robust capital expenditures; the technological narrative is still evolving. Whether viewed from the perspective of a shift in the focus of the US-China rivalry or a return to US domestic policy, technology capital expenditure will be a key investment area for both China and the US in 2026.

Major economies will temporarily return to fiscal expansion in 2026. This is both a continuation of the global fiscal framework following the pandemic and a phased response to the global demand for a return to growth in 2026.

Faced with each tariff increase, Chinese companies proactively respond by accelerating their overseas expansion, i.e., shifting production capacity overseas. Following the 2018 trade war, China entered its first phase of overseas expansion, and the global supply chain underwent a reshaping. The new trade rules enacted by Trump in 2025 will further reshape the global supply chain, ushering in China's second phase of overseas expansion, with companies becoming more diversified.

Amidst these three major waves, which asset prices exhibit longer-term trend changes?

The asset implications of the fiscal expansion wave include a high inflation center, high nominal interest rates, and high government debt.

The asset implications of the technological revolution include higher real interest rates, more extreme asset differentiation, and a more resilient dollar center.

The asset implications of supply chain reshaping include short-term supply tightness and a continued global capital expenditure boom.

What will global assets be priced in 2026? Antifragility and the Great Wave.

Three major trends and short-cycle antifragility suggest that global asset pricing in 2026 may follow three key clues worth tracking.

First, in 2025, the most eye-catching assets globally will be precious metals (gold and silver) that are priced as safe havens and benefit from the Fed's monetary easing. In 2026, the most eye-catching assets, driven by anti-fragility and the great wave of change, may be non-ferrous metals (copper and aluminum).

Second, the global risk aversion correction process is still underway, and the AI industry chain under the US-China technology security competition is still worth tracking.

Third, US Treasury yields and inflation are unlikely to fall in 2025. The three major trends and the global mini-recovery determine that global interest rates and inflation will remain at relatively high levels in 2026.

Industry Outlook

Technology Industry: Computing Power First, Focus on New Technology Breakthroughs

The National 15th Five-Year Plan clearly states that a new round of technological revolution and industrial transformation will accelerate breakthroughs, and the "Artificial Intelligence+" action will be fully implemented. We believe that the world is currently in the midst of an AI industrial revolution, analogous to the Industrial Revolution, with far-reaching implications. It cannot be simply compared to recent developments such as cloud computing and new energy; it requires a longer-term perspective and a broader vision.

Telecommunications: The world is currently in the midst of an AI industrial revolution, analogous to the Industrial Revolution, with far-reaching implications. It cannot be simply compared to recent developments like cloud computing and new energy; a longer-term perspective and broader vision are needed. Therefore, we are very optimistic about the computing power demand and applications driven by AI, including sectors such as optical modules/optical devices/chips, switches, liquid cooling, data centers, and edge AI. Furthermore, the traditional telecommunications industry chain is affected by declining capital expenditures from telecom operators, resulting in low market expectations. However, the development of key 6G technologies has begun, coupled with operators' increased investment in AI, making it worthy of attention. Both China and the US highly value quantum technology, leading to significant gains in related US stocks. We recommend focusing on sectors such as dilution chillers and cryogenic coaxial cables.

Computer Science: AI is leading the main development of the computer industry, and with the synergy of domestic production, quantum technology, financial IT, and intelligent driving, the industry is expected to see a double recovery in performance and valuation. Specifically, in the AI field, rapid model iteration, high computing power demand, and a gradually forming ecosystem are accelerating commercialization; domestic production is entering a deeper phase driven by policy and orders, with industrial software becoming a core support for a manufacturing powerhouse; quantum technology, as a future industry, is opening up a new track for global competition; meanwhile, high-growth sectors such as financial IT and intelligent driving continue to offer structural opportunities. We recommend focusing on AI, domestic production, and cutting-edge technologies.

Artificial Intelligence: 1) In the computing power sector, investment opportunities should focus on leading companies, new technology upgrades, accelerated localization of industrial clusters, and order spillover, with particular attention to heat dissipation, PCBs, power supplies, and power generation. 2) In the medium term, the shift of orders towards domestically produced chips is inevitable. Considering that domestically produced chips are gradually entering mass production and delivery, a significant increase in market concentration is expected. Focus should be placed on chip manufacturers that have significantly increased their market share among cloud vendors. 3) Companies like OpenAI have accelerated the commercialization of their applications this year, resulting in rapid revenue growth. Investment opportunities should be sought in how AI empowers and transforms various industries.

Media & Internet: We remain optimistic about AI applications and content consumption in 2026. AI applications saw accelerated commercialization in 2025, with a focus on integrating AI with existing products in 2026. WeChat, Douyin, and Doubao are expected to become traffic gateways in the AI era. Furthermore, AI+advertising is expected to translate into tangible results, such as OneRec's efficiency improvements and cost reductions. Simultaneously, AI's overseas expansion is accelerating, leveraging high product strength and cost-effectiveness to capture overseas markets. In the gaming sector, the market outlook and profit margins continue to rise. Supply-side growth in game licenses (23% year-on-year increase in the first 10 months of 2025) supports subsequent revenue. Tencent, NetEase, and miHoYo are releasing a flurry of new games. Mid-sized manufacturers are exploring innovative categories (such as SLG+elimination, creative card games, and emerging female-oriented games) with significant potential. Weakening channel bargaining power and AI-driven user acquisition efficiency will lead to continued profit margin increases. In content consumption, leading IP-based trendy toys are accelerating their overseas expansion and improving single-store efficiency. GuZi Consumption is shifting from rapid, unregulated growth to high-quality integration. Music platforms are driven by both volume and price, and live performances are booming. Film and television benefit from policy support, and AI is assisting content innovation (such as comics and group broadcasts). Both policy and supply are bottoming out and recovering.

In the electronics sector: On the model side, large AI model vendors are experiencing rapid expansion in both user base and revenue, with OpenAI and Anthropic's ARR still growing exponentially. As AI applications and edge computing accelerate their deployment, CSPs are increasing capital expenditures, undertaking the largest infrastructure investments in history. On the hardware side, NVIDIA's GB300 server solution is entering mass production, the Rubin architecture solution is gradually emerging, and ASIC players are also ramping up their efforts. The surge in computing power demand is driving high growth in sub-sectors such as GPUs, storage, advanced packaging, and PCBs, providing a golden period for the development of domestic semiconductors. On the edge side, generative AI is driving a new wave of content generation, search, and productivity-related applications, covering terminal categories including smartphones, PCs, automobiles, XR, and IoT, providing entirely new user experiences. New terminals such as AI glasses, toys, and robots are poised for explosive growth.

Consumer Industry: Supply and Demand Reversal Drives Price-to-Quality Ratio, Emotional Value Emerges as a New Trend

Food & Beverage: The food and beverage sector has undergone a long-term correction, with low attention to domestic demand, significantly reduced valuations, and low market expectations. The bottoming logic for high-quality assets like baijiu (Chinese liquor) is clear. We are particularly optimistic about four sectors: 1) Baijiu: Focus on three types of high-quality targets, awaiting a recovery in demand. Stimulus policies are expected to be strengthened, and economic data is expected to bottom out, driving a consumption recovery. 2) Snacks, Health Products & Beverages: New channels and new categories in snacks are resonating, creating multiple investment opportunities. The trend towards healthier and more functional beverages is gaining momentum, with high growth potential in specific sub-categories. New consumption drivers in health products are leading to a revaluation of the health product sector. 3) Dairy Products: A pro-cyclical trend in milk prices is approaching, liquid milk may be reaching a turning point, and the deep processing industry is rising. 4) Catering Chain: Focus on efficiency as internal competition slows, embracing trends to expand new sales channels.

Light Industry, Textiles & Apparel, and Education: Looking ahead to 2026, we believe the industry's external demand beta is relatively better, and we recommend prioritizing stocks with strong alpha. Regarding domestic demand, supply innovation remains the biggest structural highlight. The sector as a whole is in the bottom valuation range. We should pay attention to future marginal changes in consumption and real estate policies and remain vigilant. 1) Export Priority: Sino-US relations are progressing smoothly, and US tariffs on Southeast Asia and other regions have been largely finalized. Downstream orders have gradually recovered since Q3. Tariff transmission and terminal price increases may affect some demand. The Fed's interest rate cut is expected to boost US consumption, especially demand related to the post-real estate cycle. Export companies sharing tariffs may affect gross profit margins, and leading companies are expected to increase their market share due to their overseas production capacity and manufacturing advantages. 2) Domestic Demand Accumulation: China's real estate completion and sales data remain under pressure, and retail sales are lackluster. Supply innovation remains the biggest structural highlight of domestic demand, and overall, domestic demand is still in the accumulation phase. The sector is currently in the bottom valuation range. We recommend paying attention to changes in real estate and consumption stimulus policies and waiting for the right-side inflection point.

Home Appliances: In 2025, the home appliance sector was hampered by tariff increases, fluctuations in the trade-in policy, and expectations of a high base in the second half of the year, resulting in overall underperformance compared to the CSI 300. From a long-term perspective, corporate competitiveness will ultimately return to the essence of product innovation and efficiency advantages. Therefore, from an investment perspective, we believe there are two main themes: firstly, overseas expansion will continue to be the most important source of growth; and secondly, the dividends of transformation. In summary, we believe that investment opportunities in 2026 mainly lie in 1) the era of large-scale overseas expansion; and 2) a new cycle of transformation.

Social services and commerce: While policies focus on quality consumption and opening up to the outside world, they also provide guidance for structural optimization. We expect continued growth in upgraded and basic consumption in the new year. The duty-free industry is poised to benefit from the return of consumption to the mainland and the new dividends of border closures and inbound trade. The gold tax reform and the overseas expansion of fashion brands are resonating, and the high-quality development of the service industry, accompanied by high-quality supply, is stimulating new consumer demand. At the start of the 15th Five-Year Plan, consumption is expected to gradually emerge from a pattern of weak expectations and reality, creating sector-wide opportunities, and the story of Chinese brands is becoming increasingly rich.

Pharmaceuticals: Value Reshaping, Awaiting the Blossoming of Success

China's pharmaceutical industry has entered a critical stage of "innovation realization + global layout," with a large population and domestic demand base, as well as full-chain manufacturing capabilities forming core support. Enterprises are actively exploring diversified overseas expansion paths. Facing global competition and deepening policies, the industry needs to "focus on domestic development, lead with innovation, and expand overseas," strengthening supply chain security and compliance capabilities domestically, and deepening diversified overseas expansion. Looking ahead to 2026, the focus should be on seizing opportunities arising from innovative commercialization, global breakthroughs, policy optimization, and industry mergers and acquisitions.

Pharmaceuticals and Biopharmaceuticals: The traditional Chinese medicine (TCM) industry is expected to see a short-term easing of base effects, with accelerated inventory clearing in distribution channels. A year-end demand recovery is anticipated, along with subsequent fundamental and valuation improvements. Innovation could help build a second growth curve, and TCM consumer goods companies have ample room for brand expansion. The blood products industry is focused on the "15th Five-Year Plan" for plasma station construction and the progress of industry mergers and acquisitions. On the demand side, the industry is optimistic about increased demand for intravenous immunoglobulin (IVIG) and factor-based products, as well as new product development. The vaccine industry is focused on improved sales of blockbuster products and the progress of innovative pipeline development. Policy announcements and vaccine exports are expected to further drive company growth. The pharmaceutical retail industry is undergoing steady transformation and reform, with attention focused on subsequent diversified catalysts. The pharmaceutical distribution industry is showing stable revenue growth, with attention focused on cash collection and the "15th Five-Year Plan."

Medical Devices: In the short term, with policy easing, centralized procurement clearing, new product and business expansion, and overseas expansion, many leading medical device companies are expected to see a performance inflection point in 2026. We recommend seizing investment opportunities in performance and valuation recovery, as well as investment opportunities in emerging medical technologies such as brain-computer interfaces and AI-driven healthcare. Long-term investment opportunities in the medical device sector stem from innovation, overseas expansion, and M&A integration. The sector's innovative and international capabilities are gradually gaining recognition, and its valuation is being reassessed.

Innovative Drugs: The innovative drug sector exhibits three major trends: Internationalization 2.0 is deepening, with 103 license-out transactions and a record-high initial payment of $8.45 billion in 2025, allowing companies expanding overseas to enjoy valuation premiums; unprecedented policy support, improved efficiency in medical insurance negotiations, and the first-ever establishment of a commercial insurance innovative drug catalog; and continuous technological breakthroughs, with ADCs, IO bispecific antibodies, GLP-1 weight loss drugs, and small nucleic acid drugs flourishing. The CXO industry adjustment is largely complete, overseas demand is stable, and domestic investment and financing have bottomed out and rebounded. Focus should be placed on CDMO companies with strong overseas capabilities and leading clinical CROs. The upstream industry chain has recovered significantly, with ample room for improvement in domestic production rates, driven by both intelligent and digital production and international expansion. We are optimistic about the future development of China's pharmaceutical industry chain.

High-end manufacturing

Machinery: Looking ahead to 2026, with relatively weak domestic demand, the industry is expected to experience structural prosperity. Investment strategies include: ① Focusing on new technologies: Prioritizing emerging industries with rapid technological changes and strong capital expenditures, such as humanoid robots, solid-state battery equipment, controlled nuclear fusion, and PCB equipment; ② Seeking new growth: From exports to overseas expansion, identifying beneficiaries of interest rate cuts and manufacturing capacity relocation, such as construction machinery, hardware tools, mining machinery, oilfield service equipment, and injection molding machines. These companies generally have lower valuations and higher growth rates, making them worthy of close attention.

Defense Industry: The pattern of "domestic demand as the foundation, foreign trade expansion, and civilian use supporting the military industry" is profoundly reshaping the landscape and boundaries of China's defense industry. The industry is shifting from "cyclical growth" to "comprehensive growth." 1) Domestic Defense Demand: Focusing on "preparing for war" and equipment modernization, demand stems from stable growth in the defense budget and equipment upgrades. Strong deterrence, high precision, and low cost combined with systematic, unmanned, and integrated systems are the main growth directions. 2) Overseas Military Trade: Leveraging its cost-effectiveness advantages, systematic combat capabilities, and geostrategic cooperation, China's share of the military trade continues to increase, making it a major global supplier and achieving a win-win situation of strategic influence and economic benefits. 3) Civilization of Military Technology: Cutting-edge military technologies are spilling over into the civilian sector, giving rise to trillion-dollar new industries such as commercial aerospace, low-altitude economy, future energy, deep-sea technology, and large aircraft, driving the development of new processes, new materials, and new devices, forming a virtuous cycle of "military technology for civilian use, supporting the defense industry."

Automotive: The automotive industry offers three investment avenues: cyclical, growth, and overseas expansion. With weakening policy expectations in 2026, the industry's cyclical attributes are diminishing. It is recommended to downplay expectations regarding overall domestic demand and focus on changes in industry structure and trends. Overseas expansion and growth are expected to become core investment directions, with commercial vehicles possessing undervalued and stable growth potential. The growth theme lies in intelligent driving/Robotaxi and AI applications in specific robotics sectors. The valuation of OEMs is expected to be reshaped as their technological attributes strengthen, while auto parts will benefit from breakthroughs in the robotics and other supply chains, opening up new growth opportunities.

New Energy: After three years of capacity digestion, and with demand exceeding expectations, the power equipment and new energy industry is standing at the starting point of a new cycle. During the 15th Five-Year Plan period, the global installed capacity of new energy is expected to reach a new level, which will bring about revolutionary changes to the power system: ① A high proportion of wind and solar power integration will generate massive demand for energy storage and capacity. ② Global power grids, especially those in Europe and the United States, will continue to increase investment to adapt to the carbon neutrality process. ③ The aforementioned adjustment costs and grid transformation costs will further drive up electricity prices, opening up long-term demand space for residential and industrial energy storage. ④ AI will drive the growth rate of global electricity consumption, and the importance of low-carbon, high-density power sources (offshore wind, SOFC, nuclear power, gas turbines) will also increase, with data center power supply modes shifting towards high voltage. All these changes will begin to materialize in 2026.

Banks: Driven by both liquidity and market factors, banks with stable and high-dividend attributes are more favored.

The macroeconomic recovery is expected to continue its weak trend in 2025, with no significant improvement in the fundamentals of the banking sector. High-dividend strategies will continue to be employed. From a funding perspective, long-term insurance funds, state-owned funds, and mutual funds still have strong incentives to increase their allocation to banks. As the fundamentals of domestic banks continue to bottom out, the safety margin for allocation-oriented demand, driven by a bottom-line mentality, high confidence, and high success rate, will further improve. Given the current lack of strong economic recovery characteristics, we remain optimistic about high-dividend strategies and will pay attention to undervalued stocks with potential for change.

Securities: Looking ahead to the 15th Five-Year Plan, the securities industry will safeguard the high-quality development of the capital market.

With the core guiding principle of "improving the inclusiveness and adaptability of the capital market system" set in mind during the 15th Five-Year Plan period, the securities industry is expected to usher in a new upward cycle, contributing to the construction of a strong financial nation.

The core driver comes from three major policy opportunities:

First, policies guide the capital market to serve new productive forces. The deepening reforms of the Science and Technology Innovation Board and the ChiNext Board promote the upgrading of investment banking value creation, matching the full life-cycle financing needs of high-tech enterprises and opening up medium- and long-term growth potential for investment banking business.

Second, policies have improved the ecosystem for long-term capital investment. Channels for medium- and long-term funds such as social security and insurance funds to enter the market remain open, and the expansion of equity products has activated the incremental business of securities firms' asset management and institutional clients, driving the industry's transformation towards allocation-driven growth.

Third, policy promotion will foster the development of top-tier investment banks and promote internationalization . Chinese securities firms can leverage the Hong Kong market and the Stock Connect policy to accelerate their international business breakthroughs. Mergers and acquisitions will help concentrate industry resources on leading firms, enhancing their capital strength and international competitiveness.

Insurance: Eight Major Trends in the Insurance Industry Looking Ahead to the 15th Five-Year Plan

The 15th Five-Year Plan period is not only a crucial time for strategic transformation in the insurance industry, but also an important period for the continued emergence of investment value in the sector. From an investment perspective, we recommend paying close attention to the allocation value of the insurance sector. Listed insurance companies are expected to see a synchronized improvement in both their asset and liability performance, and we suggest focusing on the "Davis Double Play" investment opportunity of long-term performance growth and valuation repair in the insurance industry.

Cyclical industries

Real Estate: With continued policy support for the real estate industry, the decline in sales has narrowed significantly. We predict that market sales will stabilize in 2026. Investment, due to its inherent lag, may remain under pressure. We project year-on-year growth rates for national commercial housing sales area, real estate development investment, new construction starts, and completed construction area in 2026 to be -5.2%, -9.8%, -13.6%, and -10.5%, respectively. After nearly four years of industry consolidation, the peak of debt defaults by real estate companies has passed, and debt restructuring of troubled companies has made positive progress. The investment logic in the real estate industry has shifted entirely from survival to a fresh start, and high-quality companies in each sector are expected to gain a first-mover advantage. In the development sector, we favor companies with concentrated land reserves in core cities and strong product capabilities; in the commercial sector, we favor companies with abundant and high-quality commercial real estate holdings and strong operational capabilities; and in the property management sector, we favor companies with high levels of digitalization and excellent cost control capabilities.

Construction: The "15th Five-Year Plan" emphasizes building a modern industrial system and accelerating high-level technological self-reliance. As a traditional industry, the construction sector needs to seek new growth sources in the era of a declining real estate market and existing infrastructure construction. It also needs to rely on industrial upgrading and technological progress to build a modern infrastructure system for new productive forces, empower industrial development, and seek its own transformation to achieve industrial upgrading. Meanwhile, in terms of expanding domestic demand, new urbanization and urban renewal will be key investment areas, and overseas expansion will continue to contribute incremental growth to construction companies. It is recommended to focus on three major directions: empowering a modern industrial system, expanding domestic demand, and overseas expansion.

REITs: The C-REITs market experienced a rollercoaster ride in 2025, reaching new highs before a correction, and has now bottomed out and stabilized. Performance divergence between and within different sectors continued in the third quarter, with assets exhibiting strong operational capabilities and counter-cyclical characteristics maintaining steady growth, while some highly competitive sectors still face challenges. In the short to medium term, market demand for high-quality assets remains very strong. Looking ahead to 2026, policy dividends are poised to materialize. Considering the pace of policy implementation this year, significant counter-cyclical adjustment space is expected before the end of the year. Specific policy directions include increasingly mature index-based products, more comprehensive tax policies, and highly supported holding-type real estate ABS. We recommend a shift in primary market strategy from "general selection" to "selective investment," while focusing on three main themes in the secondary market: counter-cyclical, growth-oriented, and strong fundraising.

Metals and New Metal Materials: In early 2024, we clearly proposed a bull market for resource commodities with limited supply, which was confirmed in 2024 and 2025, with non-ferrous metals experiencing a magnificent market. Looking at the present, we remain optimistic about the further advancement of non-ferrous metals in 2026, maintaining a bull market trend. In 2006, the demand for "real estate and infrastructure" was booming, while this round of bull market is driven by demand for "new quality productivity," which we prefer to call a "new quality productivity bull market." Benefiting from China's rapid rise and huge industrial advantages, new quality productivity elements will continue to maintain a bull market trend in 2026. The tight supply and strong demand will remain the characteristics of this round of bull market. AI and robotics new materials will also take advantage of this trend and usher in a strong growth cycle.

Chemicals: In our 2026 chemical industry strategy, against the backdrop of slowing capital expenditure and an approaching cyclical inflection point, we recommend focusing on sectors that are likely to benefit from the anti-involution strategy and be among the first to see a significant shift in market structure, including pesticides, urea, soda ash, filament, organosilicon, and spandex. Additionally, during the interest rate cut cycle, China's counter-cyclical policies are supporting a recovery in domestic demand; we suggest focusing on polyurethane, coal chemicals, petrochemicals, and fluorochemicals. Furthermore, developing new productive forces, achieving self-reliance and control, and upgrading industries are steadfast choices in the context of great power competition. New materials remain one of the main development directions for China's chemical industry, with a focus on the continued development of semiconductor materials, OLED materials, COC materials, and other high-value-added products. Moreover, high-quality companies with high shareholder returns will continue to be revalued; we recommend focusing on leading companies in the oil, gas, and petrochemical sectors, including the three major state-owned oil companies, coal chemicals, compound fertilizers, phosphate chemicals, and monosodium glutamate/feed amino acid industries.

Transportation: Spring, summer, autumn, and winter—not every season is suitable for sowing! 1. Insurance and passive funds favor dividends, leading to a narrowing A-H share premium. 2. Container shipping: The US inventory cycle is entering a recessionary phase, putting pressure on demand for container shipping. 3. Oil shipping: Gradually moving towards a compliance-driven bull market. 4. Specialized freight: The export of the "new three categories" (referring to specific types of goods) is driving demand for specialized freight, and the export boom for specialized goods continues. 5. Express delivery: Supply and demand are both approaching a turning point; a historic moment in the competitive landscape is approaching. 6. Airline: Price cuts are used to increase volume and improve load factors, with oil prices and exchange rates providing support.

Public Utilities & Environmental Protection: Since 2025, the power index has performed at a relatively low level among various industries. As of October 22, 2025, the Wind power sector has risen 2.7% year-to-date; the CSI 300 Index rose 16.7% during the same period. The environmental protection index has risen 19.1% year-to-date, ranking in the middle compared to other Wind Level 1 industries, outperforming the broader market by 2.4 percentage points. Recently, the detailed implementation rules for Document No. 136 in various provinces have been basically completed. Overall, Document No. 136 requires each province to formulate policies based on its own power market operation, and the implementation policies of each province show a trend of regional differentiation. In terms of thermal power, the utilization hours of thermal power have decreased year-on-year due to the pressure from the growth of renewable energy power generation. From January to September 2025, the cumulative power generation of thermal power decreased by 1.2% year-on-year. In terms of fuel costs, since 2025, the price of thermal coal has generally declined, gradually rebounding from the middle of the year. In summary, against the backdrop of the overall decline in the utilization hours of thermal power, the possibility of a significant increase in thermal coal prices is small, and the profitability of thermal power is expected to remain.

FICC Investment Strategy

Interest Rate Bonds: In terms of operations, we believe that in a market environment where long-term interest rates are mainly fluctuating within a wide range and the central yield may slowly rise in the medium term, we do not recommend a one-sided bet on duration strategies. We suggest that investors focus on coupon strategies, with short-duration credit bonds as the core holding. At the same time, given that the central bank's monetary policy is still supporting the real economy, it is better to continue to use leverage strategies to carry trade moderately, and supplement this with more flexible long-term volatility operations to enhance returns.

Credit Bonds: Credit spreads have remained low overall this year, exhibiting significant cyclical fluctuations. Looking ahead to 2026, with overall weak financing demand and no significant increase in credit risk, credit spreads are expected to continue to remain low. Widening spreads due to new events will create opportunities for investment. Specifically, short-term spreads are currently compressed to an extreme degree; for investment, more attention should be paid to the potential for high spread compression in 5-year and longer-term bonds. For local government financing vehicle (LGFV) bonds, focus on the progress of debt restructuring; consider extending the duration for high-credit-rating entities and regions. For corporate bonds, focus on the "turnaround" of weaker credit-rating entities after a fundamental shift. For financial bonds, leverage the high elasticity of long-term bonds to capture more valuation volatility gains. For Chinese-funded overseas bonds, the Fed's interest rate cut path continues. Regarding market timing, valuation pullbacks due to new events still present investment opportunities. Based on the experience of reviewing five rounds of pullbacks in recent years, a pullback of more than 30 basis points presents a good opportunity to actively position oneself.

Convertible Bonds: Looking ahead to 2026, we believe that convertible bonds, driven by equity asset catalysts and constrained by a high probability of forced redemption, are likely to continue exhibiting significant range-bound trading. On the one hand, the increased expected returns of equity assets and the scarcity of convertible bonds themselves make a sharp pullback in convertible bond assets unlikely. On the other hand, due to the continuously increasing probability of forced redemption and the shortening average remaining maturity of convertible bonds, the time value of convertible bonds may further diminish, making it difficult for the market to price them at higher valuations. Therefore, we recommend paying attention to fluctuations in convertible bond valuations and price centers, flexibly adjusting the allocation of convertible bonds, and obtaining trading returns. For newly issued convertible bonds, in addition to actively subscribing in the primary market, continued monitoring during the initial listing period is advisable, as statistical arbitrage opportunities exist.

You May Also Like

Morgan Stanley Files Spot Bitcoin ETF

Will XRP Price Increase In September 2025?