Reflecting on the cyclical changes in this round of crypto bull market, how to formulate an effective selling strategy?

Author: Finish , Crypto KOL

Compiled by: Felix, PANews

This cycle is very hard, worse than any previous one. Many people even call it a "crime cycle" because the number of scams and projects that are scamming people for money keeps growing.

The purpose of this article is to reflect on the past and try to predict what will happen next.

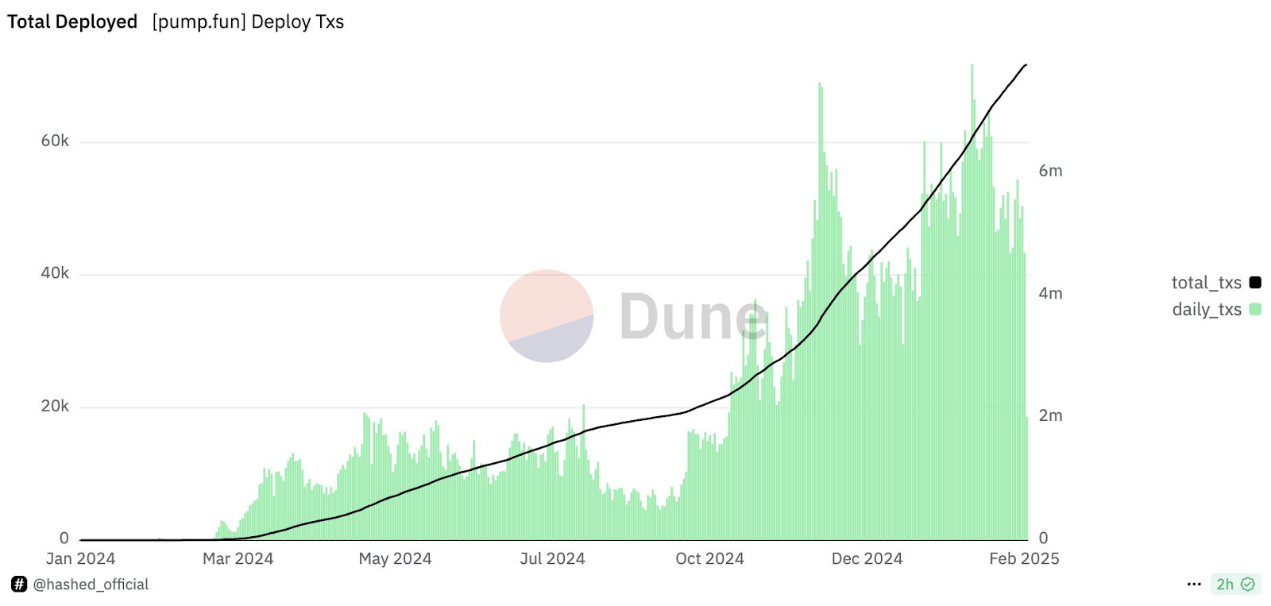

Pump.Fun is born

On January 19, 2024, Pump.fun was born, and the well-known meme token was changed from then on. Regardless of age, profession or nationality, everyone has the opportunity to issue tokens.

The hype wasn’t that big at the time, but eventually Pump.fun started to take off in March last year with tokens like MICHI and FWOG. The fact that almost anyone could post a meme in seconds changed the entire crypto space.

With so many tokens tied up, Pump.fun is a fair launch opportunity with no insider dumping. While it looks good, it also comes with a lot of fees.

Since its launch, Pump.fun has made over 2.86 million SOL, or about $577 million, making it perhaps one of the most successful startups of all time.

This liquidity has been permanently extracted and pocketed by the Pump.fun developers, which is one of the big things that makes this cycle unique.

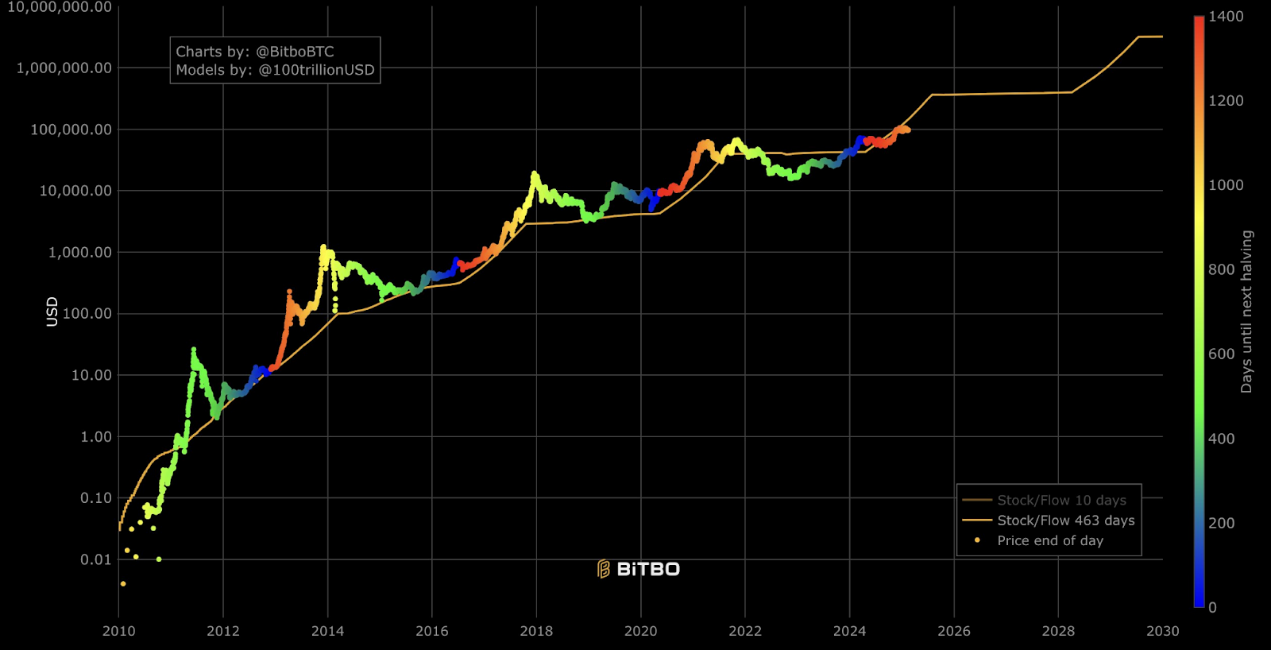

Bitcoin Halving

Next up is one of the most critical moments in the current cycle. On April 20th of last year, the reward for mining a BTC block was reduced from 6.25 to 3.125. With the first ETF approved on January 10th, many viewed the halving as a “sell the news” event, but instead a new ATH occurred.

ETF + Bitcoin halving is the most bullish setup because many have been waiting for institutional liquidity to start pouring in, and that is exactly what happened. Fidelity, BlackRock, and MicroStrategy are buying every day, injecting more and more liquidity into it.

This gave traders hope. Many traders thought this cycle would be similar to the last one, but this time, everything was different. The market always seemed to move in the opposite direction of the "masses".

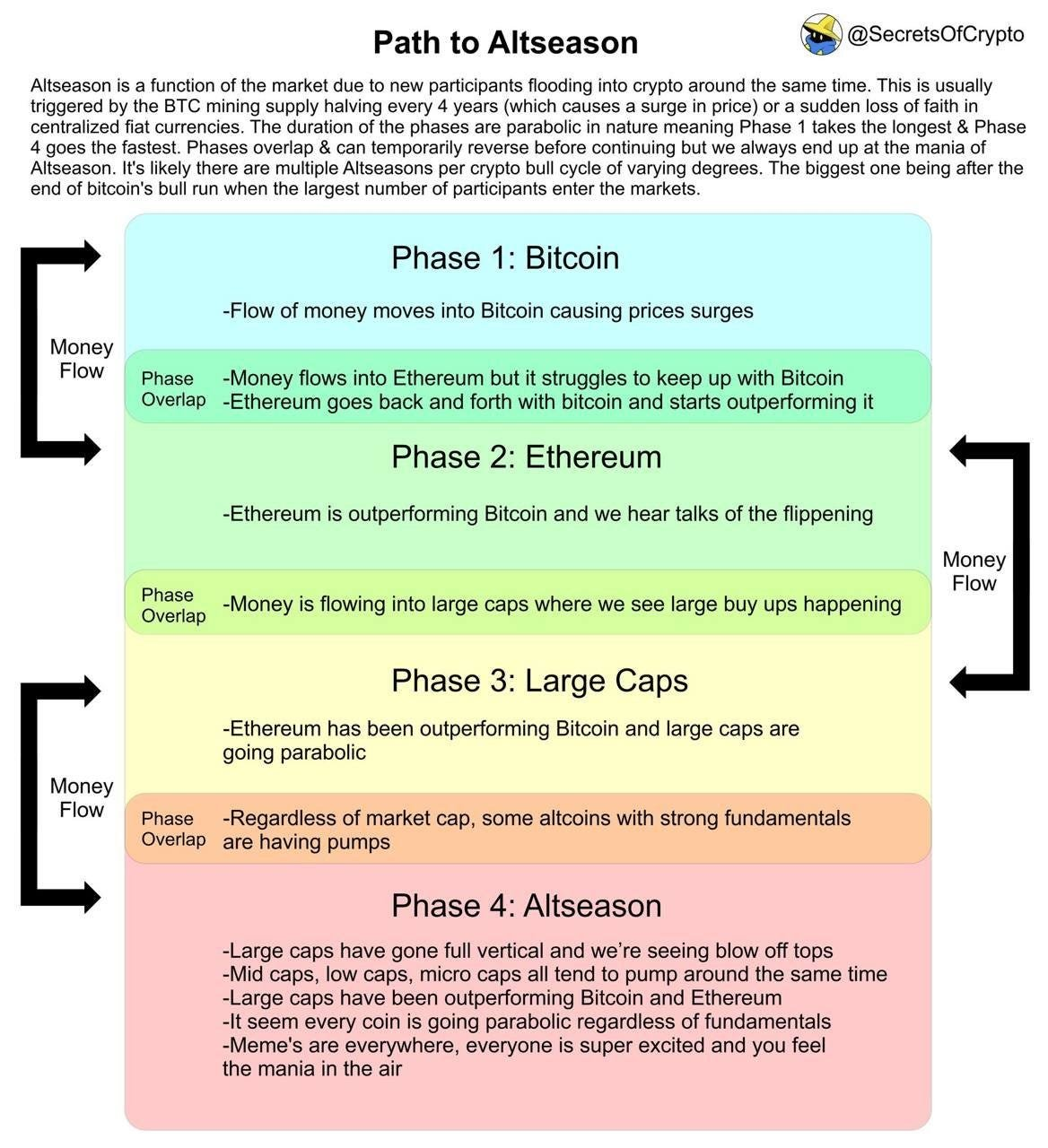

What you expect is your problem

Looking back at the cycles in 2017 and 2021, the two cycles are actually very similar. It was not difficult to make money, and it did not require any special knowledge. At that time, there were 10-20 altcoins that everyone knew about and had been hoarding.

First, BTC rises, and then ETH follows as a beta play in the cycle, usually with a higher return on investment. Then the transition from ETH to altcoins, from high-market-cap coins to low-market-cap coins.

That’s why many people decided to skip the BTC phase and go straight to ETH or altcoins in 2024. If ETH can go up 5x and large altcoins can even go up 10x, why wait for BTC’s 2-3x return?

The logic is simple, yet “the public” fails to consider that this cycle might be different. There are 100x more projects, tokens, memes than ever before, and people buy familiar tokens like DOT, ATOM, ADA, and expect 10x returns.

It turns out that when liquidity turns to altcoins, due to the excessive number of altcoins, especially the emergence of new altcoins, all the old altcoins are left behind.

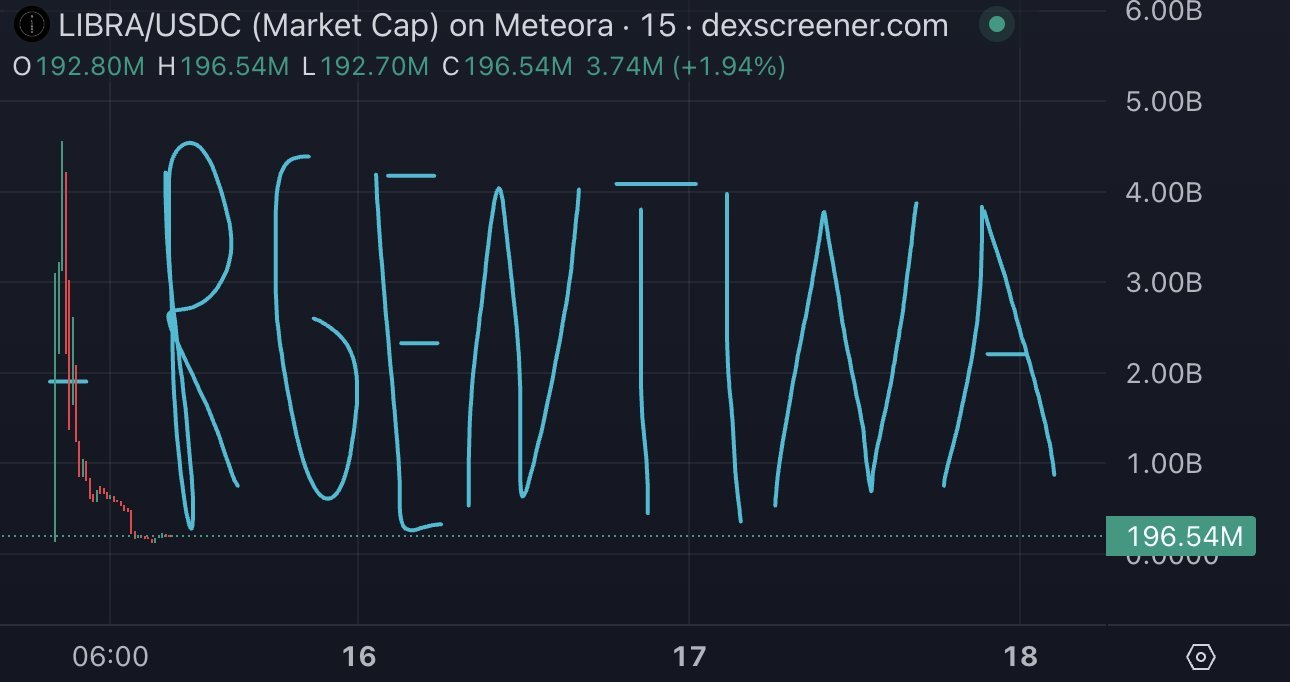

Scams look different compared to 2021

Crypto KOL OverDose mentioned a reasonable point. In 2021, scammers are very creative for "Rug", and users can stop at the brink as long as they are not too greedy.

- Do Kwon’s Terra $LUNA

- Sam Fried’s FTX

- 3AC had long-term investments before the crash

- Alameda pushes a different narrative and manipulates the market

Scams are difficult and require a certain level of intelligence, but nowadays they just use big names, celebrities, and even presidents to promote their junk projects."

Players were used to gambling, started to feel FOMO about TRUMP and MELANIA, and tried to make money on CAR or LIBRA, only to lose a lot.

I personally know of 10-15 good traders who invested heavily in LIBRA (to the tune of $1 million), and insiders dumped over $100 million on them.

It’s time for a change

It’s time to understand that cycles will never be the same, altcoins are not just a “beta play” for BTC or ETH, it’s a completely different niche with more risks and opportunities.

You can’t continue to expect DOT or ATOM to go higher just because BTC led altcoins after breaking through its all-time high in 2021.

There is no doubt that I am still bullish on BTC and believe that it will continue to be one of the best compounding assets over the next 10-20 years, but the returns will be similar to stocks and will no longer easily achieve 200% annual growth rates.

The key things you need to learn from this cycle:

- Simply holding is a cowardly act, if you don’t sell at the right time, you will face losses. Murad has been calling for holding, almost all of his memes are down 80-90% since the ATH.

- You need to have a strategy for when to sell. This may sound harsh, but markets being what they are, you need to have a specific strategy for exiting your trades before you enter them.

- Narrative rotation. There has been a crazy rotation lately from meme to AI agents to TRUMP etc. If you lag behind at any point, most of your gains may be wiped out. Always follow the narrative and remember that liquidity is limited.

- It's better to be on time than to be early. Don't overthink it, rotate when the time is right.

- No matter how much you believe in the protocol, ensuring steady profits and continually accumulating Bitcoin, Bitcoin is still better than most stock or real estate opportunities.

Hopefully this cycle isn’t over yet and the current BTC consolidation will dictate what happens in the next 2-3 months.

Related reading: The Dark Forest of MEME Coin: Industrialized harvesting assembly line earns millions a day, but retail investors have difficulty finding gold with a retention rate of one in ten thousand

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future