Is The Dogecoin Rally A Dead Cat Bounce? Analysts Weigh In

With a 28% rally over the past four days, Dogecoin (DOGE/USDT) is back at a familiar decision point on higher timeframes, with three analysts leaning toward “pullback-then-continue” rather than a simple fade, so long as a key Fibonacci reclaim holds.

Across the 4H, weekly, and monthly charts shared by Matt Hughes (@matthughes13), Byzantine General (@ByzGeneral), and Cantonese Cat (@cantonmeow), the market is framed as strong but now confronting nearby resistance after a sharp move.

Is Dogecoin’s Rally A Dead Cat Bounce?

Matt Hughes’ core tell is the weekly 0.382 retracement at 0.13847, which his chart highlights as the pivot level bulls needed to regain. He put it plainly: “DOGE regaining the .382 fib at .13847 is bullish for continuation higher. It was just a few days ago when some people were bearish at this major support zone that I pointed out in the post below” He anchored that read to the prior demand area he’d flagged last week: “Risk/reward in the .11-.12 zone for DOGE is incredible here.”

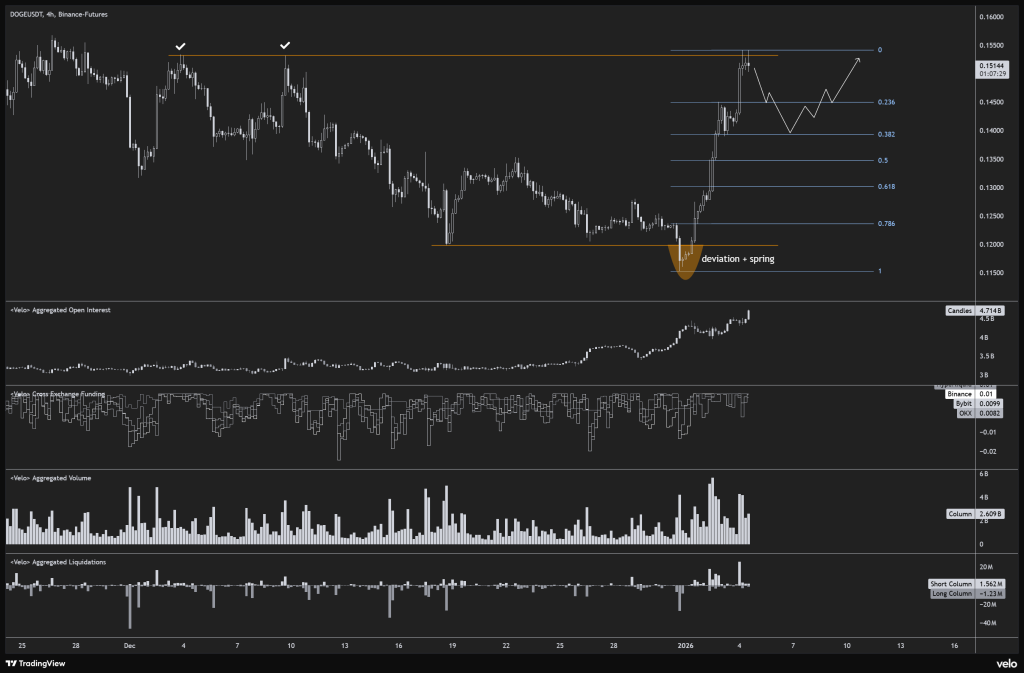

The most recent, lower-timeframe view (DOGEUSDT 4H, Binance futures) shows why “dead cat bounce” talk is tempting: price ripped higher, tagged the prior range highs, and then backed off, exactly the kind of sequence that can either turn into a clean retest or an abrupt rollover.

Byzantine General’s take matches that posture. He expects a reset to the $0.14 region, before the rally resumes: “DOGE made a pretty incredible move. After taking out the range highs I think a little pullback makes sense, but it still looks very strong overall.”

On the same 4H layout, the move is accompanied by rising derivatives positioning, Velo’s aggregated open interest is shown pushing up to 4.714B, while cross-exchange funding reads positive (Binance 0.01, Bybit 0.0099, OKX 0.0082), consistent with a market leaning long but not obviously depicted as euphoric in these panels.

Cantonese Cat’s framing is more tactical: the rally can still “work,” but only if it respects the structure and reacts cleanly at resistance. He wrote: “DOGE maybe hitting resistance here soon Let’s see how it reacts there So far it’s just been a brutal retrace to 0.382, which still makes this a valid handle for the big 4-year cup and handle formation.”

After price met that area, he followed up: “Literally right on the money with resistance. Now what? We’ve got a whole month ahead of us. Let’s see how DOGE does it from here on out.”

On the 4-hour chart by Hughes, the roadmap is explicit: the 0.382 level sits at 0.13847, with the next marked retracements above at 0.19070 (0.5) and 0.26261 (0.618).

The monthly view reinforces that the current zone is a tight band between 0.11778 (0.382) and 0.15428 (0.5), with 0.20210 (0.618) above, useful reference points for where continuation would need to prove itself, step by step, rather than in a single candle.

That leaves the “dead cat bounce” question mostly conditional. If DOGE can keep weekly acceptance above 0.13847 and reclaim the nearby monthly 0.15428 area (the same neighborhood as the prior range highs on the 4H), the analysts’ shared bias reads as consolidation-before-extension.

If price loses 0.13847 again, the setup starts to look more like a failed reclaim, with the lower marked supports on the charts at 0.11778 and 0.09320 coming back into focus.

At press time, DOGE traded at $0.14944.

You May Also Like

USDC Surpasses USDT in Growth for Second Year

Trump must print—and keep gas cheap—for Bitcoin to rip: Arthur Hayes