XRP, XLM, and ALGO Bullish Sentiment Tops 90% – Why it Matters

- Bullish sentiment has surged above 90% across multiple blockchains, led by XLM, with XRP, ALGO, CRO, and KAS close behind.

- Infrastructure-focused networks are driving the conviction, reflecting renewed confidence in real-world utility.

- Analysts see the sentiment cluster as belief-led positioning, suggesting foundational chains built during the bear market are regaining favor.

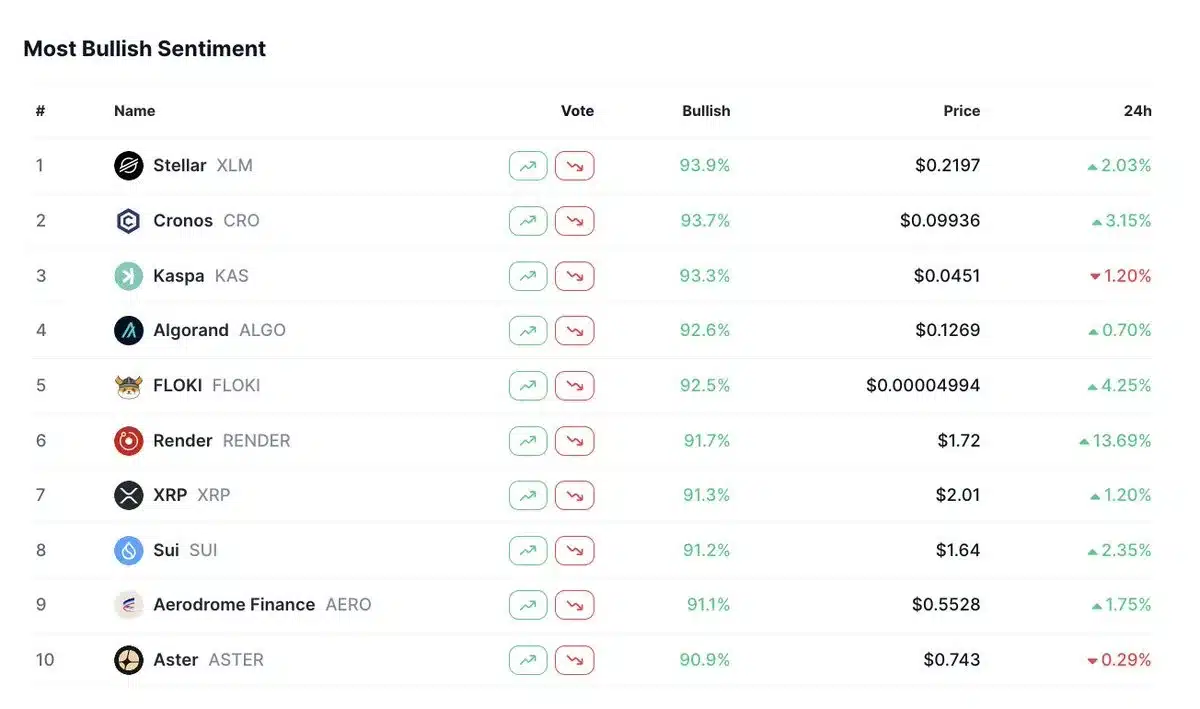

Bullish sentiment across several major blockchain networks has surged above the 90% mark, according to a recent snapshot shared by analyst X Finance Bull.

The data highlights Stellar (XLM) leading the rankings with 93.9% bullish sentiment, followed closely by Cronos (CRO), Kaspa (KAS), Algorand (ALGO), and XRP, all clustered in the low-to-mid 90% range.

While sentiment metrics often fluctuate, readings above 90% are typically viewed as a sign of strong collective conviction rather than short-term speculation. As X Finance Bull put it, “Sentiment isn’t just numbers, it’s conviction.”

XLM Leads as Infrastructure Narratives Gain Traction

Stellar’s position at the top of the sentiment table stands out. With nearly 94% of participants expressing bullish views, XLM is signaling renewed confidence after years of quieter development. Analysts note that Stellar’s focus on cross-border payments, tokenization, and real-world financial access aligns with the broader market shift toward utility-driven blockchains.

X Finance Bull suggested this reflects a changing narrative: networks emphasizing openness and efficiency are increasingly favored over those built around tighter control.

Also Read: Egrag Crypto Reveals Chart Pattern That Could Signal a Massive XRP Price Surge

XRP and ALGO Join the High-Conviction Cluster

XRP, registering over 91% bullish sentiment, sits alongside Algorand (ALGO) at roughly 92.6%, reinforcing the idea that legacy infrastructure-focused chains are back in focus. XRP’s presence near the top comes amid growing attention on regulated products, institutional rails, and enterprise use cases tied to the XRP Ledger.

Algorand’s inclusion further supports the theme. Known for its emphasis on scalability, low fees, and institutional-grade design, ALGO has continued building throughout the bear market, a point the analyst emphasized in his follow-up commentary.

Source: X Finance Bull/X

Meanwhile, in a subsequent post, X Finance Bull argued that the clustering of XLM, XRP, and ALGO near the top of sentiment rankings is “no fluke.” According to him, these networks spent the downturn strengthening infrastructure rather than chasing hype.

“Momentum starts with belief before charts reflect the truth,” he said, suggesting that sentiment often leads price action rather than follows it.

Why High Sentiment Matters Now

Historically, extreme bullish sentiment can be a double-edged sword. In some cases, it precedes overheating. In others, especially during early infrastructure cycles, it reflects long-term capital positioning ahead of broader adoption.

In this context, analysts interpret the current data less as retail euphoria and more as a reassessment of foundational blockchains that prioritize real-world utility. With multiple infrastructure-focused networks simultaneously crossing the 90% bullish threshold, the market appears to be signaling a renewed preference for chains built to last.

As the analyst concluded, “Eyes on the chains where freedom wins over control.”

Also Read: Bitcoin Holds Above $92,000 as Ethereum, Dogecoin, Cardano Slip

The post XRP, XLM, and ALGO Bullish Sentiment Tops 90% – Why it Matters appeared first on 36Crypto.

You May Also Like

Sensura to Showcase Non-Invasive Health Monitoring Platform, Starting with Glucose, at CES 2026

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC