4 High Impact US Economic Events For Bitcoin and Crypto Markets This Week

Bitcoin and broader crypto markets are entering the first full trading week of 2026 facing a familiar but decisive macro test: the US labor market.

With Federal Reserve rate-cut expectations finely balanced, four labor-focused economic releases are set to drive volatility across Bitcoin, equities, and global risk assets.

4 US Labor Market Tests Set the Tone for Bitcoin and Crypto Markets This Week

While the US calendar is crowded with data, and with geopolitical tailwinds drawing from Venezuela, traders are increasingly focused less on growth headlines and more on signs that labor conditions are cooling without wage inflation re-accelerating.

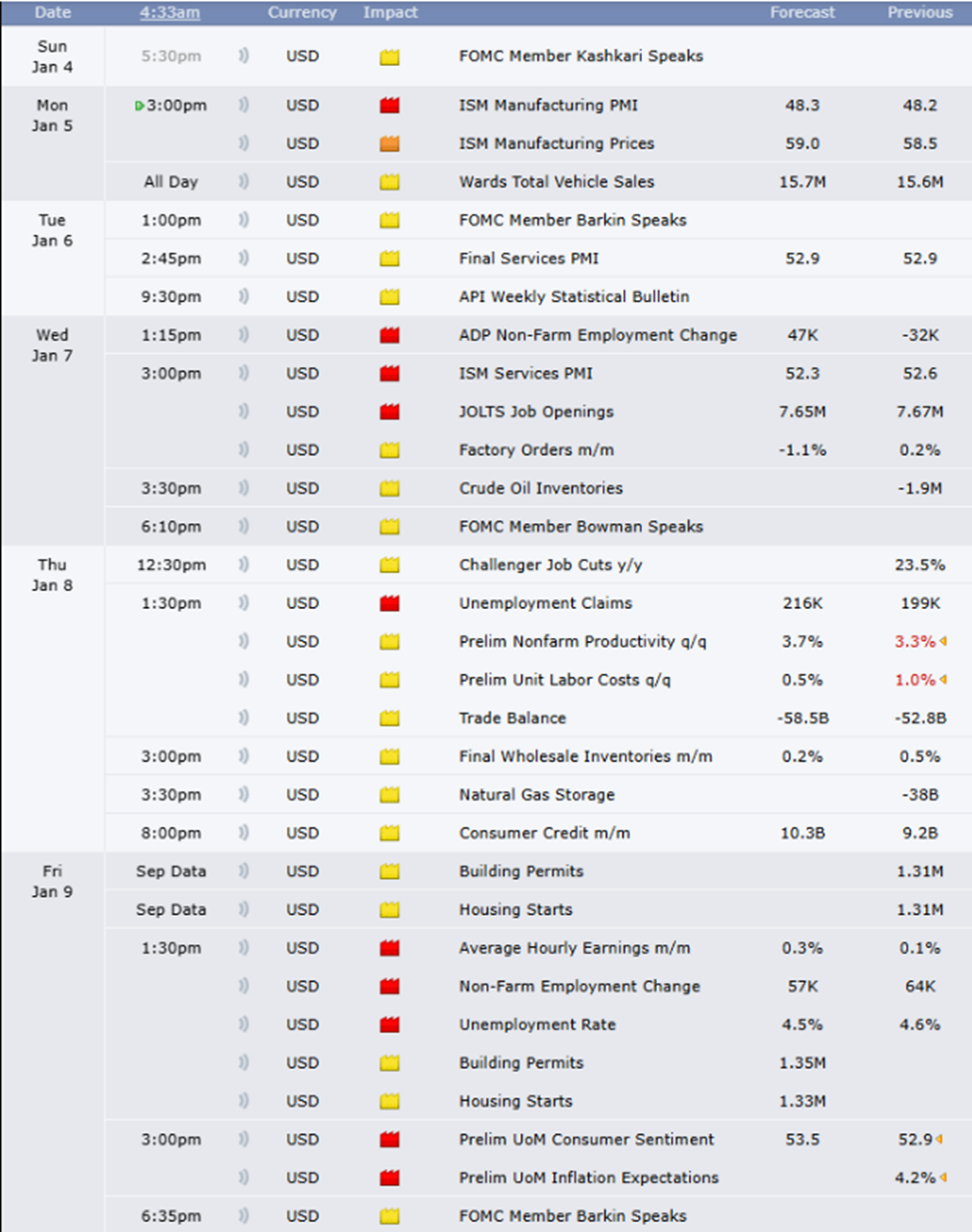

US Economic Events to Watch This Week. Source: Trading Economics

US Economic Events to Watch This Week. Source: Trading Economics

The general sentiment among analysts is that any evidence of easing job demand paired with moderating pay growth would reinforce risk-on conditions. By contrast, resilient employment or sticky wages could reprice bond yields higher and pressure crypto markets.

ADP Employment

The first labor checkpoint arrives on Wednesday with the ADP Non-Farm Employment Change. Although widely viewed as an imperfect predictor of official payrolls, ADP often influences short-term positioning when surprises are substantial.

Consensus forecasts point to a modest 47,000 job increase following a prior contraction. Notably, the direction of the surprise matters more than the headline, especially for Bitcoin.

A weak or negative print would reinforce expectations that labor momentum is fading, supporting rate-cut pricing and near-term BTC strength.

Conversely, a sharp upside surprise, particularly above 100,000, could firm the US dollar and front-end yields, prompting traders to reduce risk ahead of Friday’s data.

JOLTS Job Openings

Also on Wednesday, the November JOLTS (Job Openings and Labor Turnover) survey will provide one of the Federal Reserve’s most closely watched indicators of labor market tightness.

Openings are expected near 7.65 million, slightly below the prior reading. For crypto markets, JOLTS matters less for its absolute level than for its trend.

A continued decline would suggest easing labor demand without widespread layoffs, marking a “soft landing” dynamic that has historically been supportive of risk assets, including Bitcoin.

A stabilization or rebound, however, could revive concerns that labor conditions remain too tight for the Fed to justify aggressive easing in 2026, which would weigh on crypto sentiment beyond the US session.

Initial Jobless Claims

Thursday’s initial jobless claims offer a high-frequency snapshot of labor market stress, with claims forecast at 216,000 versus 199,000 previously.

While single prints rarely move markets on their own, sustained changes in direction often reshape macro narratives.

A gradual upward drift in claims would reinforce the view that employment conditions are cooling in an orderly manner, precisely the scenario policymakers want.

For Bitcoin, this environment has historically been constructive, as easing labor pressure supports falling real yields and improving liquidity expectations.

A sudden drop back toward 200,000, however, could undermine the labor-cooling thesis heading into Friday’s report.

Employment Report

Friday’s employment report remains the dominant macroeconomic risk. Forecasts predict 57,000 new jobs, with the unemployment rate expected to remain near 4.5%.

Yet seasoned macro traders caution that the headline payroll figure often matters less than revisions, labor force participation, and wage growth.

Average Hourly Earnings will be the key variable for crypto markets. Sticky wage growth would complicate the Fed’s inflation outlook, pushing yields higher and pressuring Bitcoin.

By contrast, soft job gains paired with moderating wages would validate expectations for policy easing, potentially setting up a risk-on close to the week.

As markets brace for early-year positioning and geopolitical uncertainty, these four labor releases will determine whether Bitcoin enters 2026 with macro tailwinds, or renewed resistance from rates and the dollar.

You May Also Like

Solana Price Outlook: Long-Term Bull Flags Clash With Short-Term Risk

Foreigner’s Lou Gramm Revisits The Band’s Classic ‘4’ Album, Now Reissued