Coinbase Analyst Warns Quantum Computing Could Threaten Bitcoin Security and Mining

Highlights:

- David Duong says quantum computing could break private keys and disrupt Bitcoin mining.

- He warns stronger machines may upset miner balance and Bitcoin’s economic security model.

- Duong notes that current machines are far from breaking Bitcoin, but migration planning continues.

Bitcoin is facing more questions as quantum computing research keeps growing. Most talks focus on wallet safety, but wider risks are now getting attention. Coinbase’s head of investment research, David Duong, warned that future machines could affect Bitcoin mining and network balance, not just private keys.

Bitcoin Faces Risks from Quantum Computing

Quantum computing means machines built to solve problems much faster than today’s systems. Many researchers think these machines could one day break common security methods. In crypto, this raises fears about stolen funds and exposed data linked to user keys. Duong shared this view in a LinkedIn post on Monday. He said a bigger issue could appear at a future time, often called Q day. He added that risks may come from quantum systems using Shor’s and Grover’s algorithms against Bitcoin’s core security.

Duong said Bitcoin depends on two basic safety systems. One helps confirm who is sending coins by using digital signatures. The other supports mining and helps keep the network secure by checking new blocks. Both are needed for Bitcoin to work safely.

Source: David Duong

Source: David Duong

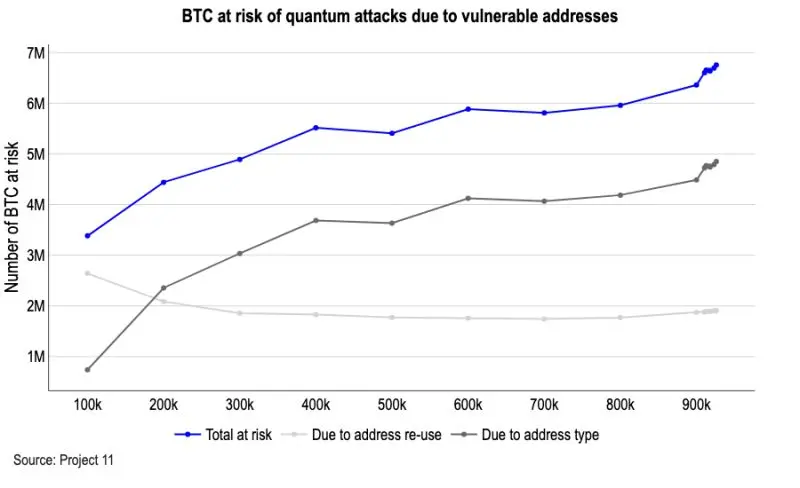

Over 32% of Bitcoin Could Face Quantum Risks

Quantum machines could create problems for both systems. One risk is that private keys may become easier to crack, which could let attackers take funds from weak addresses. Another risk is that some miners could gain much more power, which may disturb the balance of the network.

Duong added that about 32.7% of Bitcoin’s supply, roughly 6.51 million BTC, is at risk of long-range attacks. This happens because some addresses and scripts, like Pay-to-Public-Key, bare multisig, and Taproot, reveal public keys when used. Therefore, every transaction could face short-range attacks while being spent, he said. Although the chance of a real attack is low but moving to quantum-resistant signatures is necessary to protect the network over time.

Source: LinkedIn

Source: LinkedIn

Duong pointed out that mining also plays a big role. Mining works when many miners compete using energy and computers to protect the network and add new blocks. If this balance is lost, the network could face bigger issues. Bitcoin miners spend a lot on machines and electricity to solve math tasks. Quantum machines are expected to handle some of these tasks much faster than normal computers, at least in theory. If that happens, mining rewards could slowly shift toward a small number of players.

When one group controls more than half of Bitcoin’s mining power, a 51% attack becomes possible. This could let them block or change transactions, hurting trust in the network. Duong said quantum mining is not a big concern yet because current machines are limited. He believes the more urgent issue is updating old signature systems to keep user funds safe.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Why Markets Struggle to Read Signals in a World of Quiet Constraints

XRP Ledger Gets Major Boost as Ripple Works With Amazon on New Upgrade