3 Altcoins To Watch This Weekend | January 10 – 11

The coming weekend may see many altcoins facing losses for various reasons pertaining to either the market conditions or external developments.

BeInCrypto has analysed three such altcoins that the investors should watch in the coming weekend.

Polygon (POL)

POL has drawn renewed investor attention since the start of the year after printing a new all-time low on January 1, 2026. The altcoin dropped to $0.098, triggering speculative interest and attracting buyers seeking discounted entry amid broader market stabilization.

Following the low, POL rebounded 37.6% and has now secured the 50-day EMA as support. Reclaiming $0.138 would strengthen recovery prospects. A successful flip could push the price towards $0.155, aided by fresh capital from ATL buyers.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

APT Price Analysis. Source: TradingView

APT Price Analysis. Source: TradingView

Downside risk remains if bullish momentum weakens. POL could slide toward the $0.129 area, losing the $0.138 local support. A breakdown below $0.129 would invalidate the bullish thesis, erasing recent gains and restoring short-term bearish pressure as APT falls to $0.119.

Aptos (APT)

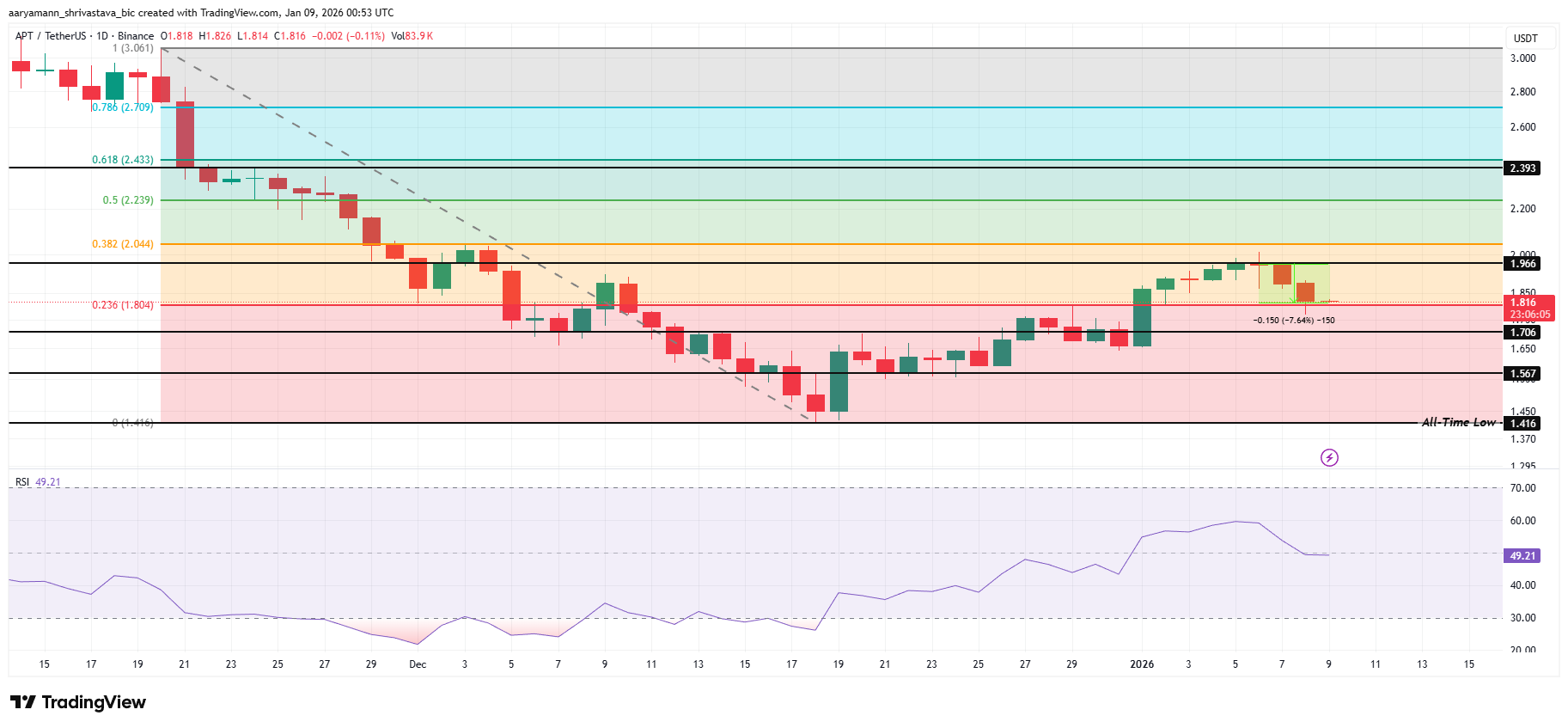

APT faces a major external catalyst as a scheduled token unlock approaches. Approximately 11.31 million APT will enter circulation, directly impacting supply dynamics. Such events often increase volatility, as markets reassess valuation amid changing token availability and short-term sentiment.

The additional supply could introduce $20.58 million worth of tokens into a bearish environment. APT is already down 7.6% in 48 hours, trading near $1.81 at the 23.6% Fibonacci retracement. Losing this level may trigger a drop toward $1.56 or the $1.41 ATL.

APT Price Analysis. Source: TradingView

APT Price Analysis. Source: TradingView

A bullish alternative remains possible if demand strengthens. APT bouncing from the 23.6% Fibonacci level could fuel another attempt above $1.96. Reclaiming $2.05 at the 38.2% retracement would confirm renewed momentum and invalidate the bearish thesis.

Midnight (NIGHT)

NIGHT has struggled to attract strong investor support in recent sessions. After failing to break the $0.1000 resistance, the altcoin dropped nearly 26%. NIGHT now trades around $0.0743, reflecting weak demand and fading confidence among market participants.

The decline is transforming into a clear downtrend. The Parabolic SAR has flipped into resistance, reinforcing bearish pressure. NIGHT also lost the $0.0753 support, increasing downside risk. Under current conditions, the altcoin remains vulnerable to a further drop toward $0.0609.

NIGHT Price Analysis. Source: TradingView

NIGHT Price Analysis. Source: TradingView

A reversal remains possible if lower prices attract buyers. NIGHT’s popularity could trigger renewed capital inflows. A recovery toward $1.000 would signal renewed strength. Breaking that level could push NIGHT to its $1.200 ATH, invalidating the bearish thesis.

You May Also Like

YUL: Solidity’s Low-Level Language (Without the Tears), Part 1: Stack, Memory, and Calldata

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC