a16z Secures $15B to Boost Crypto and Secure US Global Dominance

U.S. Venture Capital Firm Raises $15 Billion to Secure Technological Edge, Highlighting Crypto’s Role

Major venture capital firm Andreessen Horowitz (a16z) has announced the successful closure of a new funding round exceeding $15 billion, aimed at investing in cutting-edge technologies vital for maintaining America’s global technological dominance. Notably, crypto remains a central component within this strategic focus, emphasizing the importance of blockchain innovation in safeguarding national interests amid mounting international competition.

Key Takeaways

- Andreesen Horowitz has raised over $15 billion to fund U.S.-centric technology companies, with a focus on AI and blockchain innovations.

- Company leadership stresses the importance of winning key technological architectures to preserve economic, military, and geopolitical superiority.

- Alignment between the U.S. government and private sector is deemed critical for defending national interests against strategic rivals like China.

- While the firm’s dedicated crypto fund was not expanded in this round, investments in blockchain companies continue through its broader Growth funds.

Tickers mentioned: None

Sentiment: Bullish

Price impact: Neutral. The announcement underscores strategic long-term investment rather than immediate market moves.

Market context: This development reflects a broader government-private sector effort to reinforce the U.S. position in emerging technologies amid escalating global competition.

Strategic Investment Focus

In a post on X, Ben Horowitz, co-founder of a16z, acknowledged the accelerating technological race, particularly with China, which has narrowed the gap in recent decades. He emphasized that American leadership in critical future architectures like artificial intelligence and blockchain is essential for maintaining dominance across economic, military, and cultural spheres.

Horowitz warned that failure to innovate in these areas could result in significant setbacks for the U.S., including loss of economic and military power. He stressed the importance of aligning government and private sector efforts to prevent losing global influence, citing AI and blockchain as current battlegrounds.

Investment Allocation and Crypto Initiatives

The new funding will be allocated across a range of sectors, including $6.75 billion for growth-stage investments, $1.7 billion each for applications and infrastructure, and smaller allocations toward American dynamism and healthcare. An additional $3 billion will support various venture strategies.

While the dedicated crypto fund did not receive new capital, a16z’s existing investments in blockchain firms continue through its broader growth-focused portfolios. Recent strategic moves include a $15 million investment in Babylon, a Bitcoin staking and lending protocol, aimed at advancing decentralized finance (DeFi) and expanding Bitcoin’s utility as an asset.

This focus on infrastructure underscores the vital role blockchain and cryptocurrency technologies are poised to play in America’s future economic and strategic landscape. As global rivals accelerate their own blockchain initiatives, U.S. investors are increasingly prioritizing these emerging sectors to preserve technological supremacy.

This article was originally published as a16z Secures $15B to Boost Crypto and Secure US Global Dominance on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Yango taps Flutterwave for cashless taxi, food delivery payments in Zambia

Gold continues to hit new highs. How to invest in gold in the crypto market?

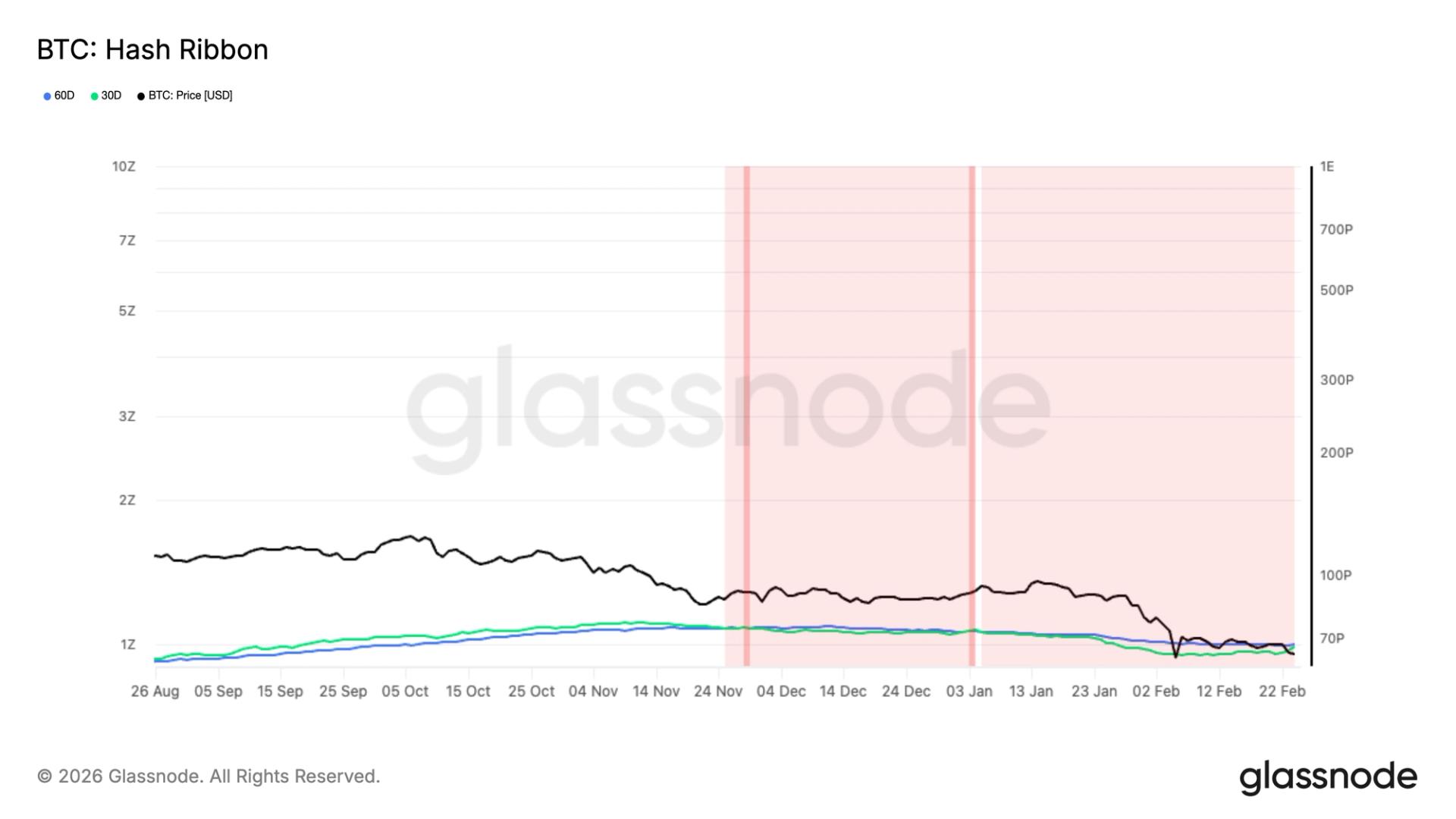

One of longest mining capitulations nears end, signaling potential BTC price bottom

Copy linkX (Twitter)LinkedInFacebookEmail