- Capybobo’s VWA game leverages PYBOBO tokens in the Web3 space.

- Blockchain technology ensures transparency in gaming transactions.

- PYBOBO tokens experience a surge as game launch nears, reflecting positive market sentiment.

Capybobo is set to launch its second-generation VWA game on January 16, with PYBOBO tokens as the entry mechanism, affecting its cryptocurrency ecosystem.

This release enhances Web3 gaming, potentially influencing tokenomics and hash power dynamics, yet lacks primary source confirmation for several technical details.

PYBOBO Tokens Surge Amid Game Launch Announcement

According to CoinMarketCap, Capybobo’s PYBOBO token recorded a 24-hour trading volume of $2,789,132.48, reflecting a change of 5.37%. While market cap data is unavailable, the fully diluted value stands at $80,494,413.98. In the past 90 days, the token showed an uptrend of 11.99%, indicating an overall positive market sentiment.

The Coincu research team suggests that Capybobo’s use of blockchain could enhance trust and security in digital economies, potentially influencing future gaming projects. This initiative may lead to more NFT-driven innovations using similar frameworks in the evolving digital landscape.

Market Insights

Did you know? The integration of blockchain technology in gaming is paving the way for unprecedented transparency and security in digital transactions.

Capybobo’s PYBOBO token is showing a strong market presence, with significant trading activity leading up to the game launch.

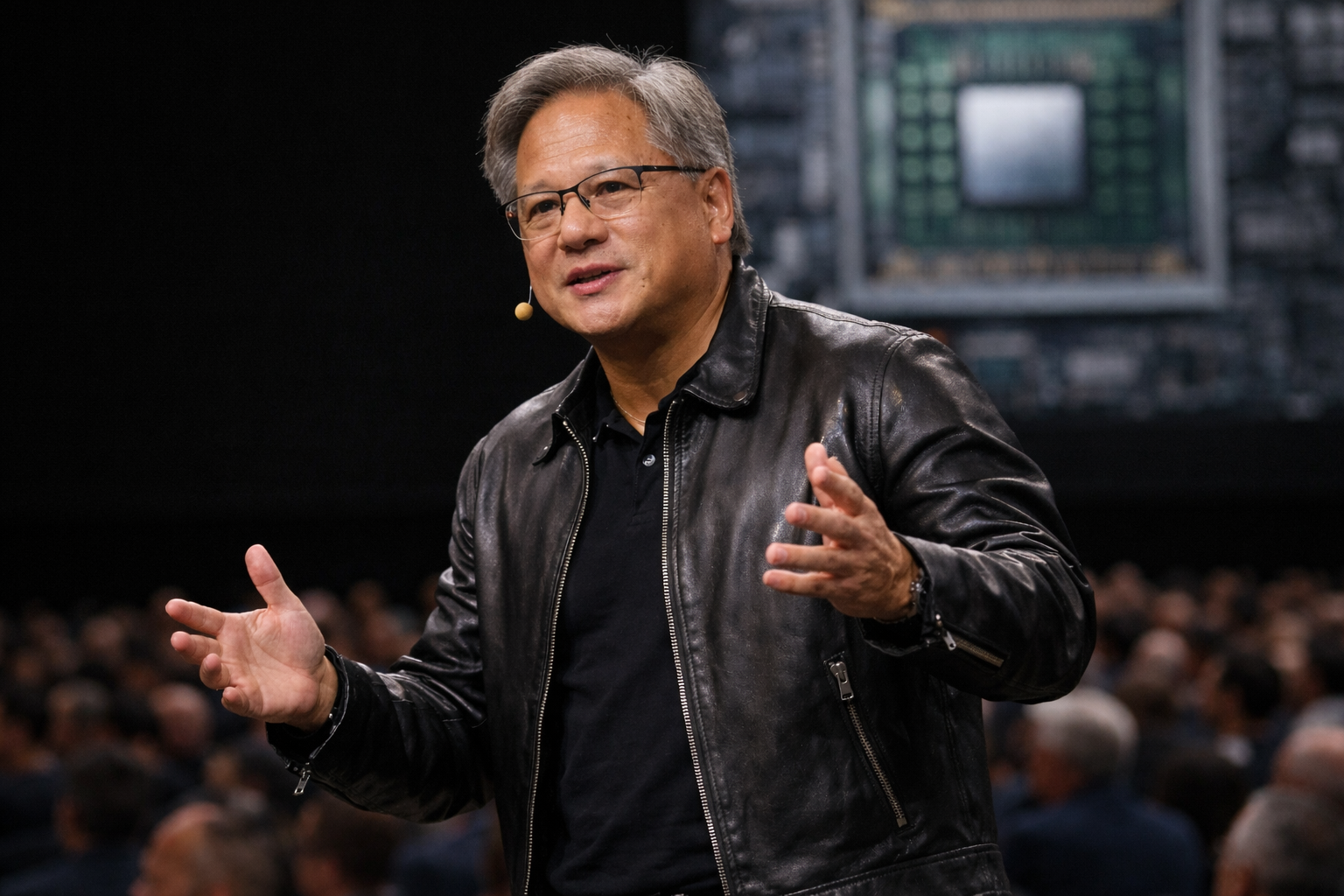

Capybobo(PYBOBO), daily chart, screenshot on CoinMarketCap at 22:11 UTC on January 10, 2026. Source: CoinMarketCapAnalysts believe that the success of Capybobo’s VWA game could set a precedent for future blockchain-based gaming projects, emphasizing the importance of transparency and user engagement.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/gamefi/capybobo-vwa-game-launch-pybobo/