JPMorgan CFO Warns Yield Stablecoins Pose Risk to Banking Stability

JPMorgan Expresses Caution Over Stablecoins Amid Regulatory Concerns

During its recent fourth-quarter earnings call, JPMorgan Chase highlighted the evolving landscape of stablecoins, emphasizing both technological promise and potential risks to the traditional banking system. Bank executives voiced cautious support for blockchain innovations while warning against certain stablecoin designs that could undermine regulatory safeguards.

Key Takeaways

- JPMorgan aligns with regulatory efforts to establish guardrails around stablecoin issuance, supporting the GENIUS Act.

- Chief Financial Officer Jeremy Barnum warned against interest-bearing stablecoins that mimic traditional banking without proper oversight.

- The bank advocates for a controlled evolution in digital asset adoption, emphasizing the importance of regulatory protections.

- Lawmakers are scrutinizing stablecoin rewards, aiming to prevent stablecoins from functioning as unregulated bank deposits.

Tickers mentioned: None

Sentiment: Cautiously optimistic with regulatory caution

Price impact: Neutral, as the discussion underpins ongoing regulatory developments rather than immediate market moves

Trading idea (Not Financial Advice): Hold, given the regulatory uncertainties surrounding stablecoins

Market context: The developments reflect broader regulatory focus on digital assets as mainstream adoption grows

JPMorgan Weighs In on Stablecoin Risks and Regulation

At JPMorgan Chase, executives discussed the implications of stablecoins during their earnings call, emphasizing the importance of safeguarding the financial ecosystem. Jeremy Barnum, CFO of JPMorgan, commented that the bank supports innovation but remains opposed to the creation of a parallel banking system that operates outside established oversight. He expressed concern over interest-bearing stablecoins that resemble deposit accounts but lack the prudential safeguards developed through decades of banking regulation.

Source: Radar w ArchieWhile JPMorgan welcomes technological competition and innovation in the digital asset space, it insists on the importance of regulation to prevent the emergence of a “parallel banking system” that could threaten financial stability. This stance echoes concerns from the broader banking industry, which perceives yield-bearing stablecoins as a disruptive threat. These tokens have gained traction as tools for fast, cost-efficient payments, on-chain settlement, and dollar access, but the prospect of earning interest on them raises regulatory alarms.

Regulatory Focus on Stablecoin Rewards

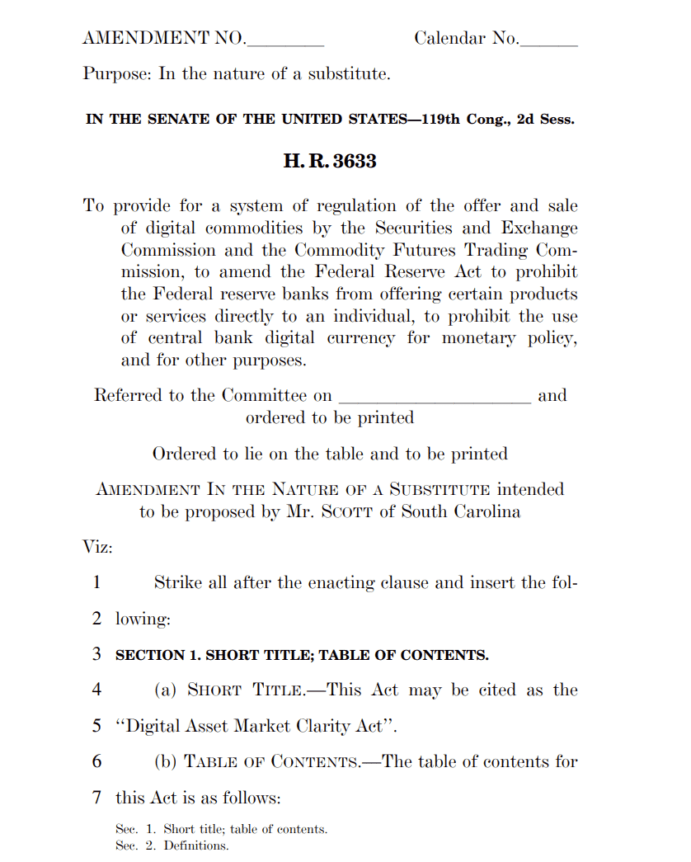

Meanwhile, U.S. lawmakers are actively examining stablecoin rewards within recent legislative proposals. The draft of the Digital Asset Market Clarity Act proposes prohibiting service providers from paying interest or yield solely based on stablecoin holdings, aiming to prevent these tokens from functioning as deposit instruments. However, it allows for incentives tied to broader participation activities, such as liquidity provision, governance, and staking, rather than passive income streams.

Source: US Senate Banking Committee

Source: US Senate Banking Committee

This legislative effort underscores ongoing efforts by regulators to balance innovation with financial stability, ensuring that stablecoins serve their intended purpose without resembling unregulated banking products. The debate is a key aspect of broader regulatory discussions that will shape the future trajectory of digital assets in the United States and beyond.

This article was originally published as JPMorgan CFO Warns Yield Stablecoins Pose Risk to Banking Stability on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Subaru Motors Finance Reviews 2026