Bitcoin Price Rises While Social Sentiment Stays Pessimistic—A Setup for the Next Bullish Move?

The post Bitcoin Price Rises While Social Sentiment Stays Pessimistic—A Setup for the Next Bullish Move? appeared first on Coinpedia Fintech News

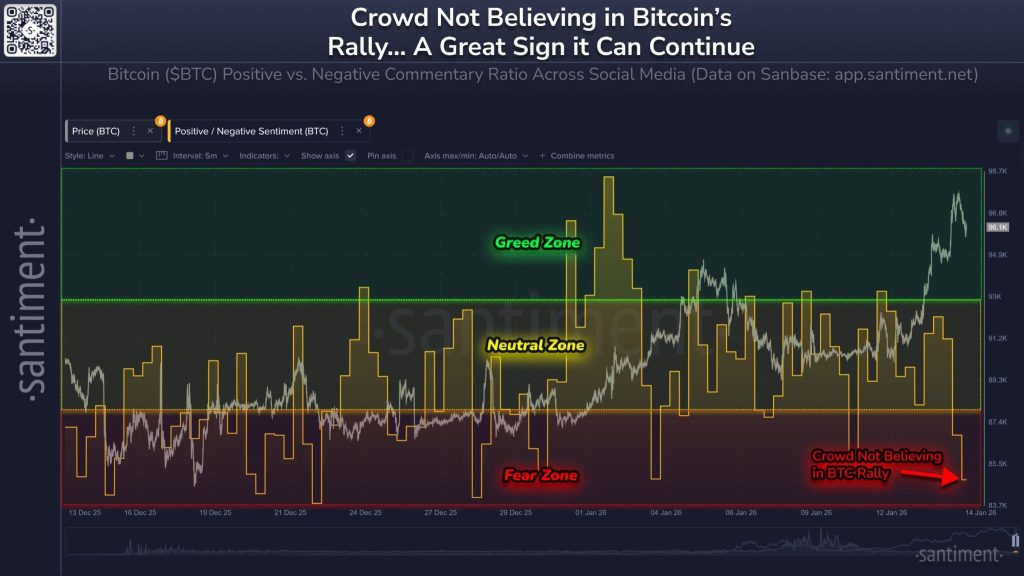

Bitcoin (BTC) price is back in motion after a tight consolidation phase by pushing higher even as the broader market remains cautious. Typically, a breakout invites optimism. This time, the reaction looks different: sentiment indicators suggest traders are still hesitant to trust the move, and social commentary is skewing more negative despite the upside.

That mismatch, price rising while conviction lags, is often where rallies can surprise. When the crowd stays fearful, it leaves room for sidelined capital to re-enter and for short positioning to unwind, both of which can add fuel to continuation. With BTC now holding above its previous range, the focus shifts to whether disbelief fades or whether it powers the next leg toward the $100K psychological mark.

Traders Stay Skeptical Even as Bitcoin Breaks Out

In strong trends, price often moves first and sentiment follows later. Right now, Bitcoin is showing that classic disconnect: it’s pushing higher after breaking out of consolidation, yet the crowd still looks unconvinced. Santiment’s positive vs. negative commentary ratio underscores this shift, dropping into the fear zone even as BTC trends upward on the price line.

That combination typically signals a “disbelief rally,” where traders hesitate to chase, shorts remain active, and sidelined capital waits for a pullback that may not come. Ironically, that caution can help extend upside because the market isn’t overcrowded with euphoric longs. The key is follow-through: if BTC holds above the breakout range, this pessimism can act as fuel, keeping the $100K psychological level firmly in focus.

Bitcoin Price Outlook: Can Sentiment Fuel a Run Toward $100K?

With BTC holding above its former consolidation band, the next phase depends on whether buyers can defend the breakout while sentiment stays cautious. When disbelief lingers, rallies often grind higher because dips get bought and bearish bets unwind in waves. A steady push toward $100K becomes more likely if Bitcoin price keeps printing higher highs and higher lows and avoids slipping back into the previous range.

That said, the risk is straightforward: if BTC loses the breakout level and sentiment remains fearful, the market can interpret it as a failed move, triggering profit-taking and a deeper pullback. For bulls, the cleanest confirmation would be continued closes above the prior range, followed by a successful retest. For now, Santiment’s fear-zone reading suggests the rally isn’t overcrowded, which can keep upside momentum intact—provided price structure doesn’t break.

You May Also Like

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement