ETF Clients Absorb $10 Million XRP in 24 Hours, But Why Is XRP Price Down Today?

- XRP sees $10M ETF inflows, but price declines persist.

- Institutional confidence rises, yet XRP faces downward pressure from liquidations.

- Massive liquidations lead to XRP price drop despite ETF interest.

XRP is seeing substantial interest from ETF clients, with a remarkable $10.63 million worth of XRP purchased in just 24 hours on January 14, 2026. This significant movement reflects growing institutional interest in the digital asset. The total assets held by XRP ETFs now stand at $1.56 billion, signaling XRP’s increasing importance in the world of digital asset management.

However, despite these positive inflows, XRP traded at $2.11, reflecting a 1.09% decline over the past 24 hours. The downward shift in value comes despite significant inflows into XRP ETFs, which absorbed more than $10 million in just one day. These inflows suggest strong institutional confidence in XRP, yet the price continues to face downward pressure.

Also Read: Breaking: Ripple Secures Major Partnership With Cross-Asset Marketplace LMAX Group: Details

Why Is XRP’s Price Down Despite the ETF Inflows?

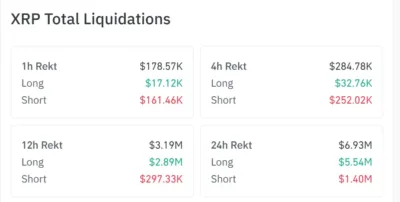

The recent price drop in XRP can be primarily attributed to the liquidations happening in the market. According to data from Coinglass, XRP experienced a total liquidation of $6.93 million over the past 24 hours.

Among these liquidations, long positions accounted for $5.54 million, while short positions totaled $1.40 million. These liquidations, especially from long positions, have created significant downward pressure on XRP’s price despite the strong institutional inflows into XRP ETFs.

Source: Coinglass

The 1-hour, 4-hour, and 12-hour timeframes also show notable liquidations. For instance, in the 4 hours, XRP saw a total of $284.78K in liquidations, with short positions dominating at $252.02K. In the 12 hours, liquidations totaled $3.19 million, with long positions again taking the largest share. The scale of these liquidations suggests that leveraged positions have been contributing to the price volatility.

Overleveraged positions and rapid market shifts are causing significant price fluctuations, even when institutional confidence in XRP remains high. While ETF inflows point to long-term bullish sentiment, the short-term market volatility created by liquidations is clearly affecting the price.

Outlook for XRP

Despite the current price dip, the growing involvement of institutional investors through ETFs remains a positive indicator for XRP’s future. With $10.63 million absorbed by ETF clients in just one day, XRP continues to attract significant interest, even if short-term price movements remain volatile.

Also Read: XRP Gets Major Price Prediction on National TV: Details

The post ETF Clients Absorb $10 Million XRP in 24 Hours, But Why Is XRP Price Down Today? appeared first on 36Crypto.

You May Also Like

Solana Price Prediction Stuck at $85 While Pepeto Presale Delivers What Solana Holders Have Been Waiting For

Apple (AAPL) Stock Gets $350 Price Target From Wedbush While One Pre-IPO Asset Targets 267x Returns