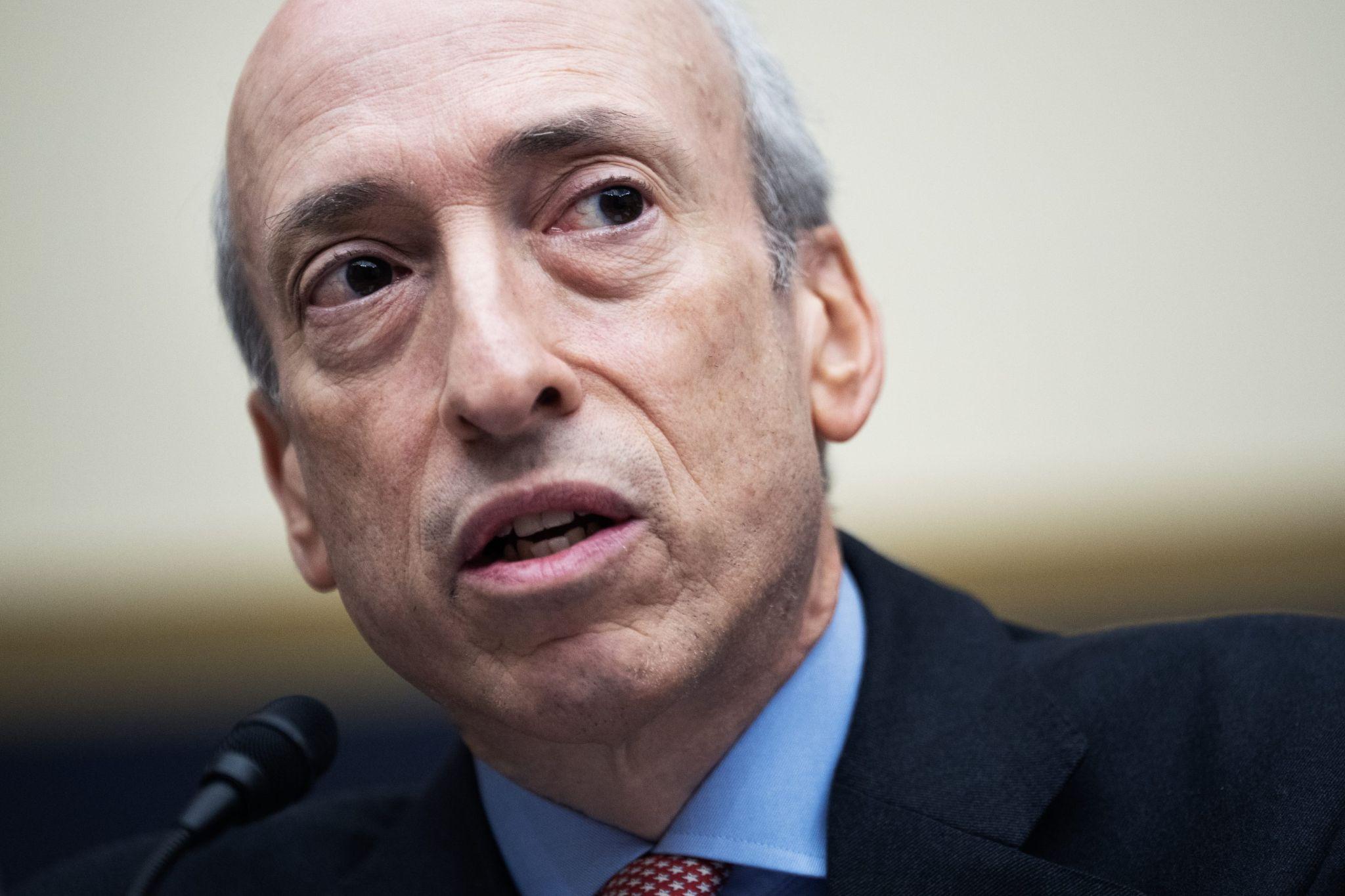

Countdown to leaving office! SEC Chairman Gary Gensler accepted a public interview and responded to 11 key questions about cryptocurrencies and capital markets

Author: Weilin, PANews

There are only six days left until the inauguration of US President-elect Donald Trump. On January 14, Securities and Exchange Commission (SEC) Chairman Gary Gensler was interviewed by CNBC and Yahoo Finance, and his leadership style and policy legacy became a hot topic. Previously, Gensler had announced that he would resign as SEC Chairman on January 20.

Based on these two interviews, PANews compiled 11 important questions about cryptocurrencies and capital markets, and how Gensler responded to them.

1. On January 14, the U.S. Securities and Exchange Commission (SEC) took action against Robinhood and some private equity firms. With less than a week left in your term, can we expect more actions from the SEC?

We are entrusted by the public to ensure that the capital markets work for them, to protect investors and to ensure that people follow the law. We have an important responsibility and we will meet that responsibility regardless of who is in leadership. There will be a different leadership transition this week and next week, but we will continue to ensure that the capital markets work for investors and that market participants follow the law.

That's what we do. Essentially, if you don't follow the facts and the law, then how do you build trust in the capital markets? In fact, honest actors in the market benefit because more investors are willing to enter the market and participate.

2. What do you think the next administration will mean for the SEC? Are you worried that what you do during your tenure will be overturned by the next administration?

What we have accomplished during this administration is remarkable. I came in right after GameStop, at the height of a whole bunch of SPACs, and we enacted the most significant reform in the stock market. I would say we did it in a unanimous and bipartisan way with the other commissioners. We also made significant reforms in the Treasury market. I can't imagine anyone wanting to go back to longer settlement cycles, and we shortened settlement cycles to one day.

I also can't imagine that anybody would want to roll back the first federal privacy notice to the public that says if your information is compromised by an investment adviser or broker, you'll be notified. I don't think anybody would want to roll back those measures, I'm sure. They're not going to make it easier for corporate insiders to trade on material nonpublic information. So I feel very good about the work that we've done.

Of course, democracy has its consequences, and the next team may choose a different direction, but I think these are good policies to reduce costs and promote integrity in the capital markets.

3. Some people believe that cryptocurrency supporters helped Trump win the latest election. How do you respond to these views?

It is important to build trust in the capital markets, and people need to follow the laws passed by Congress, and this great institution enforces these laws. Think about this question, we have rules on the highway, traffic lights, and patrol officers. If you are driving a hybrid car, on the highway, does it not need to obey traffic laws? Or does an electric car not need to obey regulations on the highway? We also enforce the law in the financial market in a consistent manner, and the cryptocurrency field is not compliant.

I would also say that voters are smart enough to know that they vote based on other issues, like inflation or other economic issues. I don't see any indication that cryptocurrency is a big factor influencing voters.

4. You have accomplished a lot during your tenure. You talked about shortening the settlement cycle, reforming the money market fund and Treasury markets, etc. But you lost 4 out of 5 challenges to your rules, which is more than the previous 3 presidents combined. Is there anything you wish you had done differently?

It's an interesting time for anybody who works in government because the courts are changing a lot. There was a quote by the great hockey player Wayne Gretsky, but it was to the effect that you should hit the puck where it's going, not where it's going. The courts here are like the puck, where is the court going? They're reinterpreting the law, whether it's environmental law, communications law, health law, securities law.

We have been working in accordance with the law, working under the laws passed by Congress. We have enacted 46 rules that are very important to the capital markets, and the vast majority of them have not only been passed, but are already being implemented. So people can now benefit from these rules, such as knowing whether company executives are being compensated on the basis of incorrect financial reports and whether they need to recover this information. As you said, our reforms in the money market area, but at the same time, the SEC now also has better information about private funds. So we have achieved a lot together.

5. You have repeatedly warned about the risks of cryptocurrencies. Over the past year, courts have in part forced you to approve spot Bitcoin and Ethereum ETFs, opening up cryptocurrency investing to the public. Do you wish there had been a different outcome? Are investors facing greater risks as a result?

Bitcoin itself is not a security, and neither I nor my predecessors have said that Bitcoin is a security, nor have I said that Ethereum is a security. I think that investors in Bitcoin and Ethereum, including the general public as you say, have had the opportunity to invest long before the ETF products. The Bitcoin ETF was approved during my tenure, which was a spot ETF, which was launched later. Investors are better protected in spot trading products, with lower fees, stricter regulation, stock market monitoring, and these products are registered and consistent with SEC requirements. My predecessors had rejected these products, and we followed JJ Clayton's leadership. Bitcoin and Ethereum account for 70% or even 80% of the crypto market. What I am really concerned about is the other part, those thousands of tokens, and the condition for their continued existence is that investors are essentially investing, or betting on a project, and they need to be properly disclosed. The law requires that you should get such disclosures, but currently these tokens are not compliant. I am not judging any one project in advance.

6. You seem to be interested in separating Bitcoin from the rest of the industry. Are you starting to have a new view on Bitcoin? Do you think Bitcoin has intrinsic value and is a means of storing value? Or do you think that when you look back in 10, 15, or 20 years, it will become the tulip bubble of the 18th century? You used to teach at MIT, so you should have some opinions. Have you read the book "Bitcoin Standard"?

It's hard to predict. I know the way you look at these other currencies, I know you're negative. But as for Bitcoin, we at the SEC have never said it's a security.

Yes, (I have read it) I think Bitcoin is a highly speculative and volatile asset. But there are 7 billion people in the world who want to trade it. Just like we have had gold for 10,000 years, we now have Bitcoin and maybe others like it in the future. These other thousands of projects need to show their use cases and prove they have actual fundamentals or they won't be sustainable.

7. What do you dislike about those other currencies?

I've never owned any of these coins, and I've been doing this for 7 or 8 years.

8. What do you think of the concept of prediction markets, especially Kalshi’s decision to hire Trump’s son as an advisor?

I have no opinion on who other people hire. But the capital markets themselves are vast, $120 trillion capital markets, whether it's stocks, bonds, and ultimately the prediction markets, are all about predicting future cash flows, or predicting future opportunities for businesses. So these markets, in a sense, are all about prediction markets, and that's why I'm very proud of some of the reforms we've made. We've implemented better disclosures to make sure that only what's meaningful to investors is disclosed so that they can make their own judgments about the future based on that information.

9. Critics say the SEC relies too much on litigation rather than legislation. What do you think?

We have laws. Congress has passed them, and they can certainly be changed. But part of the crypto space is that the investing public is investing in these projects, and a lot of these projects are regulated by securities laws. And a lot of companies in this space are not following the rules. Most of the discussions you have every day are about fundamentals, valuations, fundamentals and sentiment of stocks, bonds or markets. And crypto seems to rely more on sentiment and much less on fundamentals. But if there are fundamentals, and I mean if, then there needs to be proper disclosure under securities laws. That's the basic trading rules.

10. What do you think is the biggest risk in the current market?

We are now in a presidential transition period, and democracy has been reflected. Certain policies will be clarified over time, but policy uncertainty certainly exists. In the past four years, I also mentioned that there are also some areas of the capital market where there is a lot of leverage, a lot of borrowing and low margin. Usually these problems appear in the so-called repo market where commercial banks provide leverage to macro hedge funds. Finally, I think artificial intelligence has transformed productivity and affected various fields in a positive way, but there are still some risks in the future.

11. If you could do it all over again, what would you do differently?

I hope we can get these reforms done sooner rather than later, and that the courts can handle the issues more smoothly. It's worth noting that the courts are changing dramatically. I really hope we can better anticipate these changes so that we can do something that can better respond to the courts' challenges.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!