US Senators Slam DOJ Over Crypto Crime Unit Shutdown Amid Personal Holdings Conflict

Six US senators have challenged Deputy Attorney General Todd Blanche’s decision to order the closure of the DOJ-specific unit dealing with crypto enforcement in April at the time he personally possessed substantial cryptocurrency holdings.

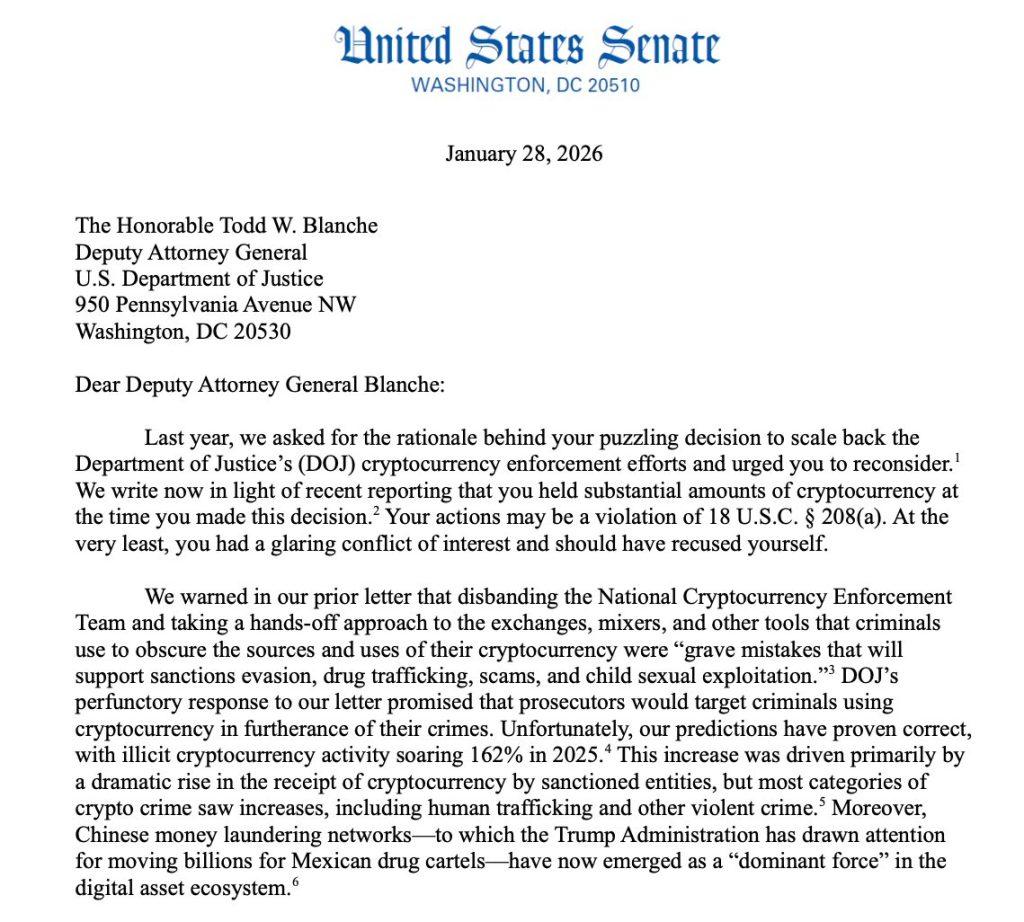

Senators Mazie Hirono, Elizabeth Warren, Richard Durbin, Sheldon Whitehouse, Christopher Coons, and Richard Blumenthal criticized Blanche in a letter dated Jan. 28, 2026, concerning his April 2025 announcement that he was disbanding the National Cryptocurrency Enforcement Team, or NCET.

Source: Mazie K. Hirono

Source: Mazie K. Hirono

The senators said the decision came at a time when Blanche had a direct financial interest in cryptocurrencies, raising concerns about conflicts of interest and potential violations of federal ethics law.

Did Crypto Conflicts Kill DOJ Enforcement? Lawmakers Demand Answers

In 2022, under the administration of President Biden, the NCET was established to lead the complicated cryptocurrency crime investigations in the Justice Department.

The unit was at the center of a number of high-profile cases, including the investigation of Binance and its founder, Changpeng “CZ” Zhao, who in 2023 admitted to breaking anti-money-laundering laws in the United States.

In April 2025, several months after Donald Trump was inaugurated, Blanche ordered the unit disbanded, and his campaign included an insistence on backing the digital asset industry.

The senators noted that Blanche disclosed crypto holdings valued between $158,000 and $470,000 in January 2025, largely in Bitcoin and Ethereum, just days before Trump’s inauguration.

On Feb. 10, he agreed to divest those assets “as soon as practicable.” However, the lawmakers noted that Blanche was confirmed as deputy attorney general on March 5 and issued the sweeping policy memo on April 7 scaling back crypto enforcement.

They added that he did not begin disposing of his crypto holdings until late May, with sales or transfers completed between May 31 and June 3.

The senators reported in their letter that Blanche could have breached the 18 U.S.C. 208(a) provision that generally prohibits executive authorities of the executive branch officials from taking part in making decisions that influence their own financial gain.

According to them, the issue is now under a complaint to the Office of the Inspector General of the DOJ, and they requested Blanche keep the documents and give a comprehensive account of how the issue was reported, responded to, and ultimately cleared by the ethics officials.

Senators had earlier raised concerns over Blanche’s decisions

The April 7 memo, titled “Ending Regulation by Prosecution,” marked a significant shift in how the Justice Department approaches digital assets.

Blanche argued that the DOJ is not a financial regulator and said prior enforcement efforts amounted to “regulation by prosecution.”

The new policy instructed the prosecutors to pursue individuals who directly victimize crypto investors or use digital assets in crimes (including terrorism, narcotics, organized crime, and human trafficking) and avoid pursuing cases involving exchanges, mixers, and other forums as their users may perpetrate crimes.

The memo also instructed that investigations that were not in line with the new priorities be shut down and NCET be officially dissolved.

Lawmakers said they warned Blanche last year that scaling back enforcement would have serious consequences. In their latest letter, they pointed to data showing illicit cryptocurrency activity surged in 2025, with TRM Labs estimating $158 billion in illegal transactions, up nearly 145% from the previous year.

They said the increase was driven in part by sanctioned entities but noted that most categories of crypto crime rose, including violent crime and human trafficking. Criminals stole an estimated $2.87 billion through nearly 150 hacks during the year.

You May Also Like

XRP Insider Shuts Down Whale Drama: Big Holders Won’t Control Crypto’s Long-Term Price

Nearly 150 Million Pi Migrated in Just Two Days, What This Unprecedented Move Means for Pi Network’s Future