Bitcoin and Ethereum Options Expiry Looms as Markets Face Critical Inflection Point

The post Bitcoin and Ethereum Options Expiry Looms as Markets Face Critical Inflection Point appeared first on Coinpedia Fintech News

Bitcoin and Ethereum are approaching a critical inflection point as one of the largest options expiries of the month collides with fragile on-chain market structure. More than $8.3 billion in Bitcoin options and $1.2 billion in Ethereum options are set to expire on January 30, placing unusual pressure on price behavior at a time when leverage is elevated and spot momentum is fading. With monetary policy uncertainty still fresh in markets and liquidity thinning, this expiry could act as a volatility trigger rather than a trend signal.

Bitcoin Options Expiry Keeps BTC Anchored Near $90K

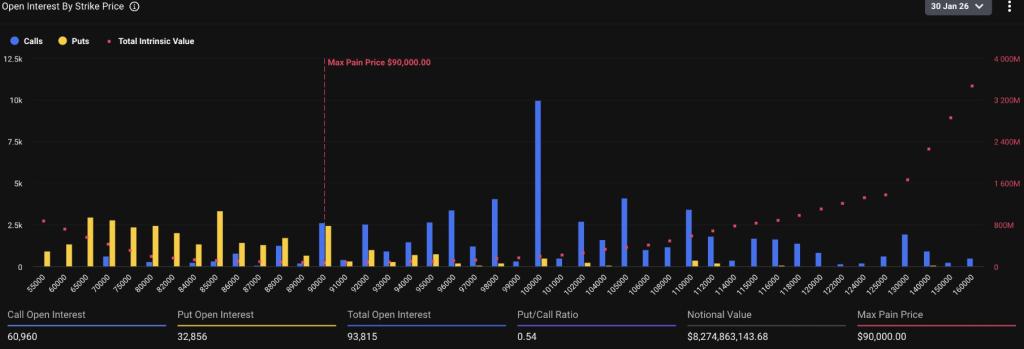

Bitcoin is moving into the January 30 expiry with more than $8.3 billion in notional options open interest, and the way that exposure is distributed explains why price has been pinned just below $90,000 despite repeated attempts to break higher. Deribit’s option chain shows a heavy concentration of contracts clustered between $85,000 and $95,000, with $90,000 clearly standing out as the max pain level, the strike where the largest portion of options would expire worthless. The put-to-call ratio near 0.54, which signals that positioning remains net bullish, yet increasingly hedged.

At the same time, Deribit data shows that futures open interest has remained steady, confirming this is not a broad deleveraging event. Instead, exposure has shifted toward options-based positioning, where traders are expressing views through structured trades rather than outright leveraged futures. When exposure becomes this concentrated around nearby strikes, price becomes more sensitive to hedging flows rather than organic spot demand.

As BTC trades near $90K, market makers are forced to dynamically hedge both sides of the book, absorbing momentum on rallies and cushioning dips. That hedging activity can suppress follow-through in either direction until the expiry clears or price decisively escapes the high-OI zone.

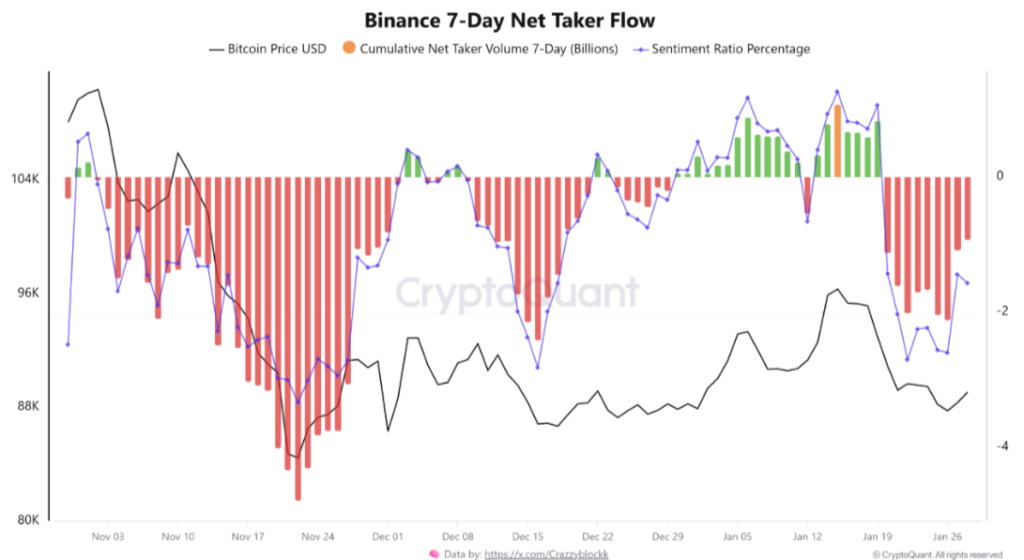

On-chain data reinforces this picture of balance rather than strength. Binance’s 7-day net taker flow remains only marginally positive, showing that buyers are present but not aggressive. In prior bullish expansions, sustained upside only emerged when taker buy volume expanded decisively and consistently absorbed sell pressure.

Once the options roll off, this equilibrium is likely to break. If BTC holds above $90K post-expiry, suppressed upside flows could unwind quickly as hedges are lifted. Conversely, a clean rejection below that level risks triggering short-term downside as protective puts move into the money and hedging pressure flips direction.

Ethereum Options and On-Chain Leverage Signal Higher Volatility Risk

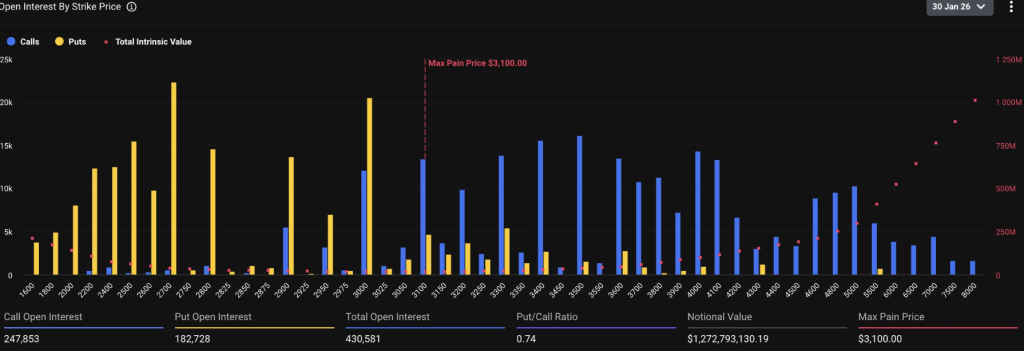

Ethereum is entering the same expiry window with approximately $1.27 billion in notional options open interest, and while smaller than Bitcoin’s, the risk profile appears more fragile. Deribit data shows ETH’s put-to-call ratio around 0.74, indicating a higher demand for downside protection relative to Bitcoin. The max pain level sits near $3,100, while price continues to consolidate well below its prior highs.

The option chain reveals a wider dispersion of strikes, but with notable put interest building below current levels. This suggests traders are less confident in ETH’s ability to hold support cleanly and are actively hedging against sharper downside moves. Unlike Bitcoin, where positioning remains compressed and controlled, Ethereum’s structure allows for more asymmetric price reactions once hedging flows intensify.

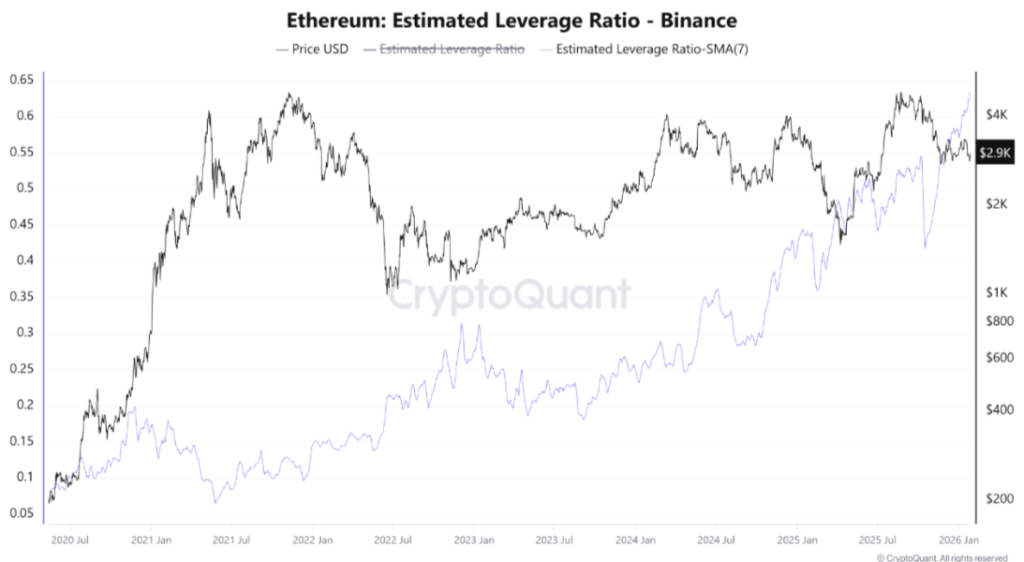

On-chain leverage data adds another layer of concern. CryptoQuant shows Ethereum’s estimated leverage ratio on Binance at record highs, signaling a heavy concentration of leveraged positions still embedded in the system. Elevated leverage alone is not bearish, but when combined with unstable taker behavior, it increases the probability of abrupt price dislocations. Currently, ETH price sits around $2920 and faces bearish pressure. For Ethereum, the crucial zone is to sustain above $3,080 for a major short covering move.

FAQs

Options expiry is the date when crypto options contracts settle, forcing traders to close, exercise, or let positions expire, often increasing short-term volatility.

Bitcoin and Ethereum options expiry is when derivative contracts settle, often increasing volatility as traders unwind hedges and market makers adjust positions.

Large expiries can amplify price swings because hedging flows, max pain levels, and leverage shifts influence short-term price behavior more than spot demand.

You May Also Like

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm

USAA Names Dan Griffiths Chief Information Officer to Drive Secure, Simplified Digital Member Experiences