Trust in DeFi Starts with Proper Risk Management

DeFi has entered an institutional phase, with large investors gradually testing the waters in crypto ETFs and digital asset treasuries. The shift signals the maturation of on-chain finance, introducing new instruments and digital counterparts to traditional assets. Yet as flows rise, so do questions about risk management and the resilience of underlying infrastructure. For institutions to participate with confidence, the ecosystem must harden its guardrails, standardize risk disclosures, and ensure liquidity access remains predictable even under stress. The broad arc is clear: move beyond yield chasing toward a structured, auditable framework that aligns DeFi with the expectations of regulated finance.

Key takeaways

- Institutional participation in crypto is expanding beyond spot exposure to regulated products and digital asset treasuries, expanding on-chain liquidity and demand for governance-grade infrastructure.

- Three primary risk areas are highlighted: protocol risk driven by DeFi’s composability, reflexivity risk from leveraged staking and looping strategies, and duration risk tied to liquidity timelines and solver incentives.

- Trust is the scarce resource in the next phase of DeFi, with standardized guardrails and interoperable risk reporting viewed as prerequisites for a true institutional supercycle.

- Stablecoins and tokenized real-world assets are reshaping on-chain fundamentals, driving institutional demand and signaling Ethereum’s prominence as a settlement layer.

- Industry signals point to a need for shared risk-management frameworks similar to those in TradFi, including clearinghouse-like structures and standardized disclosures for DeFi protocols.

Tickers mentioned: $BTC, $ETH

Sentiment: Neutral

Market context: The ascent of regulated ETFs and on-chain treasuries sits within a broader push toward more liquid, transparent, and auditable crypto markets. As institutional flows grow, liquidity conditions and risk governance will increasingly shape which DeFi primitives scale and which remain niche experiments.

Why it matters

The current rise of regulated institutional products has done more than inflate on-chain TVLs; it has moved the dialogue from “how much yield can be generated” to “how can risk be measured, disclosed, and managed at scale.” A Paradigm-backed view suggests risk management is treated as an operational pillar rather than a compliance checkbox, underscoring the need for formalized standards as DeFi seeks to attract larger, more durable capital footprints. The near-term implication is a shift in emphasis from rapid experimentation to rigorous governance, with industry-wide norms around disclosure and interoperability acting as the backbone for broader adoption.

Within this frame, the industry has begun to witness a practical convergence around three pillars: the maturation of stablecoins as a payment and settlement tool, the tokenization of real-world assets (RWAs), and the tokenization of traditional instruments such as government securities. The stability and scalability of stablecoins have become critical to supporting multi-chain liquidity and cross-border settlement, while RWAs enable the on-chain replication of largely traditional asset classes. In parallel, large institutions are piloting tokenized treasuries and stock-market access through on-chain equivalents, hinting at a future where a wider class of financial products can live on Ethereum and related networks. The net effect is a more connected, on-chain financial system that retains the risk sensitivities familiar to regulated markets.

Source: EYIn the institutional ETF arena, the appetite has produced notable landmarks. The framing of regulated Bitcoin and Ethereum exchange-traded products has produced flows that some observers describe as a bellwether for broader acceptance. Specifically, two of the most successful ETF launches in the last two years—BlackRock’s iShares Bitcoin ETF (CRYPTO: BTC) and Ethereum ETF (CRYPTO: ETH)—illustrate a growing willingness among asset managers to bring digital assets onto balance sheets. The momentum around ETH-related products is particularly pronounced, with net inflows into Ethereum vehicles building momentum in a tight, high-conviction space. This dynamic culminates in a broader realization: official pricing and settlement rails may increasingly depend on on-chain infrastructure built to accommodate institutional-grade risk controls and reporting standards.

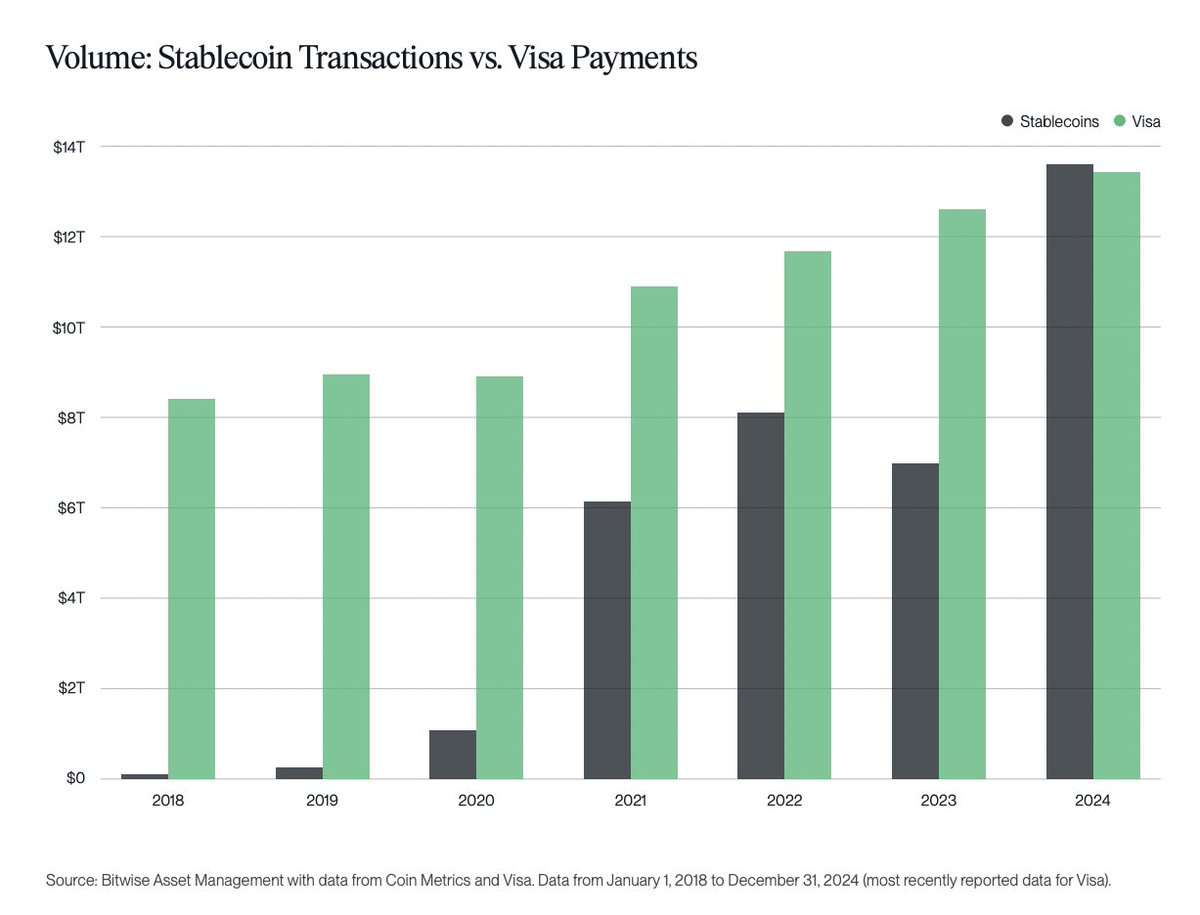

Source: Bitwise Asset Management

Source: Bitwise Asset Management

Beyond ETFs, the on-chain tooling narrative has also gained traction. Stablecoins have become crypto’s product-market fit as regulatory clarity improves, enabling them to function more reliably as settlement rails and liquidity buffers. Their TVL across protocols is approaching a striking milestone—nearly $300 billion—while they move nearly as much money every month as traditional payment rails such as Visa. This liquidity capacity, when combined with tokenized RWAs, introduces a more scalable, on-chain settlement layer that can absorb large institutions’ demand without compromising speed or risk discipline. The evolution of these instruments signals a credible path for large-scale participation, especially as governance and disclosure standards converge toward TradFi-like rigor.

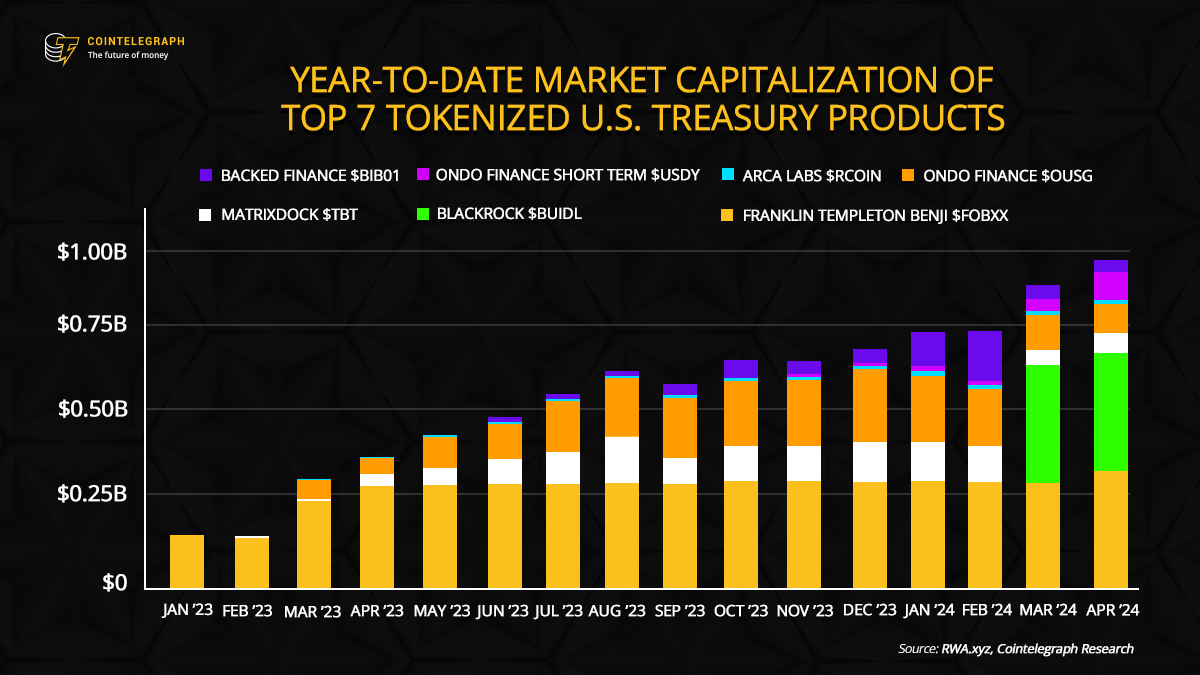

Tokenization remains a central theme in institutional strategy. Robinhood Europe, for example, has advanced tokenization projects across its stock-exchange ecosystem, while BlackRock has pursued tokenized government securities through its BUIDL initiative. The trend toward converting real-world assets into tradable digital tokens aligns with a broader push to enhance liquidity, accessibility, and efficiency across markets. As tokenization scales, it raises critical questions about transparency, custody, and governance; the path forward will hinge on robust interoperability and standardized risk reporting across platforms.

Source: Cointelegraph Research

Source: Cointelegraph Research

All of this reinforces a central insight: both stablecoins and RWAs are reframing DeFi’s narrative around Ethereum as a settlement and interoperability layer. The on-chain economy is increasingly anchored to the same building blocks traditional finance relies upon—clear risk delineation, verifiable disclosures, and robust settlement rails—while preserving the permissionless innovation that defines DeFi. The net effect is a push toward an on-chain financial system capable of onboarding the next trillion dollars of institutional capital, provided guardrails and standards keep pace with innovation.

In a recent assessment, Paradigm argued that risk management is not simply a cost but a core capability that must be embedded into the operational fabric of DeFi. If institutions are to scale, DeFi will need comparable institutions to the traditional clearinghouses and rating agencies—open, auditable, and interoperable frameworks for assessing and reporting risk. The evolution will not require abandoning experimentation; rather, it will require a disciplined approach to risk that can be understood, verified, and trusted across a diverse ecosystem of protocols, vaults, and strategies.

Opinion by: Robert Schmitt, founder and co-CEO at Cork.

As momentum builds, the market will increasingly reward projects that demonstrate transparent risk management, verifiable liquidity, and resilient infrastructure. The coming year is likely to feature more regulatory clarity around stablecoins, additional tokenization deals, and new on-chain products designed to meet institutional standards. The DeFi supercycle, if it unfolds, will be defined not only by capital inflows but by the depth of risk governance that can withstand the next wave of market shocks. In that sense, the focus shifts from chasing yield to building a durable, on-chain financial system that can operate at the scale of traditional markets while preserving the openness that makes DeFi unique.

What to watch next

- Upcoming industry standards for cross-chain risk disclosures and protocol reporting.

- Regulatory developments affecting stablecoins and tokenized RWAs in major jurisdictions.

- New ETF filings or substantial inflows into BTC and ETH ETFs as institutional appetite evolves.

- Expanded tokenization projects from major custodians or asset managers, including government securities and blue-chip equities.

- Governance updates and liquidity-architecture improvements that affect withdrawal timelines and risk parameters on leading DeFi platforms.

Sources & verification

- Paradigm’s report on TradFi, DeFi, and risk management in extensible finance.

- Regulated ETF launches for Bitcoin and Ethereum by BlackRock, including performance flows.

- Ethereum digital asset treasuries (ETH) and market dynamics surrounding DATs, including Bitmine Immersion.

- Stablecoin market capitalization, locked value, and regulatory clarity milestones (EY insights on treasury use and DLT).

- Robinhood Europe’s tokenization initiatives and BlackRock’s tokenization efforts on U.S. government securities (BUIDL).

This article was originally published as Trust in DeFi Starts with Proper Risk Management on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Visa Expands Stablecoin Rails Across Blockchains With Ethereum at Core

Zcash (ZEC) Tests Descending Triangle Support After Sharp 24-Hour Sell-Off