CertiK Stablecoin Report 2025: What are the top 5 most secure tokens in the stablecoin race?

As stablecoin adoption grows more mainstream, so do the security risks associated with them. Which tokens are leading the race in terms of security?

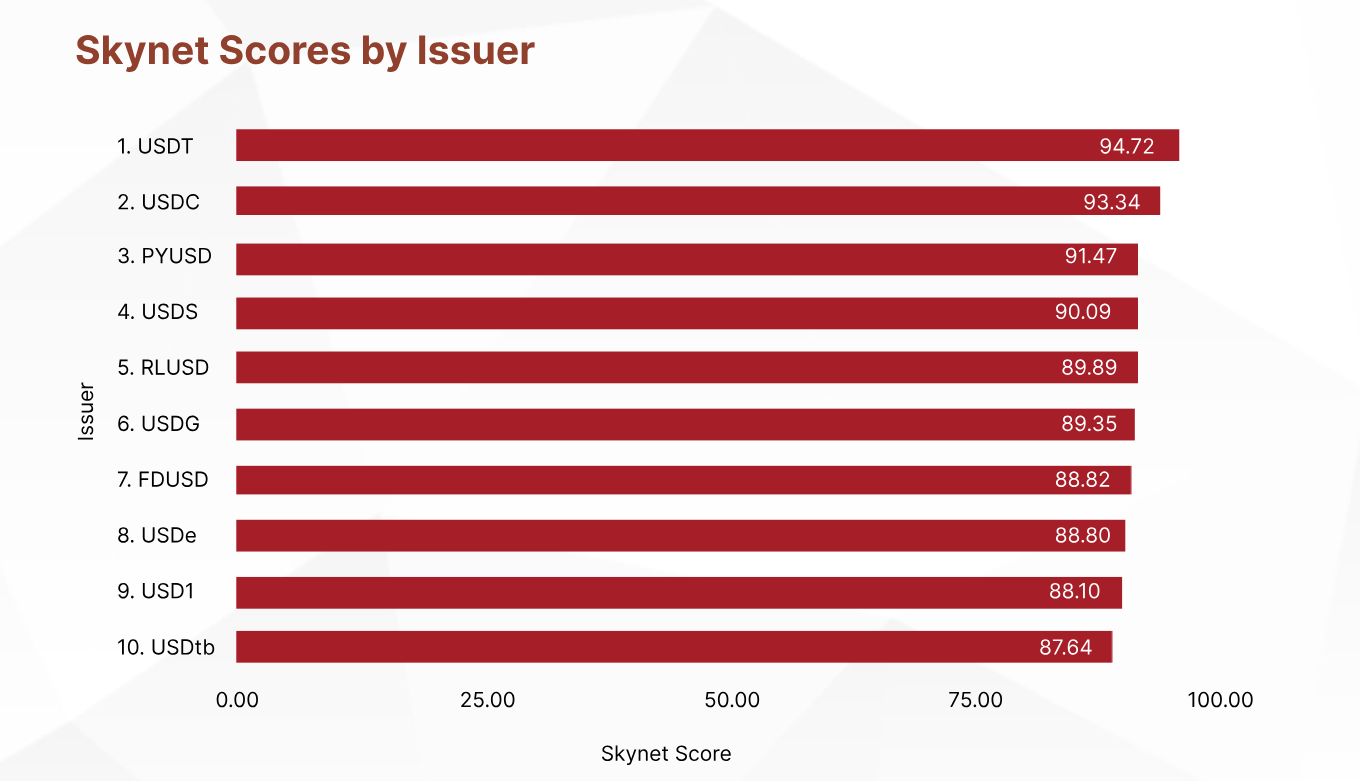

- Tether’s USDT holds the top spot among major stablecoins based on the Skynet scoring system.

- Security incidents in the crypto space have led to major drops in stablecoin value, most of which are related to exploits and price depegs.

The first half of 2025 saw a surge in stablecoin use cases, with a monthly settlement volume rising by 43% to $1.39 trillion. According to the security firm, this rapidly increasing growth in adoption hides the widening gaps in security posture, compliance, and operational risk that still need to be addressed by the community.

As a result, CertiK has managed to rank the top fiat-pegged tokens from a security and risk standpoint. The six-item Skynet rating framework assesses each token based on factors including operational resilience, governance strength, fundamental health, code security, market dynamic and community trust.

According to the Skynet framework, Tether’s USDT (USDT) ranks at number one with an overall score of 94.72. The security firm highlighted USDT’s decision to increase its circulation from $138 billion to $154 billion in the first half of 2025.

In second place is Circle’s USDC (USDC) with 93.37. Having secured a MiCA license and completed an IPO, Circle’s token supply increased from $41 billion to $61 billion. Although it is still slightly behind Tether, CertiK has dubbed it the “fastest growing” major stablecoin.

Ranking in third place is the PayPal-Paxos jointly issued PYUSD (PYUSD) with a score of 91.47. The token’s market cap has doubled in the first half of 2025. Recent developments for the token include expansions into Solana (SOL) and Arbitrum (ARB) as well as a rewards program.

In fourth place is USDS by Sky with 90.09. The rebranding of DAI into Sky has helped to expand the token into multiple chains. Since its launch on Solana, it has grown to become the fifth largest stablecoin.

Ripple’s RLUSD (RLUSD) stands at number five with a Skynet framework score of 89.89. Although it still ranks below USDT and USDC in terms of supply and security mechanisms in place, CertiK noted that the token has experienced zero security incidents since its launch.

Other notable tokens mentioned in the top 10 include First Digital USD (FDUSD), USDG by Paxos, Ethena’s USDe (USDE) and USDtb, as well as World Liberty Financial’s own USD1.

The impact of security incidents on stablecoins

According to blockchain security firm CertiK, as many as 344 crypto security incidents occurred in the past year. These incidents led to the theft of $2.47 billion worth of crypto assets industry-wide. Though these incidents are not always linked to stablecoins directly, they often bear the brunt of exploits, more so than regular tokens.

For instance, First Digital USD saw its price plummet to $0.76 amid rumors about whether or not its reserves were secure. It was only able to recover its $1.00 value after the issuer disclosed audited holdings to prove that its reserves were safe. This case shows just how easily the cookie crumbles when it comes to stablecoins.

Causes leading to stablecoin value drops in the past 10 years

Price depegs (Total: 14):

- Compliance events

- Problems with asset liquidity

- Delisting from exchanges

- Suspected asset mishandling

- Company halts issuance

Exploits (Total: 7):

- Token contract vulnerability

- Other contract vulnerability

- Chain vulnerability

Death Spirals (Total: 3):

- Design failure

- Insufficient reserve asset

Due to the nature of fiat-pegged tokens, its reserves are considered sacred in a way that differs to other tokens. One wrong move could result in the 1:1 ratio backed by real currencies to dip and lead to the token’s downfall.

CertiK’s report showed that exploits in the crypto space, such as hacks, death spirals, and price depegs, were mostly caused by operational failures compared to technical flaws in the system. According to the study, vulnerabilities in systems where stablecoins are the primary asset made up a large portion of the losses.

You May Also Like

a16z published an article stating that blockchain is a key infrastructure for internet trust in the AI era.

South Korea’s FSC Declares War On Crypto Money Laundering With Stricter Regulations