URANUS jumps 175%, NILA spikes double digits while market rally slows down

The overall crypto market shows signs of cooling, but several altcoins continue to rally. URANUS is in the lead with a notable 175% increase, alongside noteworthy moves by MindWaveDAO and RIZE.

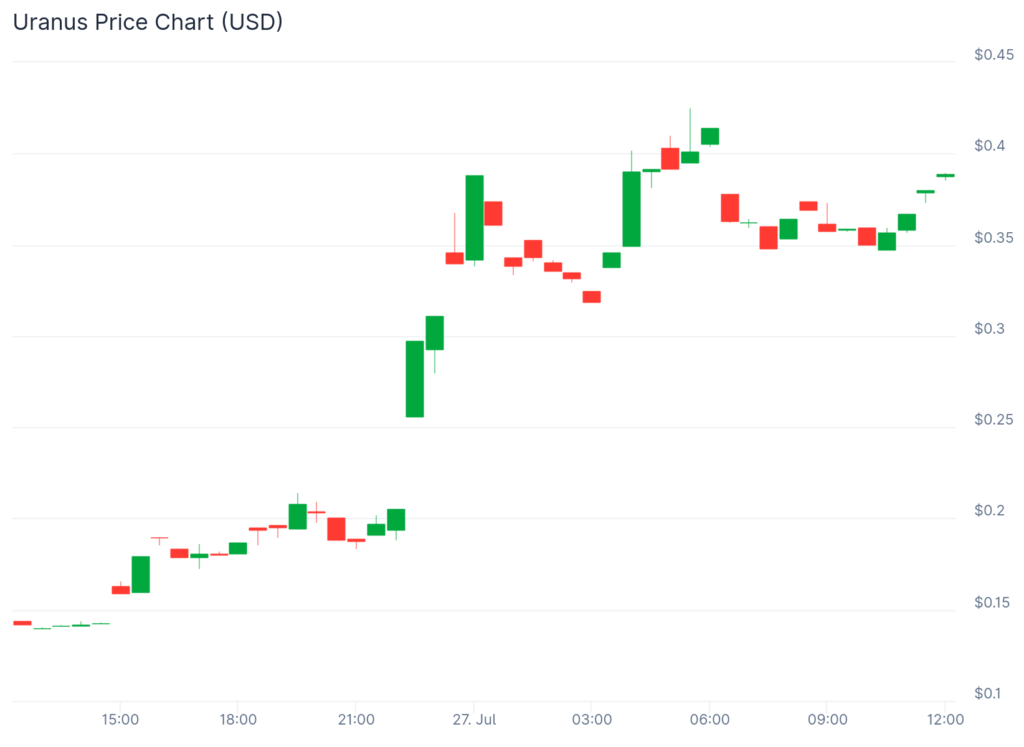

URANUS has jumped by 175.6% in the last 24 hours, trading at $0.3897 from a low of $0.1397. The exact catalyst for this surge remains unclear, as the project is relatively new and has limited public information available.

The token has been gaining attention on X, with increasing social media mentions driving visibility. Recently, Moonshot shared a post about URANUS, which may have contributed to the momentum. Moonshot is a platform that lets users “Buy, Sell, and Create Memes with Apple Pay,” providing easy access for retail investors.

According to reports, URANUS has performed even more impressively on the Moonshot platform itself, climbing almost 3x.

Platform development aids NILA

MindWaveDAO (NILA) has surged 80% over the past 24 hours, reaching $0.07079 from $0.03757. The price movement appears connected to a major platform development that could drive institutional interest.

The project announced the launch of the “$NILA OTC Desk,” offering “High-volume, no-slippage access to $NILA with early DAO governance + Bitcoin-yield alignment.”

This infrastructure development positions MindWaveDAO to serve larger investors and institutions seeking substantial NILA positions without affecting market prices.

Additionally, the team highlighted their “Bitcoin treasury engine” as part of their recent developments, suggesting a focus on Bitcoin-backed yield strategies.

However, despite today’s gains, NILA remains down 36% over the past seven days.

Third on CoinGecko’s top gainers list is RIZE. The token has climbed 50.3% in the last 24 hours, trading at $0.08777 from $0.05754. RIZE has also spiked 370% in the past seven days following a major partnership announcement.

The project revealed a collaboration with Canton Network, describing it as “The Partnership That Redefines On-Chain Finance!”

“We’re officially partnering with a $4T privacy-first @CantonNetwork, bringing institutional tokenization to a whole new scale,” the team announced. T-RIZE now operates as a validator, issuer, and builder of real-world assets on this trusted infrastructure.

Furthermore, RIZE has established a substantial governance structure, allocating 30% of the total RIZE supply to a community-owned Governance Treasury.

The strong performance of these altcoins comes as the overall crypto market appears to be entering a consolidation phase following recent gains. While major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have stabilized, smaller projects continue to buck the trend.

You May Also Like

And the Big Day Has Arrived: The Anticipated News for XRP and Dogecoin Tomorrow

Trump swears he'll donate winnings in $10 billion lawsuit against his own IRS