XRP News Today: Bank of America Adds XRP ETF Amid Institutional Demand

The post XRP News Today: Bank of America Adds XRP ETF Amid Institutional Demand appeared first on Coinpedia Fintech News

Following the regulatory clarity of XRP, institutions and banking giants rushed to get their hands on XRP. And what’s more stable than an ETF?

In a recent investment disclosure, Bank of America has shown its exposure in XRP through investment in an XRP exchange-traded fund (ETF). This shows that the bank continued to deepen its partnership with Ripple, exploring cross-border payments and RLUSD stablecoin.

Bank of America Discloses XRP ETF Holdings

As per the latest U.S. SEC filing, Bank of America holds around 13,000 shares of the Volatility Shares XRP ETF, with a total value of about $224,640. While this investment is small compared to the bank’s overall portfolio, it is still an important step toward institutional crypto adoption.

What makes this move more interesting is that Bank of America recently expanded its crypto-related services. On January 5, 2026, the bank allowed its wealth advisors to begin recommending crypto ETFs to clients for the first time.

This move follows Bank of America’s shift in strategy, where Bank of America started supporting limited crypto exposure of up to 1–4% in client portfolios, mainly through regulated investment products like ETFs.

Institutional Growing Interest in XRP ETFs

Rising institutional demand for XRP ETFs is a key trend in the market. U.S. spot XRP ETFs have seen strong inflows and rapid growth since their launch, putting them on track to near $1.20 billion in assets under management (AUM) in a short period.

In fact, XRP ETF products have recorded extended streaks of inflows as demand from pension funds, asset managers, and advisory firms increases.

On 3 feb XRP ETF recorded an inflow of $19.46 million.

- Also Read :

- Charles Hoskinson Teases Major Cardano Update with Logan AI Bot Upgrade

- ,

XRP Price Still Sluggish Despite ETF Growth

Even with strong institutional activity, the XRP price has remained weak. As of now, XRP is trading around $1.59, reflecting a drop of about 1%.

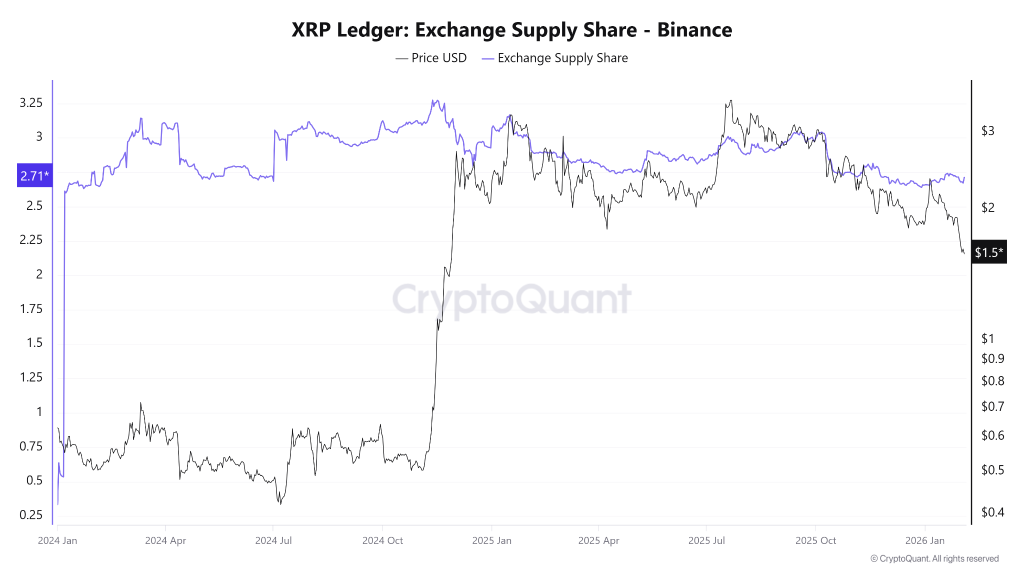

Perhaps, Cryptoquant data shows that the XRP exchange supply on Binance has been shrinking. From early 2025, the exchange stayed relatively stable around 2.7% – 3.1%.

This suggests holders are moving XRP to private wallets instead of selling, which indicates accumulation and potentially reduced selling pressure.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Institutions invest in XRP ETFs for regulated crypto exposure, portfolio diversification, and to participate in Ripple’s cross-border payment network.

Despite strong ETF inflows, XRP trades around $1.59, showing little change as accumulation suggests reduced selling pressure.

XRP ETFs offer regulated crypto exposure, limiting risk to 1–4% of a portfolio, making them a safer option for wealth advisors and investors.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

Ethereum Fusaka Upgrade Set for December 3 Mainnet Launch, Blob Capacity to Double